1

advertisement

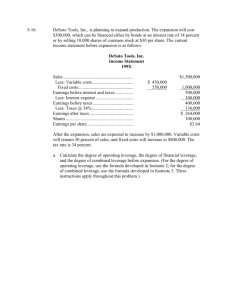

1 Learning Outcomes Chapter 12 Describe how business risk and financial risk can affect a firm’s capital structure. Describe how businesses determine their optimal capital structures. Describe how leverage can be used to make capital structure decisions, and discuss the effects (a) operating leverage, (b) financial leverage, and (c) total leverage have on risks associated with a firm. 2 Learning Outcomes Chapter 12 Discuss how managers consider liquidity when determining the optimal capital structure for a firm. Discuss the two general theories—that is, (a) trade-off theory and (b) signaling theory—that have been developed to explain what firms’ capital structures should be and why firms’ capital structures differ. Describe how and why capital structures vary among firms in the United States and around the world. 3 The Target Capital Structure Capital Structure: The combination of debt and equity used to finance a firm Target Capital Structure: The ideal mix of debt, preferred stock, and common equity with which the firm plans to finance its investments 4 The Target Capital Structure Four factors that influence capital structure decisions: The firm’s business risk The firm’s tax position Financial flexibility Managerial attitude 5 What is Business Risk? The risk associated with the firm’s operations. ignoring any fixed financing effects. 6 Factors Affecting Business Risk Sales variability Input price variability Ability to adjust output prices for changes in input prices The extent to which costs are fixed: operating leverage 7 What is Operating Leverage? Operating Leverage: Use of fixed operating rather than variable costs If most costs are fixed (do not decline when demand falls) then firm has high DOL (degree of operating leverage) 8 What is Financial Risk? Financial Leverage: The extent to which fixed-income securities (debt and preferred stock) are used in a firm’s capital structure Financial Risk: Additional risk placed on stockholders as as result of financial leverage 9 Business Risk vs. Financial Risk Business risk depends on business factors such as competition, product liability, and operating leverage. Financial risk depends only on type of securities issued: More debt, more financial risk. 10 Determining the Optimal Capital Structure: Seek to maximize the price of the firm’s stock. Changes in use of debt will cause changes in earnings per share, and thus, in the stock price. Cost of debt varies with capital structure. Financial leverage increases risk. 11 EPS Indifference Analysis EPS Indifference Point: The level of sales at which EPS will be the same whether the firm uses debt or common stock (pure equity) financing. 12 The Effect of Capital Structure on Stock Prices and the Cost of Capital The optimal capital structure maximizes the price of a firm’s stock Always calls for a debt/assets ratio that is lower than the one that maximizes expected EPS. 13 EPS Analysis and the Effects of Financial Leverage 14 Relationships Among Expected EPS, Risk and Financial Leverage 15 Indifference Point The level of sales at which EPS will be the same whether the firm uses debt or common stock pricing 16 The Effect of Capital Structure on Stock prices and the Cost of Capital The optimal capital structure is the one that maximizes the price of the firm’s stock This always calls for a debt/assets ratio that is lower than the one that maximizes expected EPS 17 Relationship Between Capital Structure and Cost of Capital 18 Relationship Between Capital Structure and Cost of Capital Cost of Capital (%) Cost of Equity, rs Weighted Average Cost of Capital, WACC Minimum WACC = 11.1% After-Tax Cost of Debt, rdT Debt/Assets (%) 19 Relationship Between Capital Structure and Stock Price 20 Cost of Equity at Different Capital Structures 21 Degree of Operating Leverage (DOL) The percentage change in operating income (EBIT) associated with a given percentage change in sales. 