PS4 - Cornell

advertisement

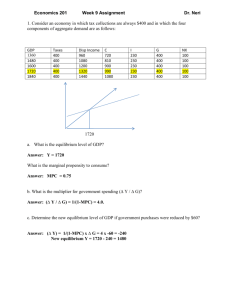

Economics 102 Introductory Macroeconomics Spring 2004, Professor J. Wissink Problem Set 4 Due: Monday 3/15 at the start of class. Boxes will be removed ten minutes after the start of class. Remember: We will NOT accept problem sets late. Period. Thanks for minding this policy and not asking if you can hand it in late. 1. Consider the following information about a hypothetical open economy. Y C Iplanned G Taxes Exports Imports 300 400 500 600 700 800 190 270 350 430 510 590 30 30 30 30 30 30 120 120 120 120 120 120 120 120 120 120 120 120 130 130 130 130 130 130 110 110 110 110 110 110 Note: all values are in billions of dollars What is the equilibrium level of national income, Y*? Graph its determination. What is the: marginal propensity to consume out of Y (mpc)? What is the marginal propensity to invest out of Y (mpi)? What is the marginal propensity to export out of Y (mpx)? What is the marginal propensity to import of Y (mpm)? In this open economy the general formula for the investment multiplier is: KI = 1/(1-mpc-mpi-mpx+mpm) What is the numerical value of the multiplier given your answers to c-f? h) What does the multiplier tell us? i) What would happen to the equilibrium level of national income if planned investment exogenously increased by $1 Billion? a) b) c) d) e) f) g) 2. Multiple Choice: 1) If the “Keynesian” investment multiplier is 2.5 and if investment rises by $20 while government spending falls by $10 (other things remaining constant), by how much will the equilibrium level of income (Y*) rise? a. 0. b. 25. c. 40. d. 50. e. By an indeterminate amount. 2) If income can only go to consumption and saving then the following must be true: a. b. c. d. e. the mpc+mps = 1 the mps = 0. the apc+aps = 1 both a. and c. none of the above 3) In a closed economy with no government, which one of the following will occur when the economy is in equilibrium: a. b. c. d. e. S=C Y=S C=Y I=C none of the above 4) A reduction in the marginal propensity to consume will: a. cause the AEd line to become flatter and a given change in investment to have a smaller effect on output. b. cause the AEd line to become flatter and a given change in investment to have a greater effect on output. c. cause the AEd line to become steeper and a given change in investment to have a smaller effect on output. d. cause the AEd line to become steeper and a given change in investment to have a great effect on output. e. cause the AEd line to shift up. 5) Refer to the figure depicting the relationship between income received (Y) and consumption spending (C) for a given household. Assume there is no government spending and taxes. This household's saving will be zero when income is: a. b. c. d. e. 1,400. 1,200. 1,000. 800. 600. Consumption function C 440 370 100 200 Y 3. A good friend of yours gets a job working for the federal government of Tropicalia, a warm sunny country in the Caribbean. Because she knows that you are taking Econ 102, she invites you down for spring break on the condition that you help her solve Tropicalia’s problems. Because you love both economics and warm weather, you accept her deal. Upon arrival you are given the following information about Tropicalia: Consumption function: C = $200 + .8Yd Investment: I = $600 Government spending: G = $250 Taxes: T = $250 Exports: EX = 0 Imports: IM = .2Y a) Calculate Tropicalia’s equilibrium level of output/income Y*. b) Draw a graph representing Tropicalia’s aggregate desired expenditure function. Clearly label the expenditure equilibrium point. c) Calculate the general multiplier for Tropicalia. (This is the multiplier that applies when autonomous expenditure increases by one dollar.) d) Calculate the balanced budget multiplier for Tropicalia. (This is the multiplier that applies when both government spending and net taxes increase by one dollar.) Suppose that Tropicalia wishes to increase its level of output (stimulate economic growth). As part of your assignment, you are asked to evaluate a number of different policy options. Assume that Tropicalia has a substantial amount of unutilized resources. This means that an increase in expenditure (aggregate demand) will lead to an increase in output without inflation. This will help Tropicalia grow. e) The first policy option is a lump-sum reduction of taxes by $100. What effect would this tax have on the equilibrium level of national income? Is this a good policy given Tropicalia’s goal of growth? Why or why not? f) The second policy option is to increase government spending by $100. What effect would this have on the equilibrium level of national income? Is this a good policy given Tropicalia’s goal? Why or why not? g) The third policy is to simultaneously increase government spending by $100 and finance it with a lump-sum increase in taxes of $100. What effect would this have on the equilibrium level of national income? Is this a good policy given Tropicalia’s goal? Why or why not? h) The forth policy option is to begin to export the straw hats that the residents of Tropicalia can produce. The estimated increase in exports would be $100. What effect would this have on the equilibrium level of national income? Is this a good policy given Tropicalia’s goal? Why or why not?