Cash from Operating Activities

advertisement

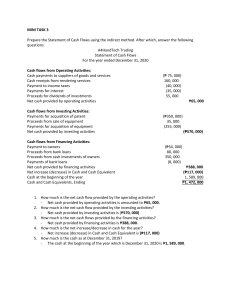

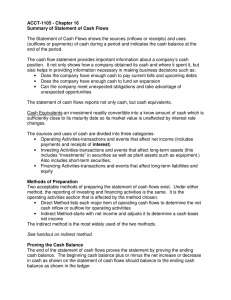

Cash Flow Statement 1 Cash Flow Statement Discussion Jerry Kennedy ACT/529 Lewis Worcester January 23, 2005 Cash Flow Statement 2 Cash Flow Statement Discussion Introduction This paper will provide a cursory insight into how individuals and institutions benefit from the Cash Flow Statement. The paper begins with a discussion of the three components that make up this statement: operating activities, investing activities, and financing activities. It then concludes with a comparison of the two accepted methods: direct and indirect. Cash from Operating Activities As indicated by the heading, this section describes how cash flows in an organization with regard to operations. This is a key portion of the statement as it describes how an organization utilizes cash to maintain core competency. Deficiencies in this section may indicate that the organization may not be competent to compete in a particular line of business. This section answers the question: “How does the organization perform in the industry?” Cash from Financing Activities A key part of any organization is the way in which financing is managed. Newly formed entities require large capital investments to support operations. In lay speak, this is known as leveraging. Depending on the organization and structure of the finances, an entity may find that the monetary costs to support operations cannot be overcome by operational activity. Simply stated, no matter how much the organization sells, financing will preclude desired profit. The question this section addresses is: “Is the cost of capital available so excessive that the firm is unable to make a profit given any operational scenario?” Investing Activities While important, investing is the least important of the three activities tracked on the Cash Flow Statement. Certainly an organization is better served if available assets not directly targeted for operations are managed in such away that they provide maximum ROI. Yet, such assets are not a part of the core business Cash Flow Statement 3 References Mason, R. S., (1976). Product maturity and marketing strategy. European Journal of Marketing, 10(1), p 36. Retrieved November 17, 2004, from EBSCOHost Research Databases Market Structure Simulation-UOP Website. https://mycampus.phoenix.edu/secure/resource/vendors/tata/sims/economics/economics_simulatio n1.html