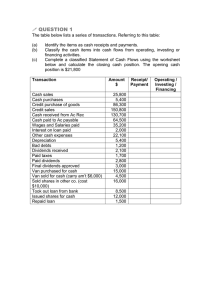

Statement of Cash Flows (Contd.)

advertisement

Chapter 3 Income Flows versus Cash Flows: Understanding the Statement of Cash Flows Copyright © 2011 Thomson South-Western, a part of the Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used herein under license. Statement of Cash Flow Provides Key Insights into The three sections logically corresponding to the primary pursuits to generate profits. The cash flows to and from the entities with which the business conducts business. Can be combined with other financial statements to assess the overall quality of overall financial statements. Chapter: 03 2 Statement of Cash Flows (Contd.) SFAS 95, FASB Codification Topic 230 Cash equivalents include highly liquid investments, very short-term treasury bills, commercial paper, and money market funds. Reporting: Chapter: 03 Interest paid and dividends paid - Operating or Financing activities. Interest received and dividends received - Operating or Investing activities. 3 Statement of Cash Flows (Contd.) IAS 7 Cash equivalents include those under U.S.GAAP and bank overdrafts Reporting Chapter: 03 Interest paid/received and dividends received Operating activities. Dividends paid - Financing activity. 4 Income Flows vs. Cash Flows Why cash flows do not equal income flows? Accrual accounting used for net income Noncash expenses Chapter: 03 5 Cash Flows from Operations Direct Method Indirect Method 2 types of adjustments: Non-working capital accounts Adjustments for changes in working capital accounts Working Capital = Current Assets minus Current Liabilities Chapter: 03 6 Non-Working Capital Accounts Examples Depreciation and amortization Deferred income taxes Employee stock option expense Gain/loss on disposition of asset Pension cost Impairment charges Chapter: 03 7 Working Capital Accounts Examples Accounts receivable Inventories Prepaid expenses Accounts payable Income taxes payable Chapter: 03 8 Net Income relative to Cash Flows from Operations Type 1 adjustments Usually increase cash flows over net income Type 2 adjustments’ effects depend on: Firm’s stage in life cycle Length of firm’s operating cycle Chapter: 03 9 Simplified Schematic of the computation of Accruals from the Operating Section of the Statement of Cash Flows Chapter: 03 10 Net Income relative to Cash Flows Relation among PepsiCo's Net Income, Cash Flows from Operations, Cash Flows from Investing Activities, and Cash Flows from Financing Activities Chapter: 03 11 Product Life Cycle Introduction Revenues are low Net income may be negative Negative CF from operating activities Negative CF from investing activities External financing (Positive CF from financing) Chapter: 03 12 Product Life Cycle (Contd.) Growth Increasing revenues. Net income becomes positive. Increasing cash flows from operations. Continuing negative cash flows from investing activities. Decreasing positive cash flows from financing activities. Chapter: 03 13 Product Life Cycle (Contd.) Maturity Peak revenues. Peak net income. Positive cash flows from operations. Cash flows from investing activities may begin to increase. Cash flows from financing activities may become negative (repayment of debt, stock repurchases, etc.). Chapter: 03 14 Product Life Cycle (Contd.) Decline Revenues decrease. Net income decreases (may become negative). Cash flows from operations decreases. Cash flows from investing activities positive (as firm divests). Cash flows from financing activities negative. Chapter: 03 15 The Relation between Cash Balances and Net Cash Flows Net cash flows equal the (net) sum of cash flows provided by or used for operating, investing, and financing activities. Ending Cash Balance = Beginning Cash + Cash Receipts – Cash Expenditures Chapter: 03 16 Preparing a Statement of Cash Flows May be necessary for firms outside U.S. Estimates made should approximate actual values. Change in Non-cash assets Liabilities Cash flow Shareholders’ equity Chapter: 03 17 Preparing a Statement of Cash Flows (Contd.) Accounting equation Δ Cash = Δ Liabilities + Δ Shareholders’ Equity - Δ Non-Cash Assets In general: Chapter: 03 Changes in current assets and current liabilities affect Operating Activities. Changes in Fixed Assets and other noncurrent assets affect Investing Activities. Changes in Long-term liabilities and Stockholders’ Equity accounts (except net income) affect Financing Activities. 18 Preparing a Statement of Cash Flows (Contd.) Notable Exceptions Marketable securities These are considered to be Investing Activities, regardless of short-term nature. Notes payable If payable to banks, are considered financing activities, even if very short-term. Current portion of long-term debt Financing Chapter: 03 19 Statement of Cash Flows Assess Earnings Quality Gauge whether reported net income reflects the underlying economics of the business. Highlights accounting accruals, which can provide insight into the overall sustainability and quality of a firm’s reported earnings. Chapter: 03 20 Statement of Cash Flows to Assess Earnings Quality (Contd.) Patterns of Earnings Surrounding High and Low Accruals Chapter: 03 21