Custom Snowboards, Inc. Financial Data

advertisement

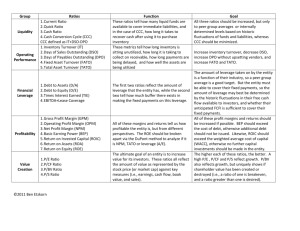

Custom Snowboards, Inc. Financial Data Company requirement • Custom Snowboards, Inc. needs an amount of $1,000,000 and it approached the bank authorities • Bank authorities thinking the proposal to accept or deny. However the bank interested to provide $1,000,000 with 15-year term at 6.75% • In this regard, the bank imposing a condition that the company must maintain the compensating balance of $300,000 Financial Picture Financial Area 14 13 12 Competitor Times interest earned 1.10 1.74 3.45 5.1 Debt to total assets 56% 58% 57% 38% Financial leverage 11.23 2.34 1.41 NA Net profit margin 0.09% 0.68% 2.25% 5.14% Return on total assets 0.35% 2.68% 8.67% 5% Return on Equity 0.81% 6.41% 24.20% 8% Assets turnover 4.12 3.94 3.86 2.1 Mitigating Risks The company financial leverage is increasing over the next 3 years and it will be as follows: Year 14 13 12 Calculation of Financial Leverage EBIT 82000 134000 284500 EBT 7300 EBIT/EBT 11.23 57200 202000 2.34 1.41 Loan Repayment Financial Area 14 13 12 Competitor Times interest earned 1.10 1.74 3.45 5.1 Debt to total assets 56% 58% 57% 38% Financial leverage 11.23 2.34 1.41 NA Net profit margin 0.09% 0.68% 2.25% 5.14% Return on total assets 0.35% 2.68% 8.67% 5% Return on Equity 0.81% 6.41% 24.20% 8% Assets turnover 4.12 3.94 3.86 2.1 CONCLUSION • The company asking the fund of $1,000,000. • In this regard, bank is under thinking as it will • be risk and hence can ask mortgage of the property. Further the bank making restriction to maintain the composite balance of $300,000 which is another burden to the company. CONCLUSION • Therefore, the company should request to • • decrease the maintenance of composite balance. Further, the bank may also ask security by way of mortgage to mitigate the risk. As the company has not enough properties for such security, it should acquire more properties by way of collateral securities.