INTERNATIONAL FOREIGN EXCHANGE PARITY RELATIONSHIPS

advertisement

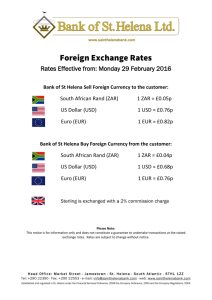

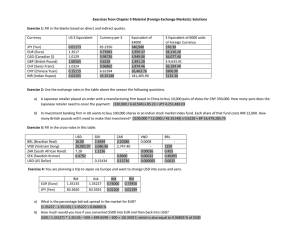

INTERNATIONAL FOREIGN EXCHANGE PARITY RELATIONSHIPS Practice Problems 1. Suppose the nominal South African interest rate is 9.0% and the expected inflation rate is 3.5%. Calculate the real interest rate. a. Use the linear approximation method. .09 = real + .035 real = .09 – .035 = .055 = 5.5% b. Use the exact methodology (Fisher Effect). 1.09 = (1 + real)(1.035) (1.09/1.035) – 1 = real .053 = 5.3% 2. Suppose that the Eurozone expected inflation rate is 9.0%, and that the expected South African inflation rate is 13.0%. The nominal interest rate in the Eurozone is 10.09%. Use the international Fisher relation to approximate the nominal interest rate in South Africa. In Europe: 10.09% – 9.0% = 1.09% In South Africa: r – 13.0% = 1.09% r = 14.09% 3. The 2010 Big Mac Index, perhaps the most popular example of the Law of One Price or absolute PPP methodology in the world, reported that the average price of a Big Mac in the United States was $3.58 while the dollar-equivalent price in the People’s Republic of China was $1.83. a. Was RMB undervalued or overvalued in 2010? By how much? 1- ($1.83 / $3.58) = -48.9% The RMB was undervalued against the dollar by 48.9%, according to the 2010 Big Mac Index. b. How does this comparison compare to that of the Big Mac Index in 2015 (listed in our IFC 2 Powerpoint presentation)? According to the Big Mac Index, the past five years have seen significant strides for the RMB vis-à-vis the dollar. Whereas in 2010, the RMB was extremely undervalued by 48.9%, by 2015 the RMB had made up some of this gap, although it was still very undervalued by 42%. 4. One of the most common examples of the relative PPP methodology is the consumer price index (CPI). The average price of gasoline in India in 1980 was 20 Rs/liter. If we use the price levels of 1967 as our base year, the CPI is said to be 100 in that year. In 1980, the CPI is 210 and, in 2015, it is 440. a. What should the price of gasoline per liter be in India, assuming that the value of gasoline has stayed flat over the past 35 years? 20 * (440/210) = 41.90 Rs/liter b. Obviously, gasoline has become more dear since 1980, but by how much has the real price risen by if gas sells for Rs 55/liter in 2015? (55 – 41.90)/41.90 = 31.25% 5. The current spot rates are: 1.32 USD/EUR 95 JPY/USD The current inflation rates are: US: 4.00% Eurozone: 6.50% Japan: 8.00% Using the spot exchange rates and the inflation rate information provided, a. Calculate the USD/EUR one year from today. 1.32 * (1.04/1.065) = S1 1.32*0.9765 = 1.289 USD/EUR b. Calculate the JPY/USD six months from today. 95 * (1.08/1.04)0.5 = S0.5 95*√1.0385 = 96.81 JPY/USD 6. Suppose the spot exchange rate quote is 1.0120 Canadian dollars (C$) per U.S. dollar. The 1-year nominal interest rate in Canada is 3.0% and the 1-year nominal interest rate in the United States is 1.0%. The expected exchange rate at the end of the year using the uncovered interest rate parity is closest to a. C$1.0320 b. C$0.9923 c. C$0.9918 For this question, you do not even need to calculate the specific number because the CAD must by definition appreciate because its nominal interest rate is higher. Thus, choice A is the only potential answer. Were this not a multiple choice question, the calculation would be: C$1.012 * (1.03/1.01) = C$1.032 7. The forward rate for the USD/EUR exchange rate one year from today is $1.1255 , while the spot rate is currently $1.1163 per euro. According to forward parity, I can predict with confidence that the future spot rate will experience how much appreciation from today’s spot rate? (1.1255 – 1.1163) / 1.1163 = 0.008242 = .8242%