Solution: DeSoto Tools, Inc. 5

advertisement

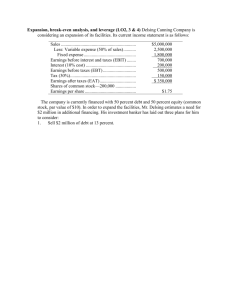

5-16. DeSoto Tools, Inc., is planning to expand production. The expansion will cost $300,000, which can be financed either by bonds at an interest rate of 14 percent or by selling 10,000 shares of common stock at $30 per share. The current income statement before expansion is as follows: DeSoto Tools, Inc. Income Statement 199X Sales .............................................................. Less: Variable costs..................................... Fixed costs................................................. Earnings before interest and taxes................. Less: Interest expense ................................. Earnings before taxes .................................... Less: Taxes @ 34% ..................................... Earnings after taxes ....................................... Shares ............................................................ Earnings per share ......................................... $1,500,000 $ 450,000 550,000 1,000,000 500,000 100,000 400,000 136,000 $ 264,000 100,000 $2.64 After the expansion, sales are expected to increase by $1,000,000. Variable costs will remain 30 percent of sales, and fixed costs will increase to $800,000. The tax rate is 34 percent. a. Calculate the degree of operating leverage, the degree of financial leverage, and the degree of combined leverage before expansion. (For the degree of operating leverage, use the formula developed in footnote 2; for the degree of combined leverage, use the formula developed in footnote 3. These instructions apply throughout this problem.) 5-16. Continued b. Construct the income statement for the two alternative financing plans. c. Calculate the degree of operating leverage, the degree of financial leverage, and the degree of combined leverage, after expansion. d. Explain which financing plan you favor and the risks involved with each plan. Solution: DeSoto Tools, Inc. a. DOL DFL S TVC S TVC FC $1,500,000 $450,000 2.1x $1,500,000 $450,000 $550,000 EBIT EBIT I $500,000 $500,000 $100,000 $500,000 1.25x $400,000 5-16. Continued DCL S TVC S TVC FC I $1,500,000 $450,000 $1,500,000 $450,000 $550,000 $100,000 $1,050,000 2.63x $400,000 b. Income Statement After Expansion Sales Less: Variable Costs (30%) Fixed Costs EBIT Less: Interest EBT Less: Taxes @ 34% EAT (Net Income) Common Shares EPS Debt $2,500,000 750,000 800,000 950,000 142,0001 808,000 274,720 533,280 100,000 $5.33 Equity $2,500,000 750,000 800,000 950,000 100,000 850,000 289,000 561,000 110,0002 $5.10 1 New interest expense level if expansion is financed with debt. $100,000 + 14% ($300,000) = $142,000 2 Number of common shares outstanding if expansion is financed with equity. 100,000 + 10,000 = 110,000 5-16. Continued c. DOL DOL Debt/Equit y DFL S TVC S TVC FC $2,500,000 $750,000 $2,500,000 $750,000 $800,000 $1,750,000 1.84x $950,000 EBIT EBIT I DFL Debt $950,000 $950,000 1.18x $950,000 $142,000 $808,000 DFL Equity $950,000 $950,000 1.12x $950,000 $100,000 $850,000 DCL Debt $2,500,000 $750,000 $2,500,000 $750,000 $800,000 $142,000 $1,750,000 2.17 x $808,000 5-16. Continued DCL Equity $2,500,000 $750,000 $2,500,000 $750,000 $800,000 $100,000 $1,750,000 2.06x $850,000 d. The debt financing plan provides a greater earnings per share at the new sales level, but provides more risk because of the increased use of debt. However, the interest coverage ratio in both cases is certainly satisfactory and interest expense is well protected. The crucial point is expectations for future sales. If sales are expected to decline, the debt plan will not provide higher EPS at sales of less than about $2 million so cyclical swings in sales, earnings, and profit margins need to be considered in choosing the financing plan.