22 Degree of Operating Leverage (DOL) Sales Variable operating costs (60%) Gross profit Fixed operating costs Net operating income = EBIT DOL Expected Sales = –5% Outcome of Expectations $250,000 $237,500 (150,000) (142,500) 100,000 95,000 (75,000) (75,000) 25,000 20,000 %Δ -5.0% -5.0% -5.0 0.0 -20.0 Gross profit $100,000 4.0x EBIT $25,000 23 Degree of Financial Leverage (DFL) The percentage change in earnings available to common stockholders associated with a given percentage change in EBIT. 24 Degree of Financial Leverage (DFL) Net operating income = EBIT Interest Earnings Before Taxes Taxes (40%) Net Income DFL Expected EBIT = –20% Outcome of Expectations % Δ 25,000 20,000 -20.0 (12,500) (12,500) 0.0 -40.0 7,500 12,500 ( 5,000) (3,000) -40.0 4,500 -40.0 7,500 EBIT $25,000 $25,000 2.0x EBIT - I $25,000 - $12,500 $12,500 25 Degree of Total Leverage (DTL) The percentage change in EPS that results from a given percentage change in sales. 26 Degree of Total Leverage (DTL) DTL Gross profit $100,000 $100,000 8.0x EBIT - I $25,000 - $12,500 $12,500 Sales Variable operating costs (60%) Gross profit Fixed operating costs Net operating income = EBIT Interest Earnings Before Taxes Taxes (40%) Net Income Expected Outcome $250,000 (150,000) 100,000 (75,000) 25,000 (12,500) 12,500 (5,000) 7,500 Sales = –5% of Expectations $237,500 (142,500) 95,000 (75,000) 20,000 (12,500) 7,500 (3,000) 4,500 %Δ -5.0% -5.0 -5.0 0.0 -20.0 0.0 -40.0 -40.0 -40.0 27 Liquidity and Capital Structure Difficulties with Analysis We cannot determine exactly how either P/E ratios or equity capitalization rates (rs values) are affected by different degrees of financial leverage. Managers may be more or less conservative than the average stockholder, so management may set a different target capital structure than the one that would maximize the stock price. Managers of large firms have a responsibility to provide continuous service and must refrain from using leverage to the point where the firm’s long-run viability is endangered. 28 Liquidity and Capital Structure Financial strength indicators Times-Interest-Earned (TIE) Ratio • Ratio that measures the firm’s ability to meet its annual interest obligations • Calculated by dividing earnings before interest and taxes by interest charges 29 Capital Structure Theory Tax benefit/Bankruptcy Trade-off Theory Signaling Theory 30 Trade-Off Theory Interest is tax-deductible expense, therefore less expensive than common or preferred stock. Interest rates rise as debt/asset ratio increases; tax rates fall at high debt levels; probability of bankruptcy increases as debt/assets ratio increases. At a threshold debt level(D/A1), the effects of point 2 are immaterial. The optimal debt level (D/A2) occurs when the tax savings of additional debt are just offset by the increase in bankruptcy costs. Theory and empirical evidence support these ideas, but the points cannot be identified precisely. 31 Signaling Theory Many large, successful firms use much less debt than the trade-off theory suggests which led to the development of the signaling theory. 32 Signaling Theory Symmetric Information - Investors and managers have identical information about the firm’s prospects. Asymmetric Information - Managers have better information about their firm’s prospects than do outside investors. Signal - An action taken by a firm’s management that provides clues to investors about how management views the firm’s prospects Reserve Borrowing Capacity Ability to borrow money at a reasonable cost when good investment opportunities arise Firms often use less debt than “optimal” to ensure that they can obtain debt capital later if needed. 33 Variations in Capital Structures among Firms Wide variations in use of financial leverage among industries and firms within an industry TIE measures how safe the debt is: • percentage of debt • interest rate on debt • company’s profitability 34 Capital Structures Around the World We cannot state that one financial system is better than another one in the sense of making the firms in one country more efficient than those in another. As U.S. firms become increasingly involved in worldwide operations, they must become increasingly aware of worldwide conditions, and they must be prepared to adapt to conditions in the various countries in which they do business. 35