Extra Credit Questions of ACCT800 Exam III (10 points) (Due... 1. (2 Points) On December 31, 20X8, before the...

advertisement

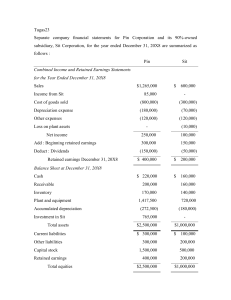

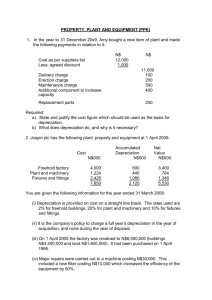

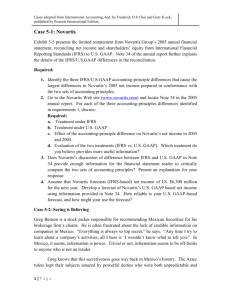

Extra Credit Questions of ACCT800 Exam III (10 points) (Due 12/15) 1. (2 Points) On December 31, 20X8, before the books were closed, the management and accountants of Hopkins Inc. made the following determinations about one depreciable assets: Depreciable asset A was purchased on January 1, 20X6. It originally costs $480,000 and, for depreciation purposes, the double-declining-balance method was originally chosen. The asset was originally expected to be useful for 4 years and have a zero salvage value. On January1, 20X8, decision was made to change the depreciation method from the double-declining-balance method to the straight-line method, and the estimates relating to useful life and salvage value remained unchanged. Required: (1) Under SFAS 154 (ASC 250), the proper accounting treatment for depreciation method change is the prospective approach. Applying the prospective approach for this change in 2008 (i.e., prepare the journal entry for the depreciation expense of 2008). (2) Describe other accounting procedures needed under this approach including the appropriate footnote disclosures. 1 2. (3 points) United Inc. changed from LIFO to FIFO inventory costing method on January 1, 2008. Inventory values at the end of each year since the inception of the company are as follows: Year 2006 2007 LIFO $200,000 300,000 FIFO $220,000 350,000 Required: (1) Under SFAS 154 (ASC 250), the proper accounting treatment for voluntary accounting method changes is the retrospective approach. Using this approach, prepare the journal entry to report this accounting change, assuming a 30% income tax rate. (2) Describe other accounting procedures needed under the retrospective approach. 2 (2 points) Oscar Company is in the process of adjusting and correcting its books at the end of 20X8. In reviewing its records, the following information is compiled. 3. Oscar has failed to accrue salary payable at the end of each of the last three years, as follows: December 31, 20X6 $6,000 December 31, 20X7 $3,000 December 31, 20X8 $7,000 Required: Ignore income tax effect, prepare the journal entries necessary at December 31, 20X8 to record the above correction. The books of 20X8 are still open. Essay Question (3 Points) State the advantages of the retrospective approach over the current period approach in accounting for voluntary accounting method changes and the possible reason(s) for the FASB to eliminate the current period approach in SFAS 154 (ASC 250). 3