Chapter 3 -- The Simple Keynesian Model

advertisement

Chapter 3 -- The

Simple Keynesian Model

Fundamental inflexibility

assumptions:

W -- inflexible

P -- inflexible

i -- inflexible

Overriding theme -- Production

Responds to Economic Activity

(focus on goods and services

expenditure)

Simplifying Assumptions

Business Saving = 0 (All private saving

is personal saving)

Taxes don’t depend upon income.

T = G (Balanced Budget)

NX = 0

Assumptions imply that the “Magic

Equation” is now S = I.

Causes of Consumption (C)

Disposable Income (YD = Y - T)

YD C

Real GDP, or Total Income (Y)

Y YD C

Net Taxes (T)

T YD C

Consumer Confidence (CC)

CC C

More Causes of

Consumption (C)

Real Interest Rate (r = i - e)

r C

Nominal Interest Rate (i)

i r C

Expected Inflation Rate (e)

e r C

Real Wealth (A)

A C

Measures -YD C Relationship

Average Propensity to Consume

(APC)

APC = C/YD

Marginal Propensity to Consume

(MPC)

MPC = C/YD

Handling Multiple

Causes of Consumption

Causes of Consumption -Y, T, CC, i, e, A.

Autonomous Consumption (C0) -changes in C due to causes other

than Y.

Causes of Investment (I)

Business Confidence (BC)

BC I

Business Taxes (BT)

BT I

More Causes of Investment

Real Interest Rate (r = i - e)

r I

Nominal Interest Rate (i)

i r I

Expected Inflation Rate (e)

e r I

Note: Investment does not depend

upon current income (Y)

Government Purchases of

Good and Services (G)

Government purchases of goods

and services is a policy variable,

controlled by the government

no causing variables.

The previous properties imply that

I and G are completely

autonomous.

A Numerical Example

Y

5

25

45

65

85

105

125

T

5

5

5

5

5

5

5

YD

0

20

40

60

80

100

120

C

10

25

40

55

70

85

100

S

-10

-5

0

5

10

15

20

I G

10 5

10 5

10 5

10 5

10 5

10 5

10 5

The Saving-Investment

Relationship

Recall -- macro identity

S + (T - G) + -NX = I

With simplifying assumptions:

S=I

Why doesn’t S = I in numerical

example?

Intentions Versus Actual

Occurrences

Must distinguish between

intended, desired, planned S and I

versus actual or realized S and I.

Intended S and I -- strategies,

described by schedules and

graphs.

Actual S and I -- the numbers after

the period is over.

Planned Expenditure (EP)

Planned Expenditure (EP) -- The

total intended spending for various

levels of income.

In equation form,

EP = C + I + G.

Planned Expenditure in

the Numerical Example

Y

5

25

45

65

85

105

125

T

5

5

5

5

5

5

5

YD

0

20

40

60

80

100

120

C

10

25

40

55

70

85

100

S

-10

-5

0

5

10

15

20

I G EP

10 5 25

10 5 40

10 5 55

10 5 70

10 5 85

10 5 100

10 5 115

An Equilibrium Level

of Real GDP: EP = Y

Y

5

25

45

65

85

105

125

T

5

5

5

5

5

5

5

YD

0

20

40

60

80

100

120

C

10

25

40

55

70

85

100

S

-10

-5

0

5

10

15

20

I G EP

10 5 25

10 5 40

10 5 55

10 5 70

10 5 85

10 5 100

10 5 115

Why is Y* = 85 an

Equilibrium?

Example 1: Suppose Y = 105.

Intended

Actual

C = 85

C = 85

S = 15

S = 15

I = 10

I = 10 + 5 = 15

G= 5

G=5

EP = 100

Note -- Actual S = Actual I

Why is Y* = 85 an

Equilibrium? (Continued)

Example 2: Suppose Y = 65.

Intended

Actual

C = 55

C = 55

S= 5

S= 5

I = 10

I = 10 + -5 = 5

G= 5

G= 5

EP = 70

Note -- Actual S = Actual I

Why is Y* = 85 an

Equilibrium? (Finally)

Example 3: Suppose Y = 85.

