Chapter 8

advertisement

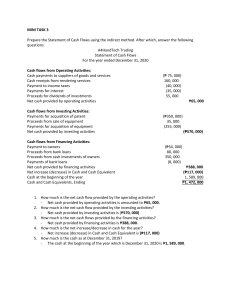

Chapter 12 Statement of Cash Flows The primary purpose of the statement of cash flows is to provide information about cash receipts, cash payments, and the net change in cash resulting from the operating, investing, and financing activities of a company during the period. o Operating Activities: include the cash effects of transactions that create revenues and expenses and thus enter into the determination of net income. Usually involve income statement items o Investing Activities: include (a) purchasing and disposing of investments and productive long-lived assets using cash and (b) lending money and collecting the loans. Usually involve changes in investments and long-term assets o Financing Activities: include (a) obtaining cash from issuing debt and repaying the amounts borrowed and (b) obtaining cash from stockholders and paying them dividends. Usually involve long-term liability and stockholder’s equity items Please, carefully look over Illustration 12-1, page 588 Significant financing and investing activities that do not affect cash are not reported in the body of the statement of cash flows, rather they are reported at the bottom of the statement as a note or supplementary schedule. Examples: o Issuance of common stock to purchase assets o Conversion of bonds into common stock o Issuance of debt to purchase assets o Exchanges of plant assets There are two ways to compute statement of cash flows: o The Indirect Method: is the most commonly used because it is easier to prepare, it focuses on the differences between net income and net cash flow from operating activities, and it tends to reveal less company information to competitors. (Example: page 602) o The Direct Method: this is the method FASB prefers, but is not commonly used it practice. The only difference between the two methods lies in the operating activities section. All the other parts of the statement remain the same. (Example: page 618) HOMEWORK: o Brief Exercises: 1, 2 o Exercise: 1, 2