3 How to Plan for Profit One Dept at a Time

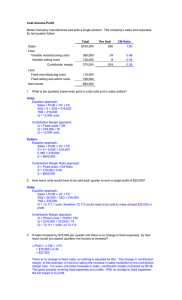

advertisement

Course Title How To Plan for Profit—One Department At a Time Lori Supinie Senseney Music Focus: Departmental Profitability Identifying product categories or departments that are profitable – Creating departmental profit/loss statements – Allocating expenses – Analyzing results and making adjustments Purpose: Departmental Profitability • Maximize Profitability • Manager Accountability • Effective use of investments – Personnel/time – Inventory $ Twin Sons of Different Mothers Chip Averwater Income Statement Approach “Turnover is not the goal – profit is. We should invest every dollar we have reasonable access to in the inventory that will offer us the best (net) profit. What that does to our turnover ratio is irrelevant.” Retail Truths, ©2012 Alan Friedman Balance Sheet Approach “Inventory turns are the name of the game when working toward achieving profitability. By turning your inventory quickly, you can make up gross profit “dollars” lost by declining margins.” Music, Inc., Aug. 2003 Departmental Income Statement • Broad (department) or Narrow (category) Southwinds Music Guitar Dept. 2012 • Revenues, Cost of Goods (including freight-in) • POS System-derived Sales $ 300,000 Cost of Goods Sold (186,000) Gross Margin 114,000 Departmental Income Statement •Controllable Expenses • Resources controlled by manager/owner • Selling & Non-selling salaries •Contribution Margin Southwinds Music Guitar Dept. 2012 Sales $ 300,000 Cost of Goods Sold (186,000) Gross Margin 114,000 Less Controllable Expenses: Salaries & Wages (45,000) Advertising (12,000) Contribution Margin 57,000 Departmental Income Statement • Overhead (NonControllable) • Allocation of expenses based on some activity measure • Net Income (Loss) Southwinds Music Guitar Dept. Sales Cost of Goods Sold Gross Margin Less Controllable Expenses: Salaries & Wages Advertising Contribution Margin Less Overhead: Occupancy Supplies Interest Telephone Credit Card Fees Contract Labor Total Overhead Net Income (Loss) $ 2012 300,000 (186,000) 114,000 (45,000) (12,000) 57,000 $ (30,000) (2,000) (3,000) (2,400) (3,000) (1,000) (41,400) 15,600 Allocation of Expenses What’s an Appropriate Activity Measure? • • • • • • Square footage (occupancy) # of employees / usage (supplies, telephone) Time (salaries) Direct attribution (contract labor, travel) % of Inventory (interest) % of Sales (credit card fees) Allocation of Expenses Southwinds Music Guitar Dept. Overhead: Occupancy $ 30,000 Total Activity Expense Measure $300,000 Sq. Footage Supplies 2,000 $10,000 % of Employees Interest 3,000 $30,000 % of Inventory Telephone 2,400 $12,000 % of Employees Credit Card Fees 3,000 $10,000 % of Sales Contract Labor 1,000 $5,000 Total Overhead $ 41,400 Direct % Dept. Total Allocation 1,500 15,000 10% 2 10 20% $70,000 2 $300,000 $1,000 $700,000 10 $1,000,000 N/A 10% 20% 30% N/A Analysis • What can I affect? – Increase revenues – Increase margins – Reduce or reallocate expenses • Controllable Expenses • Occupancy • When is a loss ok? – Maximize Contribution Margin Sales Cost of Goods Sold Gross Margin Less Controllable Expenses: Salaries & Wages Advertising Contribution Margin Less Overhead: Occupancy Supplies Interest Telephone Credit Card Fees Contract Labor Total Overhead Net Income (Loss) $ 2012 300,000 (186,000) 114,000 (45,000) (12,000) 57,000 $ (30,000) (2,000) (3,000) (2,400) (3,000) (1,000) (41,400) 15,600 Analysis • Southwinds Music Guitar Dept. Sales $ Cost of Goods Sold Gross Margin Less Controllable Expenses: Salaries & Wages Advertising Contribution Margin Less Overhead: Occupancy Supplies Interest Telephone Credit Card Fees Contract Labor Total Overhead Net Income (Loss) $ 2012 300,000 (186,000) 114,000 (45,000) (12,000) 57,000 (45,000) (2,000) (3,000) (2,400) (3,000) (4,000) (59,400) (2,400) • Southwinds Music Guitar Dept. Sales $ Cost of Goods Sold Gross Margin Less Controllable Expenses: Salaries & Wages Advertising Contribution Margin Less Overhead: Occupancy Supplies Interest Telephone Credit Card Fees Contract Labor Total Overhead Net Income (Loss) $ 2012 300,000 (195,000) 105,000 (75,000) (35,000) (5,000) (30,000) (2,000) (3,000) (2,400) (3,000) (4,000) (44,400) (49,400) In Conclusion . . . Knowing your Department-level Profitability is key to: – – – – Maximizing overall profitability Efficient allocation of staff and space Management accountability Effective investment in inventory $ How To Plan for Profit—One Department At a Time Questions?? Lori@senseneymusic.com