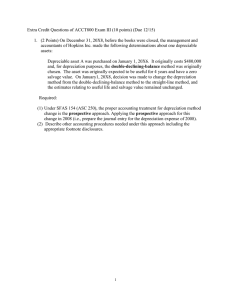

Extra credit for Exam II, Spring 2011

advertisement

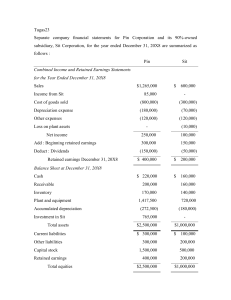

Extra Credit Questions (Due 4/13) I. 1. Multiple Choice Questions (2 points) The Konia Corporation used a periodic inventory system and the LIFO cost flow method to account for its inventory. The beginning inventory of year 20x8 consisted of the following: 35,000 units @ $15 During year 20x8, the purchases are as follows: 40,000 units @$18 80,000 units @$20 Sales of year 20x8 totaled 135,000 units at various prices, leaving 20,000 units in ending inventory. What is the amount of LIFO liquidation profit that the company must report in the footnote disclosure to its financial statements of year 20x8? Assume an income tax rate of 30%. a. $31,500 b. $42,000 c. $52,500 d. $70,000 2. (3 points) The Following disclosure note is available in Greenway Corporation’s 20x8 annual report: December 31, 20x8 Inventory stated at FIFO cost 20x8 $200,000 20x7 $170,000 Reserve for LIFO valuation Inventory stated at LIFO (20,000) 180,000 (12,000) 158,000 How much higher would the income number of 20x8 be if Greenway had used the FIFO inventory method instead of LIFO given an income tax rate of 30%? a. b. c. d. $5,600 $8,000 $20,000 $12,000 II. Work-Out Problem (3 Points) The March transaction information is available for merchandise X: Date Transaction Units Unit Cost 3/6 3/12 3/16 3/25 Balance Purchase Sale Purchase 250 330 380 150 $5 $6 Required: (Each requirement is an independent case) $7 a. The physical count on 3/31 indicates that there are 330 units on hand. Record journal entry to write off the loss units using a LIFO cost flow assumption and a perpetual inventory system. b. Using the information of requirement (a), the market value of the 330 units is $1,900. Prepare the journal entry to apply the lower of cost or market inventory valuable rule given that the allowance to reduce inventory to market account has a balance of $30 before the adjustment.