Intended

Actual

C = 70

C = 70

S = 10

S = 10

I = 10

I = 10

G= 5

G=5

EP = 85

Note -- Actual S = Actual I

Properties of Equilibrium

No unintended inventory

accumulation or depletion.

All intentions are realized.

Intended Saving = Intended

Investment (only at equilibrium).

EP = Y

Equilibrium and the

Natural Level of Real GDP

Fundamental Prediction of

Keynesian models -- Y* is not

necessarily equal to YN.

Classical Prediction: Selfcorrecting economy Y* = YN.

(Business cycle represents

deviations from equilibrium)

Keynesian Prediction -State of the Economy

Y* < YN (sluggish economy)

Y* > YN (accelerating inflation)

Y* = YN (desired state of

economy)

If Y* YN, then one needs

economic policy to achieve a new

equilibrium closer to YN.

The Keynesian Prescription

Achieve a new equilibrium by

shifting the Ep curve.

If Y* < YN, seek to increase

expenditure, described by shifting

the EP curve upward.

If Y* > YN, seek to decrease

expenditure, described by shifting

the EP curve downward.

Shifting the EP Curve

Key -- Change Autonomous

Consumption, Autonomous

Investment, or Government

Purchases (or, later,

Autonomous Net Exports).

Change C0 -- change T, CC, i, e, A

Change I0 -- change BC, BT, i, e

Change G0.

Economic Policy

Purpose -- to move Y* closer to YN.

Method -- change autonomous

expenditure (C0, I0, G0).

If economy is sluggish (Y* < YN),

increase autonomous expenditure.

If economy has accelerating

inflation (Y* > YN), decrease

autonomous expenditure.

Strategies for Policy

Expansionary Policy -- Policy

designed to address a sluggish

economy (Y* < YN).

Contractionary Policy -- Policy

designed to address an

overstimulated, or accelerated

inflation economy (Y* > YN).

Quantitative Effects -Changes in C0, I0, or G0

Y

5

25

45

65

85

105

125

T

5

5

5

5

5

5

5

YD

0

20

40

60

80

100

120

C

10

25

40

55

70

85

100

S

-10

-5

0

5

10

15

20

I G EP

10 5 25

10 5 40

10 5 55

10 5 70

10 5 85

10 5 100

10 5 115

Note: MPC = C = 25 - 10 = 0.75

YD

20 - 0

Example -- If autonomous

government purchases are

changed by 5, how much will Y*

change as a result?

Solution -- Numerical

Example

Y

5

25

45

65

85

105

125

EP

25

40

55

70

85

100

115

EP’ (G0 = 5)

30

45

60

75

90

105

120

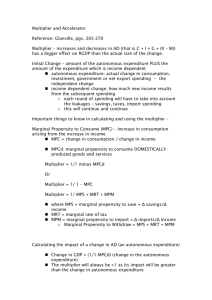

The Multiplier Effect

The Multiplier Effect -- Given an

initial change in autonomous

consumption, autonomous

investment, or government

purchases of goods and services,

the resulting change in equilibrium

output will be a multiple of the

initial change.

The Multiplier Effect

in Equation Form

Y* = m (C0, I0, G0, or NX0),

where m = the multiplier.

m = 1/(1 - MPC)

Our Example: (G0 = 5 Y* = 20)

(20) = (4)(5)

MPC = 0.75 m = 1/(1 - 0.75) = 4

Tracing the Effect on Y*:

G0 = 5, with MPC = 0.75

Round

1

2

3

...

Y*

Added

Spending

5

5(0.75)

5(0.75)2

...

20

Added

Income

5

5(0.75)

5(0.75)2

...

20

Properties: Multiplier Effect

The multiplier varies positively

with the MPC, i.e. MPC m.

Applies for either increases or

decreases in C0, I0, G0, or NX0.

Applies to changes both policyinduced and otherwise.

