Tutorial Solution - January 14th

advertisement

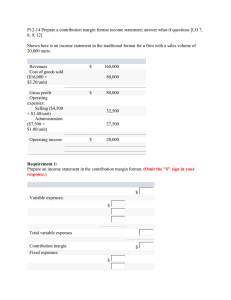

Cost-Volume-Profit Menlo Company manufactures and sells a single product. The company’s sales and expenses for last quarter follow: Total Sales Per Unit CM Ratio $750,000 $50 1.00 Variable manufacturing costs 360,000 24 0.48 Variable selling costs 120,000 8 0.16 270,000 $18 0.36 Less: Contribution margin Less: Fixed manufacturing costs 110,000 Fixed selling and admin costs 106,000 Net income $54,000 1. What is the quarterly break-even point in units sold and in sales dollars? Units: Equation approach: Sales = Profit + VC + FC 50Q = 0 + 32Q + 216,000 18Q = 216,000 Q = 12,000 units Contribution Margin approach: Q = Fixed costs / CM Q = 216,000 / 18 Q = 12,000 units Dollars: Equation approach: Sales = Profit + VC + FC S = 0 + 0.64S + 216,000 0.36S = 216,000 S = $600,000 Contribution Margin Ratio approach: S = Fixed costs / CM Ratio S = 216,000 / 0.36 S = $600,000 2. How many units would have to be sold each quarter to earn a target profit of $20,000? Units: Equation approach: Sales = Profit + VC + FC 50Q = 20,000 + 32Q + 216,000 18Q = 236,000 Q = 13,111.1 units, therefore 13,112 would need to be sold to make at least $20,000 in profit Contribution Margin approach: Q = (Fixed costs + Profit) / CM Q = (216,000 + 20,000) / 18 Q = 13,111.1 units, so 13,112 3. If sales increase by $75,000 per quarter and there is no change in fixed expenses, by how much would you expect quarterly net income to increase? Profit = CM + FC = $75,000 x 0.36 = $27,000 There is no change to fixed costs, so nothing is adjusted for this. The change in contribution margin, in this example, is found by taking the increase in sales multiplied by the contribution margin ratio. For every one dollar increase in sales, contribution margin increased by $0.36. This goes towards covering fixed expenses and profits. With no change to fixed expenses, the full impact is to profit.