Study Questions

advertisement

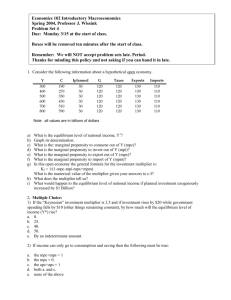

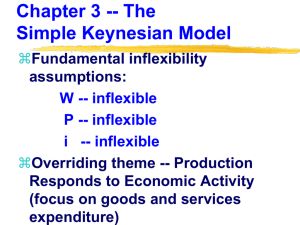

ECON 102- INTRODUCTION TO ECONOMICS II DEPARTMENT OF ECONOMICS BİLKENT UNIVERSITY Fall 2014 Study Questions Question 1: Define the following concepts in your own words: (use complete sentences and make sure that your answer will be able to explain the concept to somebody who has not taken your course) 1) GDP 2) GDP calculated using income approach 3) Disposable income 4) Desired investment expenditures 5) Unplanned inventory changes 6) Government budget 7) Net exports 8) Marginal propensity to consume (and to save) 9) Cyclical unemployment 10) Structural unemployment 11) Labor force participation ratio 12) Unemployment rate 13) Potential income level 14) GNP (I will explain this one in class) Question 2: : Assume that factors that affect the aggregate expenditures of the sample economy, which are desired consumption, taxes, government spending, investment and net exports are given as follows: Cd=600+0.6 YD, T=100 +0.2Y, G=400, d I =300-3i, NXd=200 – 0.1Y+6e TR=0 where the notation follows the one used in class and i is the interest rate and e is the exchange rate which is defined as the TL price of one dollar in Turkey (for example $1= 2.23TL today). (a) According to the above information explain in your own words how the tax collection changes as income in the economy changes? (b) Explain how desired investment expenditure behaves as interest rates increase. What is the level of desired investment expenditure in this economy if the interest rate is 10%. (c) Explain the behavior of the net exports category. Why does net exports depend on domestic income and exchange rate of the economy? (Use the exchange rate e=5 for this hypothetical economy when calculating the equilibrium). (d) Write the expression for YD. (e) Find the equation of the aggregate expenditure line. Show on a graph and show where the equilibrium income should be on the same graph. (f) State the equilibrium condition. Calculate the equilibrium real GDP level. (g) If the economy is producing Y= rather than the equilibrium level of income what will be the unplanned changes in inventory level? Show this level of income on the graph and show the comparison of AE at Y= and the Y level. (h) POLICY 1: What is the government expenditure multiplier in this economy? If the government expenditure increases by 100 (ie. G=100), what will be the change in the equilibrium income level in this economy? What will be the new equilibrium level of income? (i) If the full capacity income level (Ypotential) is equal to 4000, how much change in government expenditure is necessary for you to bring the equilibrium income to the potential income level? (first compute the Recessionary Income Gap= Ypotential- Ye then compute by using the multiplier value) (j) POLICY 2: If you were in the initial equilibrium income level and the government wants to use the taxes to increase income how should they change taxes? What is the tax multiplier? What is the amount of autonomous tax change necessary to increase income level to Ypotential ? (k) What type of policies are the above to policies? What are the tools that are used in these policies? Who is in charge of these policy tools in Turkey? (l) What is the effect of the Policy 1 on the government budget? What is the effect of Policy 2 on the budget? Which one do you recommend and why? (m) How will your answers to all above questions be modified if the mpc in the above model is equal to 0.8? [Hint: the solution to part (m) can be found in one step if you do the following problem with the model specified in general terms?] Question 3: (This is the repetition of the above question with general terms for the functions instead of the numeric values) Assume that in the Strong-economy, desired consumption, taxes, government spending, investment and net exports are given as follows: C d C mpc.YD T = T + tY , GG, d I = I - b.i , d NX = N - m.Y + q.e , where the notation follows one used in class. The new notation used are m is the marginal propensity to import, q is the net export sensitivity of net exports. a) Explain how desired investment expenditure behaves as interest rates increase. What is the desired investment expenditure function in this economy if the interest rate is 10%. b) Net export depends on domestic income and exchange rate of the economy? What is the net export function if the exchange rate e=5 for this hypothetical economy? c) Define and write the expression for YD. d) Find the equation of the aggregate expenditure line. (Note: This will be an expression of the variables C , T , G , I , N , Y mpc, b, m, and q ) e) State the equilibrium condition. Find the expression for the equilibrium Y. Show on a graph. f) What is the government expenditure multiplier in this economy? g) What is the tax multiplier in the economy? h) Which of these policies are more effective in this economy, Policy 1 to increase government spending by 100 units or to decrease autonomous taxes ie. T by 100 units? Compare the values (expressions) for these multipliers. i) How will your answers to part (h) in the above question be modified if the mpc in the above model is increases? THESE QUESTIONS ARE SIMILAR TO WHAT YOU MAY FIND IN THE MIDTERM EXAM. THEY ARE NOT DIFFICULT, YOU NEED TO FOLLOW THE SAME STEPS THAT WE HAVE SEEN IN THE LECTURES. UNDERSTANDING THESE PROBLEMS WILL HELP YOUR PERFORMANCE IN THE EXAM GREATLY.