Changes in autonomous net taxes

(T0) have a multiplier effect, but not

the same multiplier.

Changing G0 Versus

Changing T0, MPC = 0.75

Added Spending

Round

G0 = 5

T0 = -5

1

5

5(0.75)

2

5(0.75)

5(0.75)2

3

5(0.75)2

5(0.75)3

...

...

...

______________________________

Y*

20

15

The Net Taxes Multiplier

Y* =

-MPC T0

1 - MPC

The Net Taxes Multiplier is smaller

than the regular multiplier (less of

an impact on Y* for the same initial

change).

Tax or transfer policy is not as

powerful as G policy, but less

likely to overshoot YN.

Application:

The Obama Stimulus Plan

The Obama Stimulus Plan – A $787 B

stimulus package passed in February

2009, to address sluggish US economy.

-- Tax Cuts = $288 B

-- Extended unemployment benefits,

education and health care = $224 B

-- Federal contracts, grants, and loans

= $275 B (Infrastructure

improvements = $83 B)

The Simple Keynesian

Model -- The Algebra

The model in equation form.

(1) EP = C + I + G,

(2) C = C0 + b(Y - T),

(3) I = I0,

(4) G = G0,

(5) T = T0,

(6) At equilibrium, EP = Y*.

Solving for Y*

Substitute equations (2), (3), (4),

(5), and (6) into (1)

Y* = C0 + b(Y* - T0) + I0 + G0.

Solve for Y*

Y* = 1 {C0 + I0 + G0} + -b T0.

(1 - b)

(1 - b)

Removing the

Simplifying Assumptions

Investment depends upon current

output or income (Y).

I = I0 + dY,

d = marginal propensity

to invest

Income Tax

T = T0 + tY,

t = marginal tax rate

Causes of Net Exports

(NX = Exports - Imports)

Foreign output or income (Yf)

Yf Exports NX

US output or income (Y)

Y Imports NX

Barriers to Trade

Real exchange rate (e)

e NX

A Model for Net Exports

in Equation Form

NX = NX0 - fY

NX0 = Autonomous Net Exports

(made up of causes other

than Y)

f = marginal propensity to import

The Model Without the

Simplifying Assumptions:

What Results Are The

Same?

Answer -- All the qualitative

results are the same!!

Same Results

Equilibrium occurs where Ep = Y.

True equilibrium, guided by unintended

inventory changes.

Y* may be <. >, or = YN.

Need for policy if Y* is different from

YN .

Policy – change autonomous

expenditure (expansionary or

contractionary).

More of the Same Results

Same options as before

(C0, I0, G0).

Multiplier effect exists.

Tax multiplier is smaller than the

autonomous spending multiplier.

The Model Without the

Simplifying Assumptions:

What Results Are Different?

More possibilities for policy.

-- autonomous net taxes (T0)

-- marginal tax rate (t)

-- trade policy (NX0)

Different multipliers for

autonomous spending and net

taxes.

The Expanded

Simple Keynesian Model

(1)

(2)

(3)

(4)

(5)

(6)

(7)

EP = C + I + G + NX,

C = C0 + b(Y - T),

I = I0 + dY,

G = G0,

NX = NX0 – fY,

T = T0 + tY,

At equilibrium, EP = Y*.

More Realistic Multipliers

Substitute equations (2)-(7) into (1),

solve for Y*.

Y* =

1

[C0 + I0 + G0 + NX0]

(1 – b(1–t) – d + f)

-b

[T0].

(1 – b(1–t) – d + f)

The Economy and the

Federal Budget

Recall that the Federal Budget is

given by

Budget = T - G.

Substitute income tax function for

T (with Y = Y*):

Budget = (T0 + tY*) - G.

Note that Y* Budget

The Economy and the

Balance of Trade

Recall that the Balance of Trade

(BOT) is approximated by Net

Exports (NX).

Also recall that the Net Exports

equation is (Y = Y*):

NX = NX0 - fY*.

Note that Y* BOT