relevant cost

advertisement

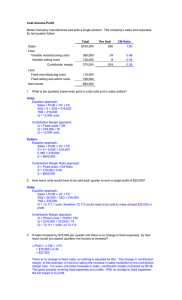

1 CHAPTER 11 RELEVANT COSTS FOR DECISION MAKING Five-Step Decision-Making Process Step 1: Obtain Information Step 2: Make Predictions About Future Costs Step 3: Choose An Alternative Feedback Step 4: Implement The Decision Step 5: Evaluate Performance Requirements for accounting information 3 Accounting information is useful for decision making if it is Reliable, Timely, Relevant. Relevant cost A relevant cost is a cost that differs between alternatives. There are 3 main recognition criteria: • Cash-flows • Future costs • Incremental costs Mr. Kiệm’s journey 5 Mr. Kiệm bought a Hue - Hanoi return ticket from Vietnam airlines. He arrived at Hanoi on Monday and will return to Hue on Friday. He doesn’t know that his company’s leaders flew to Hanoi in this week and are going to fly back to Hue on Friday, too. Mr. Kiệm thought that he should help his company save some money so he required Vietnam Airlines to refund his return ticket and flew in his company’s helicopter. Is his decision correct? Is cost of the Hanoi – Hue journey by the company’s helicopter relevant? Is cost of the Hanoi – Hue journey by Vietnam Airlines relevant? What do the company’s shareholders want Mr. Kiệm to do? Mr. Kiệm’s journey 6 Mr. Kiệm is a manager in his company and he is evaluated based on his division’s reporting profit. When Mr. Kiệm received his division’s monthly income statement, he discovered that he was allocated cost of the Hanoi-Hue helicopter journey twice as much as cost of Vietnam Airlines one. Mr. Kiệm asked the company’s accountants and knew that all passengers were allocated the journey’s cost. Mr. Kiệm was allocated the same cost as the Vice President who required that journey. Is Mr. Kiệm’s decision correct? Identifying Relevant Costs Cynthia, a Boston student, is considering visiting her friend in New York. She can drive or take the train. By car it is 230 miles to her friend’s apartment. She is trying to decide which alternative is less expensive and has gathered the following information: Automobile Costs (based on 10,000 miles driven per year) 1 2 3 4 5 6 Annual straight-line depreciation on car Cost of gasoline Annual cost of auto insurance and license Maintenance and repairs Parking fees at school Total average cost $45 per month × 8 months Annual Cost of Fixed Items $ 2,800 1,380 360 Cost per Mile $ 0.280 0.050 0.138 0.065 0.036 $ 0.569 $1.60 per gallon ÷ 32 MPG $18,000 cost – $4,000 salvage value ÷ 5 years Identifying Relevant Costs Automobile Costs (based on 10,000 miles driven per year) 1 2 3 4 5 6 Annual straight-line depreciation on car Cost of gasoline Annual cost of auto insurance and license Maintenance and repairs Parking fees at school Total average cost 7 8 9 10 11 12 13 Annual Cost of Fixed Items $ 2,800 1,380 360 Cost per Mile $ 0.280 0.050 0.138 0.065 0.036 $ 0.569 Some Additional Information Reduction in resale value of car per mile of wear Round-tip train fare Benefits of relaxing on train trip Cost of putting dog in kennel while gone Benefit of having car in New York Hassle of parking car in New York Per day cost of parking car in New York $ 0.026 $ 104 ???? $ 40 ???? ???? $ 25 Types of Decisions One-Time-Only Special Orders Make or Buy Insourcing vs. Outsourcing Branch / Segment: Adding or Discontinuing Product-Mix (Utilization of constraint resources) Equipment Replacement One-Time-Only Special Orders Accepting or rejecting special orders when there is idle production capacity and the special orders has no long-run implications Decision Rule: does the special order generate additional operating income? Yes – accept No – reject Compares relevant revenues and relevant costs to determine profitability Special Orders Jet, Inc. makes a single product whose normal selling price is $20 per unit. A foreign distributor offers to purchase 3,000 units for $10 per unit. This is a one-time order that would not affect the company’s regular business. Annual capacity is 10,000 units, but Jet, Inc. is currently producing and selling only 5,000 units. Should Jet accept the offer? Special Orders Increase in revenue Increase in costs Increase