Case 2: Hedging Transaction Exposure Sarah Scott and George Stoeckert

advertisement

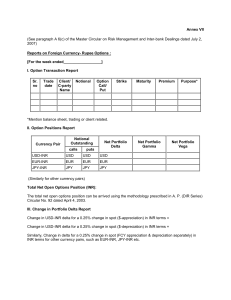

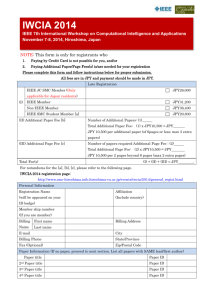

Case 2: Hedging Transaction Exposure Sarah Scott and George Stoeckert The Case December 2012: DW orders part from Japan, incurs a payable of 200,000,000.00 JPY Parts are received in April Payment due in May Part I Associated Risk: Best/Worst Case Scenario JPY Exchange Rate Multiplier Outcome Best Case Scenario 200,000,000.00 86.64 1.194209023 $ 1,932,997.11 Worst Case Scenario 200,000,000.00 86.64 0.797795674 $ 2,893,475.94 Range $ 960,478.83 Associated Risk: Simulated Distribution $ 99% Confidence Interval: 62,624.94 JPY Transaction Exposure Today +/- Confidence Interval Outcome Range Upper Bound 200,000,000.00 $ 2,308,402.59 $ 2,371,027.52 $ 2,371,027.52 $ 125,249.87 Lower Bound 200,000,000.00 $ 2,308,402.59 $ 2,245,777.65 $ 2,245,777.65 5 7 Transaction Exposure Frequency Frequency 58 53 45 31 17 1 14 5 11 22 24 27 50 45 34 27 19 11 10 8 8 4 Associated Risk: Normal Distribution Normal Distribution 99% Confidence Interval: 0.007616709 JPY Exchange Rate Multiplier Outcome Upper Bound 200,000,000.00 86.64 1.007616709 $ 2,290,953.06 Lower Bound 200,000,000.00 86.64 0.992383291 $ 2,326,119.96 Range $ 35,166.90 Value at Risk Calculation VaR: Exchange Rate JPY α σ Δt VaR 4mo 86.64 200,000,000.00 2.326347874 0.068459336 1$ 367,636.73 5mo 86.64 200,000,000.00 2.326347874 0.068459336 1.25 $ 459,545.91 Δt in terms of 4 months PHLX Options Estimated Spot Rate Calls Option Total Option Total Premium Price Price Premium Total Combined Price April Spot Rate April Close Out April Close Out + Premium Probability Exercise Option? 0.012312687 PHLX Option June .008 0.008 0.004583 $ 1,600,000.00 $ 916,600.00 $ 2,516,600.00 0.012312687 $ 2,462,537.36 $ 3,379,137.36 8.21% YES 0.012527612 PHLX Option June .008 0.008 0.004583 $ 1,600,000.00 $ 916,600.00 $ 2,516,600.00 0.012527612 $ 2,505,522.35 $ 3,422,122.35 14.37% YES 0.012742537 PHLX Option June .008 0.008 0.004583 $ 1,600,000.00 $ 916,600.00 $ 2,516,600.00 0.012742537 $ 2,548,507.35 $ 3,465,107.35 10.82% YES Estimated Spot Rate Calls Option Premium Total Option Total Premium Price Price Total Combined Price April Spot Rate April Close Out Close Out + Premium Probability Exercise Option? 0.012312687 PHLX Option June .009 0.009 0.0036255 $ 1,800,000.00 $ 725,100.00 $ 2,525,100.00 0.012312687 $ 2,462,537.36 $ 3,187,637.36 8.21% YES 0.012527612 PHLX Option June .009 0.009 0.0036255 $ 1,800,000.00 $ 725,100.00 $ 2,525,100.00 0.012527612 $ 2,505,522.35 $ 3,230,622.35 14.37% YES 0.012742537 PHLX Option June .009 0.009 0.0036255 $ 1,800,000.00 $ 725,100.00 $ 2,525,100.00 0.012742537 $ 2,548,507.35 $ 3,273,607.35 10.82% YES Estimated Spot Rate Calls Option Premium Total Option Total Premium Price Price Total Combined Price April Spot Rate April Close Out Close Out + Premium Probability Exercise Option? 