1. What would you think of a company`s ethics if ti changed

advertisement

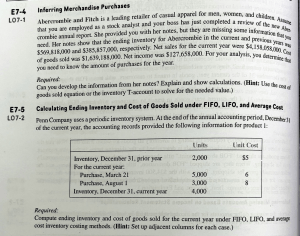

1. What would you think of a company's ethics if ti changed accounting methods every year? A company cannot change the method used once, for example, if a company uses FIFO method for inventory valuation for one year and LIFO for another then again FIFP for third year it is unethical. However it does not mean that company can never change the method; it can be done it there are strong reasons and the reasons of change in method to be mentioned in the notes to accounts. 2. What accounting principle would changing methods every year violate? Consistency principle is being violated. 3. Who can be harmed when a company changes its accounting methods too often? How? The reader, the analyst or the investor may be harmed as he will not be able to compare the figures of two years properly, and the comparison would be distorting different methods would have been used to treat same item in two corresponding years. 4. Ending inventory for the current year is overstated by $20,000. What effect will this have on the following year's net income? It will increase the net income of current year and will decrease the net income of following year.