in net income Quick Check Northern Optical ordinarily sells the X-lens for $50. The variable production cost is $10, the fixed production cost is $18 per unit, and the variable selling cost is $1. A customer has requested a special order for 10,000 units of the X-lens to be imprinted with the customer’s logo. This special order would not involve any selling costs, but Northern Optical would have to purchase an imprinting machine for $50,000. (see the next page) Quick Check What is the rock bottom minimum price below which Northern Optical should not go in its negotiations with the customer? In other words, below what price would Northern Optical actually be losing money on the sale? There is ample idle capacity to fulfill the order. a. $50 b. $10 c. $15 d. $29 Quick Check A company is evaluating an one-off contract that requires two types of material (T and V). Data relating to the material requirements are as follows: Material Quantity needed type for project T V kg 500 400 Quantity currently in stock kg 100 200 Original cost of quantity in stock £/kg 40 55 Current Current purchase resale price price £/kg 45 52 £/kg 44 40 Material T is regularly used by the company in normal production. Material V is no longer in use by the company and has no alternative use within the business. What is the total relevant cost of materials for the contract? A £40,400 B £40,900 C £43,400 D £43,900 Quick Check All of a company's skilled labour, which is paid £8 per hour, is fully employed manufacturing a product to which the following data refer: £ per unit £ per Unit Selling price 60 Less Variable costs: Skilled labour 20 Others 15 (35) Contribution 25 The one-off contract requires 90 skilled labour hours to complete. No other supplies of skilled labour are available. What is the total relevant skilled labour cost of the contract? A £720 B £900 C £1,620 D £2,160 The Make or Buy Decision A decision concerning whether an item should be produced internally or purchased from an outside supplier is called a “make or buy” decision. Let’s look at Rạng Đông Company example. The Make or Buy Decision Rạng Đông manufactures thermos-flask. Department A manufactures silvered inner containers. The unit product cost of this part is: Direct materials Direct labor Variable overhead Depreciation of special equip. Supervisor's salary General factory overhead Unit product cost $ 9 5 1 3 2 10 $ 30 The Make or Buy Decision The special equipment used to manufacture inner containers has no resale value. The total amount of general factory overhead, which is allocated on the basis of direct labor hours, would be unaffected by this decision. The $30 unit product cost is based on 20,000 units produced each year. A Chinese supplier has offered to provide the 20,000 units at a cost of $25 per unit. Should we accept the supplier’s offer? The Make or Buy Decision Cost Per Unit Outside purchase price $ 25 Direct materials Direct labor Variable overhead Depreciation of equip. Supervisor's salary General factory overhead Total cost $ 9 5 1 3 2 10 $ 30 Cost of 20,000 Units Buy Make $ 500,000 $ - $ 500,000 Should we make or buy inner containers? The Make or Buy Decision DECISION RULE In deciding whether to accept the outside supplier’s offer, Rạng Đông isolated the relevant costs of making the part by eliminating: The sunk costs. The future costs that will not differ between making or buying the parts. Adding/Dropping Segments One of the most important decisions managers make is whether to add or drop a business segment such as a product or a store. Let’s see how relevant costs should be used in this decision. Adding/Dropping Segments Due to the declining popularity of digital watches, Lovell Company’s digital watch line has not reported a profit for several years. An income statement for last year is shown on the next screen. Adding/Dropping Segments Segment Income Statement Digital Watches Sales Less: variable expenses Variable manufacturing costs Variable shipping costs Commissions Contribution margin Less: fixed expenses General factory overhead Salary of line manager Depreciation of equipment Advertising - direct Rent - factory space General admin. expenses