0.012312687 PHLX Option June .01 0.01 0.0029542 $ 2,000,000.00 $ 590,840.00 $ 2,590,840.00 0.012312687 $ 2,462,537.36 $ 3,053,377.36 8.21% YES 0.012527612 PHLX Option June .01 0.01 0.0029542 $ 2,000,000.00 $ 590,840.00 $ 2,590,840.00 0.012527612 $ 2,505,522.35 $ 3,096,362.35 14.37% YES 0.012742537 PHLX Option June .01 0.01 0.0029542 $ 2,000,000.00 $ 590,840.00 $ 2,590,840.00 0.012742537 $ 2,548,507.35 $ 3,139,347.35 10.82% YES Frequency Distribution: 4-Month Changes Frequency Percentage: Four-Month Changes in Spot Rate 16.000% 14.000% 12.000% 10.000% 8.000% 6.000% 4.000% 2.000% 0.000% Percentage OTC Options: Estimated Spot Calls Rate Option Premium Total Option Total Premium Price Price $ 0.012309668OTC Option March .009 0.0090 $ $ 0.0040810 1,800,000.00 $ 0.012508258OTC Option March .009 0.0090 $ $ 0.0040810 1,800,000.00 $ 0.012706848OTC Option March .009 0.0090 $ $ 0.0040810 1,800,000.00 Estimated Spot Calls Rate Option Premium 0.012309668 $ $ 0.0031976 2,000,000.00 0.012508258 OTC Option March .01 $ 0.0100 $ $ 0.0031976 2,000,000.00 0.012706848 OTC Option March .01 $ 0.0100 $ $ 0.0031976 2,000,000.00 March Spot Rate March Close March Close Out + Out Premium Probability Exercise Option? $ 816,200.00 $ 77,449.03 $ 2,538,750.97 0.012309668 $ 2,461,933.60 $ 3,278,133.60 10.43% YES $ 816,200.00 $ 77,449.03 $ 2,538,750.97 0.012508258 $ 2,501,651.56 $ 3,317,851.56 12.66% YES $ 816,200.00 $ 77,449.03 $ 2,538,750.97 0.012706848 $ 2,541,369.52 $ 3,357,569.52 12.48% YES Total Option Total Premium Price Price OTC Option March .01 $ 0.0100 Interest Earned Total Combined Price Interest Earned Total Combined Price March Spot Rate March Close March Close Out + Out Premium Probability Exercise Option? $ 639,520.00 $ 77,449.03 $ 2,562,070.97 0.012309668 $ 2,461,933.60 $ 3,101,453.60 10.43% YES $ 639,520.00 $ 77,449.03 $ 2,562,070.97 0.012508258 $ 2,501,651.56 $ 3,141,171.56 12.66% YES $ 639,520.00 $ 77,449.03 $ 2,562,070.97 0.012706848 $ 2,541,369.52 $ 3,180,889.52 12.48% YES Frequency Distribution: 3-Month Changes Frequency Percentage: 3 Month Changes 12.663% 12.477% 10.428% 9.311% 9.497% 9.497% 6.518% 5.400% 2.607% 1.490% 0.186% 0.000% 0.186% 0.745% 5.214% 3.166% 2.607% 3.724% 1.304% 0.559% 0.372% Percentage 1.117% 0.372% 0.559% Forward Alternative Requirement (Due March 15th) 200,000,000.00 Current Exchange Rate JPY/USD (12/15/12) 0.01247 Interest Rate US 6mo 0.26205 Interest Rate Japan 6mo 0.15158 Forward Rate Dec 6- May 17 6-Month Forward Contract Cost 0.013666 $ 2,733,247.10 Cost Comparison: Hedging Alternatives Price Comparison: Hedging Strategies Forward 6 Month Forward 3 Month, Invest Japanese Bank OTC Option March .009 PHLX Option June .008 $2,733,247.10 $2,421,350.97 $2,538,750.97 $2,516,600.00 Part II Hedging Transaction Exposure What would be the effective total cost (in USD) of the Japanese parts if you had advised… Using three months forward? Long 3 Month Forward (Dec & March) (Dec-Mar) 200,000,000 JPY * .012494 (3 Month FR) = $2,498,800.00 Rolled into new 3 month Forward and calculated the new 3 Month Forward Rate in March 2015: .01061253 (Mar-June) 200,000,000 JPY * .0161253 = $2,122,505.97 Cash Outflows from transactions = $374,955.82 + $106,580.16 Short 1 Month Forward (May-June) Shorted 1 Month Forward to Close Position with opposite transactions (May-June) 200,000,000 JPY * .010464 (1 Month Forward) = $2,092,800 Cash inflow from transactions = $76,874.19 Cost of Forward Premiums = $404,461.79 Value of JPY in May = $2,008,000.00 Total Cost (excluding other undocumented fees) = $2,412,461.79 What would be the effective total cost (in USD) of the Japanese parts if you