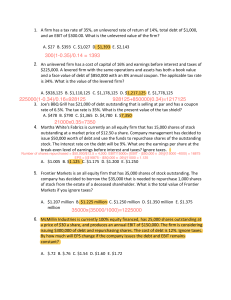

Exercises on Discounted Cash Flow Valuation (I)

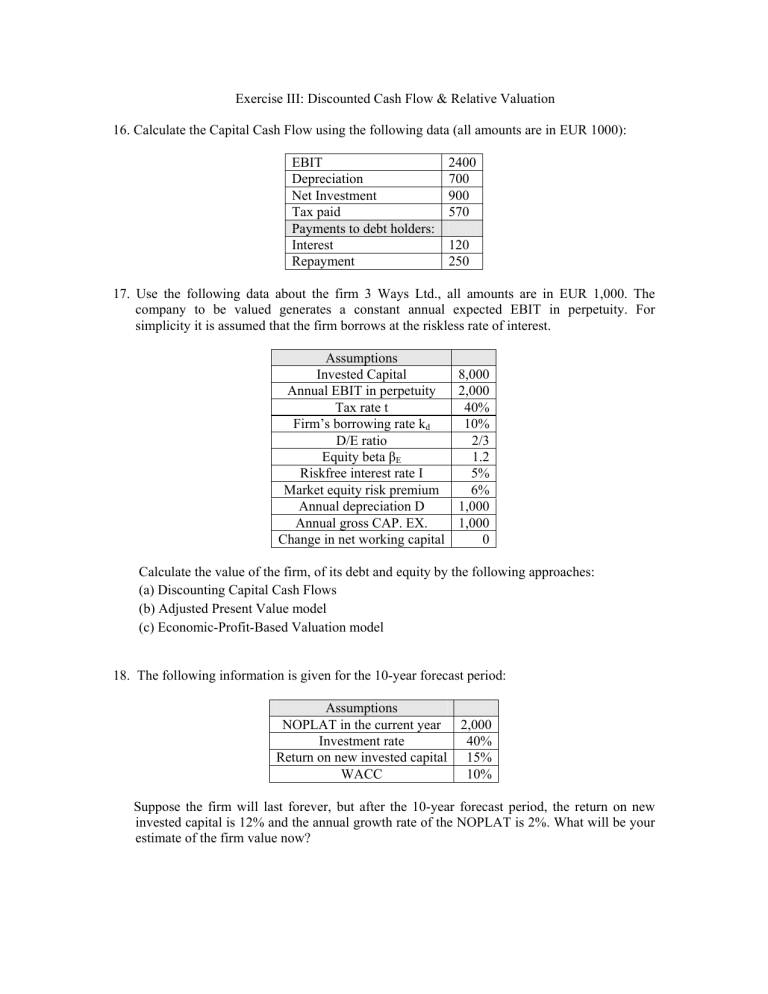

Exercise III: Discounted Cash Flow & Relative Valuation

16. Calculate the Capital Cash Flow using the following data (all amounts are in EUR 1000):

EBIT 2400

Depreciation 700

Net Investment

Tax paid

Payments to debt holders:

900

570

Interest 120

Repayment 250

17. Use the following data about the firm 3 Ways Ltd., all amounts are in EUR 1,000. The company to be valued generates a constant annual expected EBIT in perpetuity. For simplicity it is assumed that the firm borrows at the riskless rate of interest.

Assumptions

Invested Capital 8,000

Annual EBIT in perpetuity 2,000

Tax rate t

Firm’s borrowing rate k d

D/E ratio

40%

10%

2/3

Equity beta β

E

Riskfree interest rate I

Market equity risk premium

Annual depreciation D

Annual gross CAP. EX.

Change in net working capital

1.2

5%

6%

1,000

1,000

0

Calculate the value of the firm, of its debt and equity by the following approaches:

(a) Discounting Capital Cash Flows

(b) Adjusted Present Value model

(c) Economic-Profit-Based Valuation model

18. The following information is given for the 10-year forecast period:

Assumptions

NOPLAT in the current year 2,000

Investment rate 40%

Return on new invested capital 15%

WACC 10%

Suppose the firm will last forever, but after the 10-year forecast period, the return on new invested capital is 12% and the annual growth rate of the NOPLAT is 2%. What will be your estimate of the firm value now?

19. Eutech AG paid dividends per share of EUR 3.56 in 2005, and dividends are expected to grow at a rate of 5.5% forever. The stock has a beta of 0.90, and the treasury bond rate is 6.25%.

Assume that the equity risk premium is 5.5%.

(a) What is the value per share, using the Gordon Growth Model?

(b) The stock is trading for EUR 80 per share. What would the growth rate in dividends have to be to justify this price?

20. If the corporate tax rate is zero, is the PE ratio independent of leverage? If there is an effect of leverage on PE ratios, is the direction of this influence clear?

Hint: You can provide examples, or an analytical solution. Note the following formula:

Price/Earnings=(V-D)/(X-iD), where V is the market value of the firm (equal to the value of the unlevered firm since corporate rate is zero), X are the unlevered earnings, i.e., earnings of the unlevered firm, D is the market value of debt and i the interest rate on debt.

(I will be very impressed if you can also solve this problem for the case in which corporate tax is nonzero.)

21. Suppose that A1 merges with Max. Assume that A1’s PE ratio is 20 and Max PE ratio is 15.

If A1 accounts for 60% of the earnings of the merged firm, and if there are no synergies, what is the PE ratio of the combined firm? Where can you use insights from this exercise?

22. An analyst tells you that he uses PE multiples, rather than DCF, to value stocks, because he does not like making assumptions about fundamentals – growth, risk, payout ratios. Is his reasoning correct?