Net operating loss $ 500,000 $ 120,000 5,000 75,000 $ 60,000 90,000 50,000 100,000 70,000 30,000 200,000 $ 300,000 400,000 $ (100,000) Adding/Dropping Segments • Investigation has revealed that total fixed general factory overhead and general administrative expenses would not be affected if the digital watch line is dropped. • The fixed general factory overhead and general administrative expenses assigned to this product would be reallocated to other product lines. • The equipment used to manufacture digital watches has no resale value or alternative use. Should Lovell retain or drop the digital watch segment? A Contribution Margin Approach DECISION RULE Lovell should drop the digital watch segment only if its profit would increase. This would only happen if the fixed cost savings exceed the lost contribution margin. Let’s look at this solution. A Contribution Margin Approach Contribution Margin Solution Contribution margin lost if digital watches are dropped Less fixed costs that can be avoided Net disadvantage $ - Comparative Income Approach The Lovell solution can also be obtained by preparing comparative income statements showing results with and without the digital watch segment. Let’s look at this second approach. Comparative Income Approach Solution Keep Drop Digital Digital Watches Watches Sales $ 500,000 $ Less variable expenses: Manufacturing expenses 120,000 Shipping 5,000 Commissions 75,000 Total variable expenses 200,000 Contribution margin 300,000 Less fixed expenses: General factory overhead 60,000 Salary of line manager 90,000 Depreciation 50,000 Advertising - direct 100,000 Rent - factory space 70,000 General admin. expenses 30,000 Total fixed expenses 400,000 Net operating loss $ (100,000) Difference $ 500,000 120,000 5,000 75,000 200,000 300,000 Utilization of a Constrained Resource Firms often face the problem of deciding how to best utilize a constrained resource. Usually fixed costs are not affected by this particular decision, so management can focus on maximizing total contribution margin. Let’s look at the Ensign Company example. Utilization of a Constrained Resource Ensign Company produces two products and selected data is shown below: Product 2 1 Selling price per unit Less variable expenses per unit Contribution margin per unit Current demand per week (units) Contribution margin ratio Processing time required on machine A1 per unit $ 60 36 $ 24 2,000 40% 1.00 min. $ 50 35 $ 15 2,200 30% 0.50 min. Utilization of a Constrained Resource Machine A1 is the constrained resource and is being used at 100% of its capacity. There is excess capacity on all other machines. Machine A1 has a capacity of 2,400 minutes per week. Should Ensign focus its efforts on Product 1 or 2? Quick Check How many units of each product can be processed through Machine A1 in one minute? Product 1 a. b. c. d. 1 1 2 2 unit unit units units Product 2 0.5 2.0 1.0 0.5 unit units unit unit Quick Check What generates more profit for the company, using one minute of machine A1 to process Product 1 or using one minute of machine A1 to process Product 2? a. Product 1 b. Product 2 c. They both would generate the same profit d. Cannot be determined Utilization of a Constrained Resource The key is the contribution margin per unit of the constrained resource. Product 1 Contribution margin per unit Time required to produce one unit Contribution margin per minute $ ÷ 2 24 $ 15 1.00 min. ÷ 0.50 min. $ 24 min. $ 30 min. Utilization of a Constrained Resource Let’s see how this plan would work. Alloting Our Constrained Recource (Machine A1) Weekly demand for Product 2 Time required per unit Total time required to make Product 2 Total time available Time used to make Product 2 Time available for Product 1 Time required per unit Production of Product 1 × units min. min. ÷ min. min. min. min. units Utilization of a Constrained Resource According to the plan, we will produce 2,200 units of Product 2 and 1,300 of Product 1. Our contribution margin looks like this. Production and sales (units) Contribution margin per unit Total contribution margin Product 1 1,300 $ 24 $ 31,200 The total contribution margin for Ensign is $64,200. Product 