Reporting and Interpreting Sales Revenue

advertisement

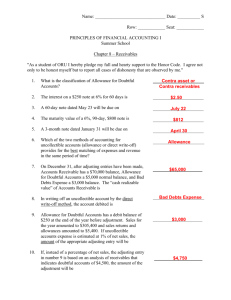

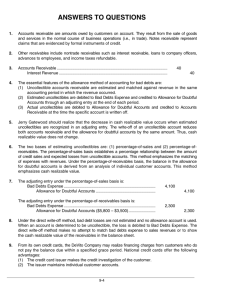

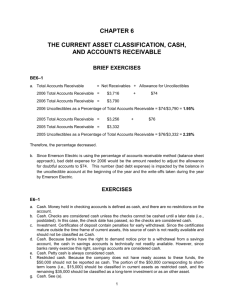

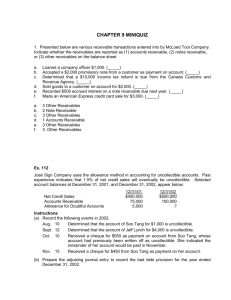

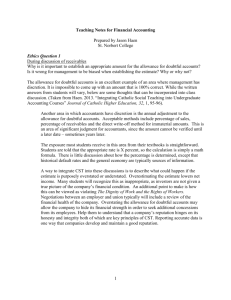

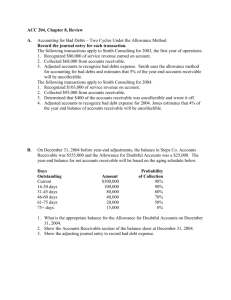

Reporting and Interpreting Sales Revenue, Receivables, and Cash Chapter 6 McGraw-Hill/Irwin © 2009 The McGraw-Hill Companies, Inc. Measuring and Reporting Receivables When companies allow customers to purchase merchandise on an open account, the customer promises to pay the company in the future for the purchase. Accounts Receivable Trade receivables are amounts owed to the business for credit sales of goods, or services. Nontrade receivables are amounts owed to the business for other than business transactions. Accounting for Bad Debts Bad debts result from credit customers who will not pay the business the amount they owe, regardless of collection efforts. Bad Debt Expense Matching Principle Record in same accounting period. Sales Revenue Most businesses record an estimate of the bad debt expense with an adjusting entry at the end of the accounting period. Recording Bad Debt Expense Estimates Deckers estimated bad debt expense for 2006 to be $4,685,000. Prepare the adjusting entry. Bad Debt Expense is normally classified as a selling expense and is closed at year-end. GENERAL JOURNAL Date Description Dec. 31 Bad Debt Expense (+E, -SE) Allowance for Doubtful Accounts (+XA) Contra asset account Debit Credit 4,685,000 4,685,000 Allowance for Doubtful Accounts Balance Sheet Disclosure Accounts receivable Less: Allowance for doubtful accounts Net realizable value of accounts receivable Amount the business expects to collect. Writing Off Uncollectible Accounts When it is clear that a specific customer’s account receivable will be uncollectible, the amount should be removed from the Accounts Receivable account and charged to the Allowance for Doubtful Accounts. Deckers’ total write-offs for 2006 were $6,969,000. Prepare a summary journal entry for these write-offs. GENERAL JOURNAL Date Description Allowance for Doubtful Accounts (-XA) Accounts Receivable (-A) Debit Credit 6,969,000 6,969,000 Writing Off Uncollectible Accounts Assume that before the write-off, Deckers’ Accounts Receivable balance was $62,640,000 and the Allowance for Doubtful Accounts balance was $13,069,000. Let’s see what effect the total write-offs of $6,969,000 had on these accounts. Before WriteOff Accounts receivable $ 62,640,000 Less: Allow. for doubtful accts. 13,069,000 Net realizable value $ 49,571,000 After WriteOff $ 55,671,000 6,100,000 $ 49,571,000 The total write-offs of $6,969,000 did not change the net realizable value nor did it affect any income statement accounts. Estimating Bad Debts ─ Percentage of Credit Sales Bad debt percentage is based on actual uncollectible accounts from prior years’ credit sales. Focus is on determining the amount to record on the income statement as Bad Debt Expense. Net credit sales % Bad debt loss rate Amount of journal entry Percentage of Credit Sales In 2008, Kid’s Clothes had credit sales of $600,000. Past experience indicates that bad debts are one percent of sales. What is the estimate of bad debts expense for 2008? $600,000 × .01 = $6,000 Now, prepare the adjusting entry. GENERAL JOURNAL Date Description Dec. 31 Bad Debt Expense (+E, -SE) Allowance for Doubtful Accounts (+XA) Debit Credit 6,000 6,000 Problems to work • Exercises 6-8, 6-9 Estimating Bad Debts Aging of Accounts Receivable Focus is on determining the desired balance in the Allowance for Doubtful Accounts on the balance sheet. Each customer’s account is aged by breaking down the balance by showing the age (in number of days) of each part of the balance. An aging of accounts receivable for Kid’s Clothes in 2008 might look like this . . . Aging Schedule Days Past Due Customer Aaron, R. Baxter, T. Clark, J. Zak, R. Total % Uncollectible Not Yet Due $ 1,200 1-30 $ 235 300 31-60 $ $ 3,500 0.01 $ 2,550 0.04 50 325 $ 1,830 0.10 Total A/R 61-90 Over 90 Balance $ 235 1,500 $ 200 $ 500 750 $ 1,540 0.25 $ 1,240 0.40 325 $10,660 Based on past experience, the business estimates the percentage of uncollectible accounts in each time category. These percentages are then multiplied by the appropriate column totals. Aging Schedule Days Past Due Customer Aaron, R. Baxter, T. Clark, J. Zak, R. Total % Uncollectible Estimated Uncoll. Amount Not Yet Due $ 1,200 1-30 $ 235 300 31-60 $ 50 $ 3,500 0.01 $ 2,550 0.04 325 $ 1,830 0.10 $ $ $ 35 102 183 Total A/R 61-90 Over 90 Balance $ 235 1,500 $ 200 $ 500 750 $ 1,540 0.25 $ 1,240 0.40 $ $ 385 496 325 $10,660 $ 1,201 The column totals are then added to arrive at the total estimate of uncollectible accounts of $1,201. Record the Dec. 31, 2008, adjusting entry assuming that the Allowance for Doubtful Accounts currently has a $50 credit balance. Aging of Accounts Receivable GENERAL JOURNAL Date Description Dec. 31 Bad Debt Expense (+E, -SE) Allowance for Doubtful Accounts (+XA) Debit Credit 1,151 1,151 1,201 Desired Balance After posting, the Allowance 50 Credit Balance account would $ 1,151 Adjusting Entry look like this . . . Aging of Accounts Receivable Allowance for Doubtful Accounts 50 Notice that the balance after adjustment is equal to the estimate of $1,201 based on the aging analysis performed earlier. 1,151 1,201 Balance at 12/31/2008 before adj. 2008 adjustment Balance at 12/31/2008 after adj. Aging of Accounts Receivable Accounts Receivable % Estimated Uncollectible Desired Balance in Allowance Account - Allowance Account Credit Balance Amount of Journal Entry Accounts Receivable % Estimated Uncollectible Desired Balance in Allowance Account + Allowance Account Debit Balance Amount of Journal Entry Receivables Turnover Receivables = Turnover Net Sales Average Net Trade Receivables This ratio measures how many times average receivables are recorded and collected for the year. Deckers reported 2006 net sales of $304,423,000. December 31, 2005, receivables were $39,683,000 and December 31, 2006, receivables were $49,571,000. Receivables Turnover $304,423,000 = ($39,683,000 + $49,571,000) ÷ 2 = 6.8 2006 Receivables Turnover Comparisons Deckers Skechers Timberland 6.8 7.7 8.4 Problems to work • Exercises 6-12, 6-14