Document

advertisement

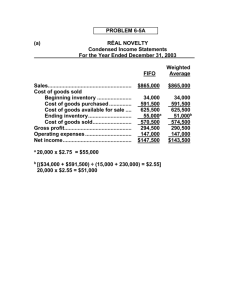

Reporting Inventory Chapter 19 Review: Perpetual system Periodic system Inventory is an asset until it is sold, at which time it “becomes” the expense Cost of Goods Sold. Here is the problem: Beg. Invent is 10 units @ $2 Purchased 20 units @ $3 Sold 15 units. Which 15 were sold? Which 15 are still in inventory? Answer: Specific I.D. - you know which ones were sold. Average: (10 x $2) + (20 x $3) = $80 / 30 = $2.67 per unit cost. FIFO: the 10 units from beg. Invent. + 5 from purchase were sold. LIFO: the 15 from the most recent purchases were sold. Why so many choices? FIFO: Gives a better Balance Sheet number - inventory reported at most recent costs. LIFO: Gives a better Income Statement number for CGS - most recent costs. Which is better, LIFO or FIFO? Since CGS is an expense and therefore reduces net income AND taxable income, a company should choose the method which results in the highest CGS. When prices are rising, this is LIFO. When prices are falling, this is FIFO. Why not use FIFO for “books” and LIFO for the tax return? IRS says we can’t do that! (Too bad, it would be the “best of both worlds”.) Inventory disclosure in financial statements: Must tell F/S reader what cost flow assumption you are using. Must report inventory at LCM. (We do this because of the conservatism principle.) A loss CGS. of inventory market value increases Sometimes we have to estimate inventory. Two methods commonly used: 1. Gross Profit method. 2. Retail method. Gross Profit Method: Use past data to estimate the Gross Profit percentage. “Work backwards” to plug in the ending inventory. (pg. 685.) Retail Method: Allows retailer to take an inventory at retail prices and then “convert” those prices to cost. Follow page 686. Cash Flow Statement Last semester - direct method. This chapter - indirect method. (We’ll cover only the operating activities section & later cover the other two sections.) I will not lecture on this - follow the example in your book. The End