COST-VOLUME-PROFIT ANALYSIS

advertisement

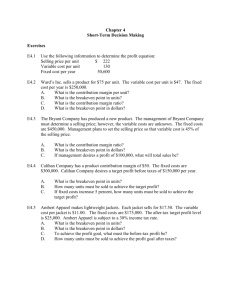

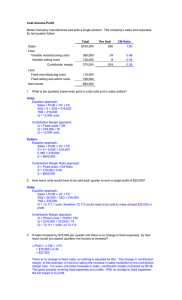

COST-VOLUME-PROFIT ANALYSIS AND PRICING DECISIONS MARKETING WANTS ANOTHER $50,000 ► ► ► 3 What will they do with it? How will it affect sales volume? What is the impact on our bottom line? © Tomwang112 / iStockphoto BREAKEVEN ANALYSIS Unit 3.1 Unit 3.2 Unit 3.3 Unit 3.4 31 . WHAT DOES IT MEAN TO “BREAK EVEN” ► ► ► ► 3 Total revenues = total expenses Profit = $0 There is one sales volume at which this relationship is true This is called the “breakeven point” TO CALCULATE THE BREAKEVEN POINT ► Use the equation approach Sales Revenue – Variable expenses – Fixed expenses = Operating income (SP×units sold) – (VC×units sold) – FC = $0 [(SP – VC)×(units sold)] – FC = $0 (CM/unit×units sold) – FC = $0 • Solve for units sold, which equals the breakeven point • Why is profit set to $0? 3 BREAKEVEN BREAKEVENPOINT POINTFOR FORUNIVERSAL UNIVERSALSPORTS SPORTSEXCHANGE EXCHANGE $20x - $16x - $168,000 = $0 $4x - $168,000 = $0 x = 42,000 jerseys SHORTCUTS… FC = Breakeven in units CM/Unit $168,000 = 42,000 jerseys $4 3 SHORTCUTS… FC CMR = Breakeven in sales $ $168,000 = $840,000 0.2 3 LET’S EVENGRAPHICALLY GRAPHICALLY LET’SLOOK LOOKAT AT BREAK BREAKEVEN $168,000 MARGIN OF SAFETY Current sales – Breakeven sales 52,500 – 42,000 = 10,500 jerseys $1,050,000 – $840,000 = $210,000 What does this mean? 3 PRACTICE BREAKING EVEN Exercise 3-2 3 EXERCISE 3-2 SOLUTION a. $.80 - $.45 = $.35 $.35 = .4375 b. Contribution margin ratio = $.80 c. $.80x – $.45x – $175,000 = $0 $.35x = $175,000 x = 500,000 bars to breakeven 500,000 bars $.80 per bar = $400,000 to breakeven d. The breakeven point will increase to: $175,000 = 700,000 bars × $0.80 = $560,000 $0.25 3 © Tomwang112 / iStockphoto C-V-P ANALYSIS Unit 3.1 Unit 3.2 Unit 3.3 Unit 3.4 3.2 LET’S REVIEW THE PROFIT EQUATION SP×(units sold) – VC×(units sold) – FC = OI 3 HOW MUCH DO I HAVE TO SELL TO MAKE $X? ► ► ► 3 This is called the “target income” question Use the profit equation (SP×units sold) – (VC×units sold) – FC = $X Use the breakeven formula and treat your target pretax income as additional fixed costs FC + Target Income = required sales volume CM / unit To find the sales dollars required to attain the target income, use the CMR rather than the CM / unit. WHAT ABOUT TARGET NET INCOME? ► ► ► You must adjust net income to pretax income Divide target net income by (1 - tax rate) Solve as before Total FC + Target net income 1 – tax rate = required sales volume CM / unit 3 TARGET PRACTICE (EXERCISE 3-10) Wimpee’s Hamburger Stand sells one burger, the Super Tuesday Burger, for $3.00. If total variable expenses are $1.75 per hamburger and total monthly fixed expenses are $25,000, how many burgers would Wimpee have to sell each month: To break even? ►To earn a pretax operating income of $6,000? ► 3 WHAT IF… Suppose Wimpee has never sold more than 21,000 Super Tuesday Burgers in a single month. ► ► 3 How likely is it that he will achieve the desired $6,000 target operating income? What can he do to improve his chances of reaching his $6,000 target operating income? CVP ANALYSIS ► ► ► 3 Stands for cost-volume-profit A tool to determine the impact of changes in sales volume, costs, or sales mix on net income Useful for evaluating decision alternatives THREE APPROACHES TO CVP ► ► ► 3 Prepare a contribution format income statement before and after implementing