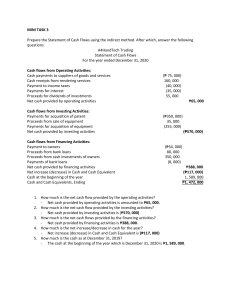

In class exercise --Cash Flow Statement

advertisement

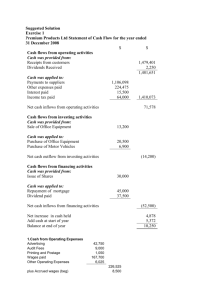

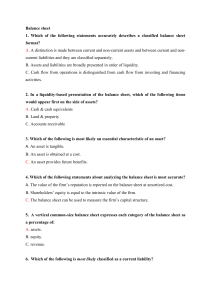

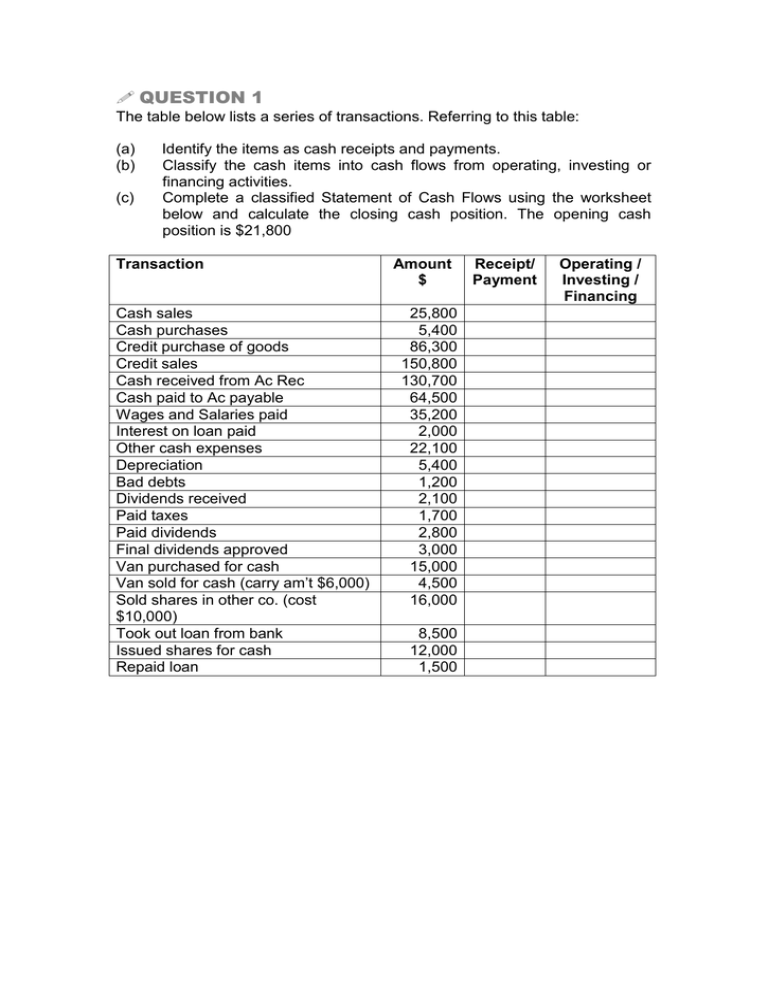

QUESTION 1 The table below lists a series of transactions. Referring to this table: (a) (b) (c) Identify the items as cash receipts and payments. Classify the cash items into cash flows from operating, investing or financing activities. Complete a classified Statement of Cash Flows using the worksheet below and calculate the closing cash position. The opening cash position is $21,800 Transaction Cash sales Cash purchases Credit purchase of goods Credit sales Cash received from Ac Rec Cash paid to Ac payable Wages and Salaries paid Interest on loan paid Other cash expenses Depreciation Bad debts Dividends received Paid taxes Paid dividends Final dividends approved Van purchased for cash Van sold for cash (carry am’t $6,000) Sold shares in other co. (cost $10,000) Took out loan from bank Issued shares for cash Repaid loan Amount $ 25,800 5,400 86,300 150,800 130,700 64,500 35,200 2,000 22,100 5,400 1,200 2,100 1,700 2,800 3,000 15,000 4,500 16,000 8,500 12,000 1,500 Receipt/ Payment Operating / Investing / Financing Statement of Cash Flows for the year ended Cash flows from operating activities Cash flows from investing activities Cash flows from financing activities Net increase / (decrease) in cash Plus opening cash position Closing cash position 21,800 Question 2 CMU Limited is a long established business whose Directors are considering selling shares to the public and are required amongst other things to produce a Cash Flow Statement. The company’s bookkeeper has never prepared a Cash Flow Statement before. The following Cash Flow Statement is the confused and incorrect result with some items disclosed in the wrong places. 1) Rewrite the Cash Flow Statement, showing only the year 2012 figures. 2) The Statement shows that cash flow has increased for the year. Give the two major sources of this increase. CMU Limited Cash Flow Statement for the year ended 31 December 2012 Cash Flows from Operating Activities Cash was provided from: Receipts from customers Proceeds from bank loans Cash was disbursed to: Payments to suppliers Ordinary share dividends paid Income tax paid Net Cash Inflow from Operating Activities 2012 $’000 2012 $’000 2011 $’000 5,000 1,400 6,400 5,200 1,000 4,500 400 50 Cash Flows from Investing Activities Cash was provided from: Proceeds from issue of ordinary shares 400 Proceeds from sale of equipment 500 Cash was disbursed to: Purchase of new equipment 100 Payments for expenses 1,000 Net Cash Outflow from Investing Activities Cash Flows from Financing Activities Cash was provided from: Dividend received Interest received Cash was disbursed to: Purchase of shares in XY Ltd GST paid Interest paid Net Cash Outflow from Financing Activities 20 5 500 200 150 Net increase (decrease) in cash held plus Cash Balance at the beginning of the year Cash Balance at the end of the year 4,950 1,450 900 1,100 (200) 25 850 (825) 425 30 455 4,300 250 250 0 50 400 800 10 5 nil 250 100 2011 $’000 6,200 4,800 1,400 50 1,200 (1,150) 15 350 (335) (85) 30 (55)