Forecasting Exchange Rates

advertisement

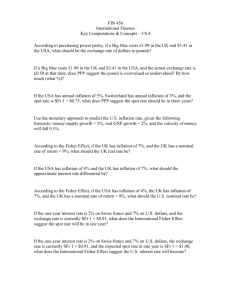

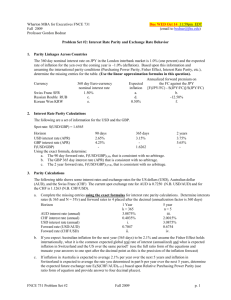

Forecasting Exchange Rates Two Approaches to Forecasting • Fundamental Analysis – Examines economic relationships and financial data to arrive at a forecast. • Short term horizons: Asset Choice Model • Long term horizons: Parity Models • Technical Analysis – Relies on historical price patterns to arrive at a forecast. • Generally very short term horizons Fundamental Analysis: Short Trerm • Asset Choice: – Examines why one currency might be preferred over others. Variables include: • • • • Relative interest rates (current and anticipated) Political/country risk Safe haven effects Carry trade strategies and carry trade unwinds – Essentially, trying to identify why the demand for a currency will change. Fundamental Analysis: Long Term • Parity Models – Through these models one attempts to calculate an “equilibrium” exchange rate in the future. – Analysis built on “long standing” economic theories of exchange rate determination. • Purchasing Power Parity Model • International Fisher Effect Purchasing Power Parity • One of the oldest exchange rate models. • Assumes that exchange rates will change to offset relative prices levels between countries. – Countries with relatively high rates of inflation will show currency depreciation – Countries with relatively low rates of inflation will experience currency appreciation • In equilibrium, the amount of depreciation (or appreciation) will be equal to the inflation differential. Purchasing Power Parity Example • Assume: – Spot GBP/USD: $1.80 – Forecasted UK rate of inflation (annualized) for the next 12 months: 2.5% – Forecasted US rate of inflation (annualized) for the next 12 months: 1.0% • PPP Spot GBP/USD Forecast – 1 year change in GBP: $1.80 x .015 = 0.027. – 1 year spot GBP: $1.80 - .027 = $1.773 – 6 month GBP: $1.80 – (0.027/2) = $1.80 – 0.0135 = $1.7865 Purchasing Power Parity Example • Assume: – Spot USD/CAD: 1.20 – Forecasted CAD rate of inflation (annualized) for the next 12 months: .5% – Forecasted US rate of inflation (annualized) for the next 12 months: 2.5% • PPP Spot USD/CAD Forecast – 1 year change in CAD: 1.20 x .020 = 0.024. – 1 year spot CAD: 1.20 - 0.024 = 1.176 – 6 month CAD: 1.20 – (.024/2) = 1.20 - .012 = 1.188 International Fisher Effect • Assume that exchange rates will change in direct proportion to relative differences in long term interest rates. – Assumes that long term interest rates capture the market’s expectation for inflation. – Countries with relatively high rates of long term interest rates (i.e., high inflation) will show currency depreciation. – Countries with relatively low rates of long term interest rates (i.e., low inflation) will show currency appreciation. • In equilibrium, the amount of depreciation (or appreciation) will be equal to the long term interest rate differential. International Fisher Effect Example • Assume: – Spot EUR/USD = $1.50 – Current 1 year German Government Bond rate = 2.15% – Current 1 year U.S. Government Bond rate = 4.5% • IFE Spot EUR/USD Forecast – 1 year change in EUR = $1.50 x 0.0235 = 0.03525 – 1 year spot EUR = $1.50 + .03525 = $1.53525 International Fisher Effect Example • Assume: – Spot USD/JPY = 98.00 – Current 1 year Japanese Government Bond rate = 0.5% – Current 1 year U.S. Government Bond rate = 4.5% • IFE Spot USD/JPY Forecast – 1 year change in JPY = 98.00 x 0.04 = 3.92 – 1 year spot JPY = 98.00 - 3.92 = 94.08 Technical Analysis • Uses charts and price patterns to forecast future moves in spot exchange rates. – Looks for price patterns that have historically signed a future move. – Assume historical relationship will result in similar moves in the future. • Not interested in “explaining” the source of the expected future move. – Not interested in financial information or news. Technical Analysis • Go to FXStreet.com to review some technical patterns. • http://www.fxstreet.com/rates-charts/forexcharts/