2 2,200 $ 15 $ 33,000 Linear programming – multiple constrained resources Linear programming is a technique for solving problems of profit maximisation or cost minimisation and resource allocation. Usefull in the cases of multiple constrained resources Steps: 1. Define variables 2. Establish constraints 3. Construction objective function 4. Graph the constraints 5. Establish feasible region 6. Add iso-profit/contribution line 7. Determine optimal solution Utilization of a Constrained Resource 39 Units of product 1 = X; Units of product 1 = Y X + 0,5Y <(=)2400 Contribution = 24X +15Y X< (=)2000; Y<(=)2200 X>=0; Y>=0 Utilization of a Constrained Resource 40 X Y<(=)2200 Area of feasible solutions 24X+15Y X + 0,5Y<(=)2400 2400 X <(=)2000 2000 Y 2200 4800 Quick Check Colonial Heritage makes reproduction colonial furniture from select hardwoods. Chairs Selling price per unit $80 Variable cost per unit $30 Board feet per unit 2 Monthly demand 600 Tables $400 $200 10 100 The company’s supplier of hardwood will only be able to supply 2,000 board feet this month. Is this enough hardwood to satisfy demand? a. Yes b. No Quick Check Chairs Selling price per unit $80 Variable cost per unit $30 Board feet per unit 2 Monthly demand 600 Tables $400 $200 10 100 The company’s supplier of hardwood will only be able to supply 2,000 board feet this month. What plan would maximize profits? a. 500 chairs and 100 tables b. 600 chairs and 80 tables c. 500 chairs and 80 tables d. 600 chairs and 100 tables Quick Check As before, Colonial Heritage’s supplier of hardwood will only be able to supply 2,000 board feet this month. Assume the company follows the plan we have proposed. Up to how much should Colonial Heritage be willing to pay above the usual price to obtain more hardwood? a. $40 per board foot b. $25 per board foot c. $20 per board foot d. Zero Managing Constraints Finding ways to process more units through a resource bottleneck At the bottleneck itself: •Improve the process • Add overtime or another shift • Hire new workers or acquire more machines • Subcontract production Sell or Process Further It will always profitable to continue processing a joint product after the split-off point so long as the incremental revenue exceeds the incremental processing costs incurred after the split-off point. Let’s look at the Sawmill, Inc. example. Sell or Process Further Sawmill, Inc. cuts logs from which unfinished lumber and sawdust are the immediate joint products. Unfinished lumber is sold “as is” or processed further into finished lumber. Sawdust can also be sold “as is” to gardening wholesalers or processed further into “prestologs.” Sell or Process Further Data about Sawmill’s joint products includes: Sales value at the split-off point Sales value after further processing Allocated joint product costs Cost of further processing Per Log Lumber Sawdust $ 140 $ 40 270 88 50 50 12 20 Sell or Process Further Analysis of Sell or Process Further Per Log Lumber Sales value after further processing Sales value at the split-off point Incremental revenue Cost of further processing Profit (loss) from further processing Sawdust Equipment-Replacement Decisions Sometimes difficult due to amount of information at hand that is irrelevant: Cost, Accumulated Depreciation and Book Value of existing equipment Any potential Gain or Loss on the transaction – a Financial Accounting phenomenon only Decision Rule: Select the alternative that will generate the highest operating income Equipment-Replacement Decisions In 2013 Honda Vietnam bought an Asimo robot system used in Assembly department. The acquisition cost is VND 2.1 billions. The estimated useful life is 6 years. In 2014 there is a new version of Asimo robots which is much more efficient than the old one. The company can save 70% of annual operating costs if it uses the new version. The purchase price of the new version is VND 4 billions. The estimated useful life is 5 years. If the company buy the new vesion, the current robot system can be disposed at the value of VND 1 bil. The current annual operating cost is VND 900 millions. Should Honda Vietnam buy the new version? 50 End of Chapter 11