Soal latihan A1034 Akuntansi Menengah Pertemuan 7 s/d 10

advertisement

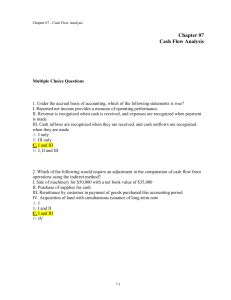

Soal latihan A1034 Akuntansi Menengah Pertemuan 7 s/d 10 Exercise 1 The statement of cash flows classifies cash receipts and payments: a. according to type of activity. b. for a period of time. c. is used as a forecasting tool. d. all of these choices. A type of transaction that is not reported as an operating activity is cash payments for: a. trading securities. 2. b. dividends. c. taxes. d. interest expense. Investing activities include all of the following except cash receipts from: a. the sale of trading securities. 3. b. the collection of principal on loans. c. sale of a business. d. sale of plant assets. 4. Financing activities include all of the following transactions and events except where cash is: a. obtained by equity financing. b. obtained by debt financing. c. used to pay dividends. d. used to pay interest expense. The most popular method used in reporting the amount of net cash flow from operating activities is the: a. direct method. 5. b. intrinsic method. c. cash basis method. d. indirect method. If wages payable increased $100 for the year and wage expense was $10,000, the amount of cash paid for wages is: a. $10,000 6. b. $10,100 c. $9,900 d. Not enough information to determine the correct amount. If credit sales were $100,000, cash collected from customers totaled $120,000 and beginning accounts receivable was $25,000; what was the ending balance in accounts receivable? 7. a. $0 b. $45,000 c. $5,000 d. Not enough information to determine. Assume the following: Inventory increased $10,000, A/P decreased $20,000, and cash payments to suppliers totaled $100,000. How much was cost of goods sold? a. $80,000 8. b. $90,000 c. $70,000 d. not enough information In computing net cash flows from operating activities in a statement of cash flows, depreciation expense is: a. listed as a cash outflow under the direct method. 9. not part of the calculation of net cash flow from operations when b. using direct method. c. deducted from net income under the indirect method. d. Not part of the calculation using the indirect method. Assume the following: Equipment - increased $100,000 Accumulated Depreciation - Equipment - increased $20,000 In addition, during the period equipment was sold for $10,000. The equipment had originally cost $30,000 and had a book value of $25,000 at the time it was sold. Determine the 10. amount of equipment purchased during the year. a. $130,000 b. $70,000 c. $100,000 d. not enough information Exercise 2 Cash flows from operations may be presented two ways, the direct method and the indirect method. True False Under the indirect method, an adjustment is made to net income for gains and losses associated with investing or financing activities. 2. True False Prior to 1987, companies presented a statement of changes in financial position that focused strictly on cash flows. 3. True False In a statement of cash flows, financing activities primarily are associated with long-term liabilities. 4. True False In computing net cash flow from financing activities, dividends paid are listed as a cash outflow. 5. True False 6. Financing activities include transactions and events where-by cash is obtained from or repaid to owners and creditors. True False An example of a noncash investing and financing activity is the declaration of cash dividends. 7. True False A statement of cash flows explains the change during a period in cash and cash equivalents. 8. True False A characteristic of a cash equivalent is that it will most likely be converted to cash in less than a year. 9. True False Reporting using the direct method tends to report a slightly larger amount of net cash flow from operations as compared to the indirect method. 10. True False