BTB110 Solution to Budgeting Problem #3 When I tried to solve this

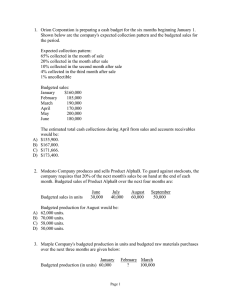

advertisement

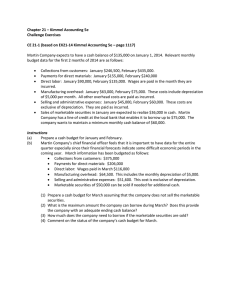

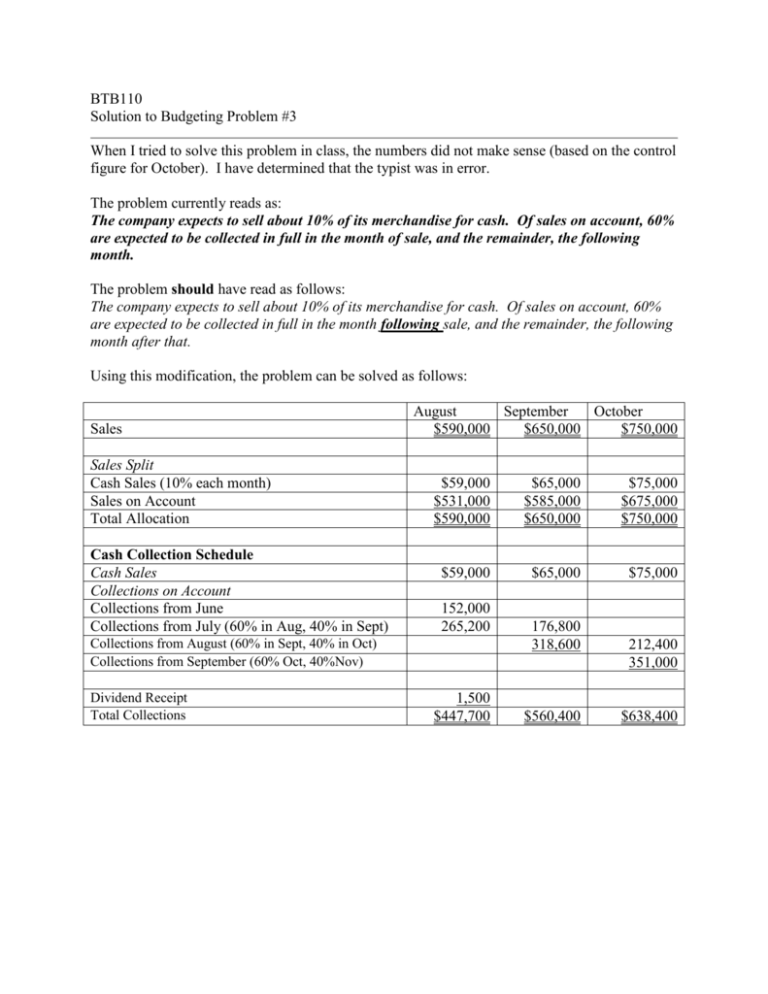

BTB110 Solution to Budgeting Problem #3 When I tried to solve this problem in class, the numbers did not make sense (based on the control figure for October). I have determined that the typist was in error. The problem currently reads as: The company expects to sell about 10% of its merchandise for cash. Of sales on account, 60% are expected to be collected in full in the month of sale, and the remainder, the following month. The problem should have read as follows: The company expects to sell about 10% of its merchandise for cash. Of sales on account, 60% are expected to be collected in full in the month following sale, and the remainder, the following month after that. Using this modification, the problem can be solved as follows: Sales Sales Split Cash Sales (10% each month) Sales on Account Total Allocation Cash Collection Schedule Cash Sales Collections on Account Collections from June Collections from July (60% in Aug, 40% in Sept) August September October $590,000 $650,000 $750,000 $59,000 $531,000 $590,000 $65,000 $585,000 $650,000 $75,000 $675,000 $750,000 $59,000 $65,000 $75,000 152,000 265,200 Collections from August (60% in Sept, 40% in Oct) Collections from September (60% Oct, 40%Nov) Dividend Receipt Total Collections 1,500 $447,700 176,800 318,600 $560,400 212,400 351,000 $638,400 August Expenses Manufacturing Costs Less: Depreciation, Insurance, Taxes Manufacturing costs for which cash is involved during these 3 months Payment Schedule Manufacturing Costs (80% in month incurred) (20% in month following) September October $300,000 30,000 $340,000 30,000 $390,000 30,000 $270,000 $310,000 $360,000 $216,000 60,000* $248,000 54,000 $288,000 62,000 100,000 2,500 200,000 120,000 15,000 *$60,000 is the balance in payables on August 1 Note Payable in October Interest payable on Note ( 90 day note @10%) Selling & Admin Expenses Capital Expenditure Dividend Income Tax Payment Total Budgeted Payments by Month 150,000 170,000 $426,000 $42,000 $514,000 $787,500 Quarterly Cash Budget Cash Balance, August 1 Add: Budgeted Receipts Total Cash Available Deduct: Budgeted Cash Payments Budgeted Cash Balance $55,000 $447,700 $532,500 $426,000 $106,700 $106,700 $560,400 $667,100 $514,000 $153,100 $153,100 $638,400 $791,500 $787,500 $ 4,000 Given that the company wants to have a $45,000 cash balance available at the end of each month, they will have a $41,000 shortfall at the end of October, and will need to borrow to bring them up to the required level.