Document 14986162

advertisement

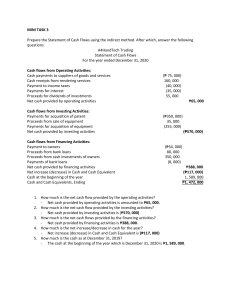

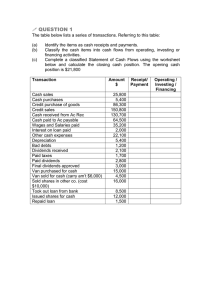

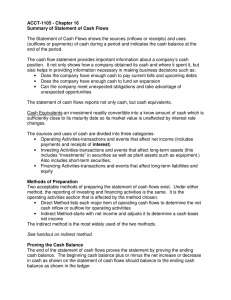

Matakuliah : F0282 - Analisis Laporan Keuangan Perusahaan Tahun : 2009 ANALISIS LAPORAN SUMBER DAN PENGGUNAAN DANA Pertemuan 9 Murniadi Purboatmodjo LAPORAN SUMBER DAN PENGGUNAAN DANA Cash Flow analysis explains the change in these focus accounts by examining all the accounts on BS other than the focus accounts Cash and cash equivalents: Cash on hand - Cash on deposit - Investments in short-term - highly liquid securities - 3 Purpose To provide the user with information as to why the cash position of the company changed during an accounting period To show all investing and financing activities, including the transaction that has no direct cash flow effect Example : company acquiring land (investing transaction) in exchange for common stock (financing transaction) The Effect All investing and financing transactions of the period must be disclosed on the CF statement or in supporting schedules, because these transactions will have future effects on CF 4 Statement of cash flow: Cash flows from operations + Cash flows from investing activities + Cash flows from financing activities = Change in cash + Beginning cash balance = Ending cash balance Supplemental disclosure: non-cash financing and investing activities 5 Operating Activities: Include all transactions and other events that are not investing and financing activities. Include delivering or producing goods for sale and providing services. CF from operating activities, generally the cash effect of transactions and other events that enter into the determination of NI 6 Operating Activities(cont’d): The cash effects of transactions and other events that enter into the determination of net income: Cash inflows from Sale of goods or services Returns on loans (interest) Return on equity securities (dividends) Cash outflows for Payments for acquisitions of inventory Payments to employees Payments for taxes Payments for interest Payments for other expenses 7 Investing Activities: Lending money and collecting on those loans and acquiring and selling investments and productive long-term assets: Cash inflows from Receipts for loans collected Sales of debt or equity securities Sales of plant, property, and equipment Cash outflows for Loans to other entities Investment in debt or equity securities Purchase of plant, property, and equipment 8 Financing Activities: Include CF relating to liability and owners’ equity. It involve IS items. Borrowing and repaying long-term loans; issuing equity securities; payment of dividends to shareholders: Cash inflows from Sale of equity securities Sale of bonds, mortgages, notes, and other short- and longterm borrowings Cash outflows for Payment of dividends Reacquisition of capital stock Payment of amounts borrowed 9 LAPORAN ARUS KAS (STATEMENT OF CASH FLOW) Ada 2 bentuk metode: Direct method Presents the income statement on a cash basis Encouraged by FASB 95 Supplemental information required: reconciliation of net income to cash provided by operations Shows cash collections from customers, interest and dividends collected, other operating cash receipts, cash paid to suppliers and employees, interest paid, taxes paid and other operating cash payments 10 STATEMENT OF CASH FLOW (cont’d) Indirect method Adjusts net income for items that affected net income but did not affect cash Supplemental information required: cash paid for income taxes and for interest Starts with net income and adjusts for deferrals; accruals; noncash items, such as depreciation and amortization; and nonoperating items, such as gains and losses on asset sales 11 Statement of Cash Flows – Direct Method OPERATING ACTIVITIES Cash received from customers Cash paid to suppliers and employees Interest received Interest paid Income taxes paid $ Net cash provided (used) by operating activities 51,000 INVESTING ACTIVITIES Capital expenditures Proceeds from property, plant, and equipment disposals (30,000) 6,000 Net cash provided (used) by operating activities FINANCING ACTIVITIES Net proceeds from repayment of commercial paper Proceeds from issuance of long-term debt Dividends paid (24,000) (4,000) 6,000 (5,000) Net cash provided (used) by financing activities Increase in Cash Beginning cash balance Ending cash balance 370,000 (310,000) 10,000 (4,000) (15,000) (3,000) $ 24,000 8,000 32,000 12 Statement of Cash Flows – Indirect Method OPERATING ACTIVITIES Net earnings Provision for depreciation Provision for allowance for doubtful accounts Deferred income taxes Loss on property, plant, and equipment disposals Changes in operating assets and liabilities: Receivables increase Inventories increase Accounts payable increase Accrued income taxes increase $ (2,000) (4,000) 5,000 2,000 Net cash provided (used) by operating activities 51,000 INVESTING ACTIVITIES Capital expenditures Proceeds from property, plant, and equipment disposals (30,000) 6,000 Net cash provided (used) by operating activities FINANCING ACTIVITIES Net proceeds from repayment of commercial paper Proceeds from issuance of long-term debt Dividends paid (24,000) (4,000) 6,000 (5,000) Net cash provided (used) by financing activities Increase in Cash Beginning cash balance Ending cash balance 40,000 6,000 1,000 1,000 2,000 (3,000) $ 24,000 8,000 32,000 13 Latihan soal FINANCIAL REPORTING ANALYSIS – Gibson P10-4 14