the changes Prepare a partial contribution format income statement that includes only those items that change (called the “incremental approach”) Compare the current total contribution margin with the proposed total contribution margin, then adjust for changes in fixed expenses CVP AND THE SUPPLY CHAIN ► ► How do the CVP decisions of supply chain partners affect each other? For example, consider the jerseys that Universal Sports Exchange purchases from C&C Sports. • What happens if C&C Sports increases the selling price? • What happens if Universal Sports Exchange decides to use a cheaper supplier? 3 OPERATING LEVERAGE ► ► ► Firms sometimes have the option to trade fixed costs for variable costs Higher levels of fixed costs introduce higher levels of risk Measures the magnitude of change in operating income for a given percentage change in sales revenue Degree of operating leverage = 3 Contribution margin Net operating income WHYDO DO WE WE CARE CARE ABOUT WHY ABOUTOPERATING OPERATINGLEVERAGE? LEVERAGE DO THE CVP Exercise 3-6 3 EXERCISE 3-6 SOLUTION $390,000 a. Contribution margin ratio = = .65 $600,000 Variable cost ratio = 1 - .65 = .35 b. Margin of safety = Current sales – Breakeven sales $292,500 Breakeven sales = .65 = $450,000 Margin of safety = $600,000 – $450,000 = $150,000 c. Net operating income would increase by the change in contribution margin: $100,000 .65 = $65,000 3 EXERCISE 3-6 SOLUTION (CONT.) $17.50 1.16 $20.30 $50 1.1 $55 $600,000 current unit sales = = 12,000 50 d. new variable cost = = new price = = new unit sales = 12,000 .98 = 11,760 operating income = [($55.00 – $20.30) 11,760] – $292,500 = $115,572 3 © Tomwang112 / iStockphoto MULTIPRODUCT C-V-P ANALYSIS Unit 3.1 Unit 3.2 Unit 3.3 Unit 3.4 3.3 MULTIPRODUCT CVP ► ► 3 Rarely does a company produce a single product Since not every product will have the same contribution margin, we have a problem when more than one product is produced WHAT IS “SALES MIX”? ► ► The “bag” or “package” of goods sold For example: • For every dining room table sold, the company also sells 4 chairs • For every computer sold, the company also sells a monitor and a printer • For every pair of athletic shoes sold, Landon Sports sells 4 baseball jerseys 3 USE THE PROFIT EQUATION…WITH ADJUSTMENTS Product Price Variable Cost Contribution Margin Jerseys $20 $16.00 $4.00 Shoes $45 $38.70 $6.30 CM(jerseys) + CM(shoes) – FC = OI 3 DETERMINE THE SALES MIX Product Contribution Margin Sales Mix Adjusted Contribution Margin Jerseys $4.00 4x $16.00x Shoes $6.30 1x $ 6.30x $4.00(4x) + $6.30(x) – FC = OI $16x + $6.30x – FC = OI 3 CALCULATING THE BREAKEVEN POINT Product Contribution Margin Sales Mix Adjusted Contribution Margin Jerseys $4.00 4x $16.00x Shoes $6.30 1x $ 6.30x 3 $16x + $6.30x – $178,400 = $0 $22.30x = $178,400 x = 8,000 shoes 4x = 4(8,000) = 32,000 jerseys LIMITING ASSUMPTIONS OF CVP ANALYSIS ► ► ► 3 All costs can be divided into fixed and variable components All cost and profit functions are linear throughout the relevant range Sales mix will remain constant CHANGES EXAMINED USING CVP ► ► ► ► ► ► Change in sales price Change in sales volume Change in variable costs per unit Change in fixed costs Change in sales mix Any combination of the above Remember to always use “constant” forms – SP/unit, VC/unit, Total FC – when doing CVP analysis 3 TIME TO MIX IT UP Exercise 3-14 3 EXERCISE 3-14 SOLUTION a. Kitchenware’s sales mix is 14,000 plastic