had advised… Using six months forward? (Dec-June) Long 6 Month JPY Forward 200,000,000 JPY * 0.012561 (6 Month FR) = $2,512,200.00 Value of JPY in June = $2,015,925.65 Cash Outflow of $496,274.19 (May-June) Short 1 Month JPY Forward 200,000,000 JPY * .010464 (1 Month FR) = $2,092,800 Cash Inflow of $76,874.19 Cost of Forward Premiums = $419,400 Value of JPY in May = $2,008,000.00 Total Cost (excluding other undocumented fees) = $2,427,400 What would be the effective total cost (in USD) of the Japanese parts if you had advised… Using June Futures? Long (Dec-June) 200,000,000 JPY * .01257 (June Future Rate) = $2,514,000.00 Cash Outflow Close position with Short (May-June) 2000,000,000 JPY * .010002 = $2,000,400.00 Cash Inflow Total Cost of Future Premiums = $513,600 Value of JPY in May = $2,008,000.00 Total Cost of Future = $2,521,600 What would be the effective total cost (in USD) of the Japanese parts if you had advised… Using the OTC JPY Option? OTC March 17th March 17th March 17th March 17th Strike Premium Premium $ Price Premium Total Cost 0.009 0.004081 0.004081 $ 1,800,000.00 $ 816,200.00 $ 2,616,200.00 0.010 0.0031976 0.0031976 $ 2,000,000.00 $ 639,520.00 $ 2,639,520.00 Ex. Rate May Strike/Spot Delta Execute 0.01004 0.00104 Y 0.01004 4E-05 Y Call Value Profit/Loss Total Value $ 208,000.00 $ (608,200.00) $ 2,616,200.00 $ 8,000.00 $ (631,520.00) $ 2,639,520.00 Call Both Options Invest JPY on March 17th = 200,000,000 *1.04595 = 200,091,880 JPY Interest Earned = 91,880 JPY Purchase JPY for Payment = 200,000,000 * .01004 = $2,000,8000.00 Convert Interest = 91,880 JPY * .01004 = $922.47 OTC .009 Total Cost = $2,616,200 - $922.47 = $2,615,277.53 OTC .010 Total Cost = $2,639,520 - $922.47 = $2,638,597.53 What would be the effective total cost (in USD) of the Japanese parts if you had advised… If the PHLX June Options had been… PHLX Strike June .008 (Call) June .009 (Call) June .010 (Call) Premium (Cents) Premium $ 0.008 0.20465 0.0020465 0.009 0.10592 0.0010592 0.01 0.29542 0.0029542 PHLX Ex. Rate May Strike/Spot Delta June .008 (Call) 0.0100 0.00204 June .009 (Call) 0.0100 0.00104 June .010 (Call) 0.0100 4.00E-05 Execute Y Y Y Exercise Value $ 1,600,000.00 $ 1,800,000.00 $ 2,000,000.00 Premium $ 409,300.00 $ 211,840.00 $ 590,840.00 Total Cost $ 2,009,300.00 $ 2,011,840.00 $ 2,590,840.00 Call Value 408,000.00 208,000.00 8,000.00 Profit/Loss $ (1,300.00) $ (3,840.00) $ (582,840.00) Total Cost of JPY $ 2,009,300.00 $ 2,011,840.00 $ 2,590,840.00 Total Cost of JPY with (June .008 Call) = $2,009,300.00 Total Cost of JPY with (June .009 Call) = $2,011,840.00 Total Cost of Option (June .010 Call) = $2,590,840.00 What would be the effective total cost (in USD) of the Japanese parts if you had advised… Left Position Open? Value of JPY in USD (Dec 2012) = $2,308,402.59 Additional Interest Income (Low Interest Rate Assumed) = $4,439.83 $2,308,402.59 * (.23%/6*12*(150/360)) = $4,439.83 Cash Inflow Value of JPY in May = 200,000,000 (JPY) * .01004 (St) = $2,008,000 USD Total Cost of JPY Less Additional Interest Income = $2,003,560.17 Final Comparison Open Position Is Most Risky but Least Expensive Left Position Open $2,003,560.17 PHLX $2,009,300.00 3 Month Forwards $2,412,461.79 6 Month Forwards $2,427,400.00 Futures $2,521,600.00 OTC $2,615,277.53