pitchers and 42,000 glass pitchers, or a sales mix of 1 to 3. ($30 – $15)x + ($45 – $24)3x – $982,800 = 0 $15x + $63x = $982,800 x = 12,600 plastic pitchers = x = 12,600; glass pitchers = 3x = 37,800 b. ($30 – $13)x + ($45 – $24)3x – $982,800 = 0 $17x + $63x = $982,800 x = 12,285 plastic pitchers = x = 12,285; glass pitchers = 3x = 36,855 3 © Tomwang112 / iStockphoto PRICING DECISIONS Unit 3.1 Unit 3.2 Unit 3.3 Unit 3.4 34 . ECONOMICS OF PRICE 3 COST-PLUS PRICING ► ► ► Start with the cost to produce the product Add a markup to the cost to arrive at price Be clear about what cost you use in the markup calculation + = 3 Product Cost Markup Sales Price CALCULATING MARKUP PERCENTAGE Sales price – Cost = Markup % Cost $20.00 - $14.80 $14.80 3 = 35% CALCULATING PRICE USING MARKUP % Cost + (Cost × Markup %) = Price $36.00 + ($36.00 × 35%) = Price $36.00 + $12.60 = $48.60 3 ISSUES WITH COST-PLUS PRICING ► ► ► 3 What if customers are willing to pay more than the calculated price? Cost-plus pricing does not recognize the value provided to the customer; it recognizes a return to the seller The costs of the seller’s inefficiencies are borne by the customers TARGET COSTING ► Start with an estimate of the price customers will pay • Subtract the desired markup • The result is the target, or maximum, product cost ► ► 3 This is calculated before the product is designed and manufactured If you can produce the product for the target cost, go forward LET’S PRICE Exercise 3-18 3 EXERCISE 3-18 SOLUTION a. cost of original pet bed = $45 – $15 = $30 $15 = 50% markup on COGS markup percentage = $30 price of high-end bed = $58 × 1.5 = $87 $15 = 1/3; COGS = 2/3 b. current gross margin = $45 high-end bed target cost of goods sold = 2/3 × $78 = $52 c. Pet Designs could •redesign the high-end bed to reduce the cost to produce the bed; •accept a lower gross margin percentage; or, •not make the bed 3 © Beverley Vycital/iStockphoto ONE FINAL REVIEW Problem 3-20 3 PROBLEM 3-20(A) SOLUTION $600,000 current sales volume: = 50,000 units $12 new sales volume: 50,000 × .95 = 47,500 units new sales price: $12.00 × 1.10 = $13.20 Sales Less variable expenses Contribution margin Less fixed expenses Operating income 3 Total $627,000 332,500 294,500 175,000 $119,500 Per unit $13.20 7.00 $ 6.20 PROBLEM 3-20(B) SOLUTION new sales price: $12.00 × 1.10 = $13.20 new variable cost per unit: $7.00 × 1.05 = $7.35 Sales Less variable expenses Contribution margin Less fixed expenses Operating income 3 Total $660,000 367,500 292,500 175,000 $117,500 Per unit $13.20 7.35 $ 5.85 PROBLEM 3-20(C) SOLUTION new sales price: $12.00 × .90 = $10.80 new sales volume: 50,000× 1.20 = 60,000 units Sales Less variable expenses Contribution margin Less fixed expenses Operating income 3 Total $648,000 420,000 228,000 175,000 $ 53,500 Per unit $10.80 7.00 $ 3.80 PROBLEM 3-20(D) SOLUTION new fixed expenses: $175,000 + $20,000 = $195,000 Sales Less variable expenses Contribution margin Less fixed expenses Operating income 3 Total $648,000 420,000 228,000 175,000 $ 53,500 Per unit $10.80 7.00 $ 3.80 PROBLEM 3-20(E) SOLUTION new sales price: $12.00 × 1.10 = $13.20 new variable cost per unit: $7.00 × 1.10 = $7.70 new fixed expenses: $175,000 + $25,000 = $200,000 new sales volume: 50,000 × .90 = 45,000 units Sales Less variable expenses Contribution margin Less fixed expenses Operating income 3 Total $594,000 346,500 247,500 200,000 $ 47,500 Per unit $13.20 7.70 $ 5.50