True endowment - Association of Fundraising Professionals–WNC

advertisement

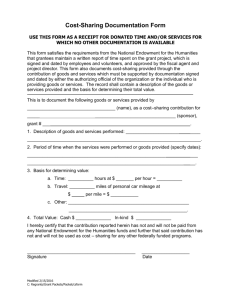

Tested. Trusted. Get Enlightened About Endowments Best Practices for Your Non-Profit Debbie Patrick Garst Reese, CFA, CIC www.boysarnold.com 1 Tested. Trusted. Part I :: Do We Need an Endowment? • What is it? • How can it help my non-profit? • How do I start one? • Policies • Due diligence in finding the right investment counselor and other professionals • Reaching out to donors • Who do I ask? www.boysarnold.com 2 Tested. Trusted. Types of Endowments 1) True endowment (also called Permanent Endowment). In a true endowment, the donor states that the gift is to be held permanently as an endowment, either for general purposes or for specific programs as identified in a written agreement. 2) Quasi-endowment (also known as Funds Functioning as Endowment - FFE). Reserve funds, financial windfalls, or unrestricted gifts that the board elects to put into endowment are quasi-endowments. The principal may be spent. 3) Term endowment. An endowment created for a set period of years or until a future event (such as the death of the donor) is known as a term endowment. After the term runs out or the event takes place, the principal may be expended. The endowed funds in the organization's endowment must be clearly labeled as one of these three types for accounting purposes. Each of the three types may be used for designated or undesignated gifts - for general purposes or to benefit specific projects. www.boysarnold.com 3 Tested. Trusted. Should You Establish an Endowment? An endowment may not be appropriate for every organization. • If your purpose is to solve a problem and then dissolve, you should not build an endowment. • If you are new or do not have a solid donor base, you should focus on building infrastructure and developing supporters rather than on establishing an endowment. • Consider if a donor advised fund through your community foundation is a more fitting solution. www.boysarnold.com 4 Tested. Trusted. Should You Establish an Endowment? • Endowments are most appropriate for organizations that are reasonably established and have stable income from contributions and other revenue sources and that plan to be in existence for the long term. • Before starting an endowment, the organization should have adequate non-endowed reserve funds to allow it to meet unexpected challenges or to absorb major, non-annual expenses. www.boysarnold.com 5 Tested. Trusted. Establishing Your Program – Step One • develop a comprehensive endowment action program • board resolution • integrate into the organization's strategic plan • include the purposes of the endowment and what the board intends that the endowment will provide for the organization in the future www.boysarnold.com 6 Tested. Trusted. Establishing Your Program – Step Two • the case for support, measurable goals, strategies and tactics to reach the goals, and the time frame, as well as staff and budget requirements. • include plans for prospect research, management and investment of gifts, donor and volunteer stewardship and recognition, marketing, and evaluation. www.boysarnold.com 7 Tested. Trusted. Establishing Your Program – Step Three • include the identification of potential endowment champions and donors. • the board of directors must embrace the value of an endowment to the organization and must be willing to commit the resources and time necessary to develop the endowment. www.boysarnold.com 8 Tested. Trusted. Endowment Policies • Written policies • • • ensure the trust and confidence of board and staff members, prospective donors, and professional advisors. protect the organization and its board of directors from their own and staff's mistakes and lack of knowledge. engage financial and legal advisors in drafting policies for approval by the board. • Purpose of the funds and how the organization will use both the income and principal • • How to handle the limits and conditions of contributions designated by the donor for a particular purpose. Any acceptable alternative application of the funds. • Uniform Management of Institutional Funds Act (UMIFA) approved in 1972 • • provides some alternatives for giving the donor and the organization influence in defining future uses of an endowment. provides a process for releasing restrictions that are no longer appropriate by mutual agreement between the organization and the donor. www.boysarnold.com 9 Tested. Trusted. Endowment Policies • Other issues: • • • • • • minimum funding levels guidelines for gift acceptance allowable restrictions provisions for investment oversight and reporting of endowment funds spending rules (the percentage of principle to be distributed annually if the organization chooses not to use only interest/dividends) www.boysarnold.com 10 Tested. Trusted. Ideas for success - Manager My Red Flags • “The endowment model” There isn’t one • “All weather portfolio” There isn’t one • “Low volatility, but up side capture” We all want • Pitchbooks with more product than questions Firm, not client focus Wall Street Sells, But Not Always What You Need www.boysarnold.com 11 Tested. Trusted. Manager Selection • Personal Qualities • Some you want to spend time with & trust • Not a vendor, a partnership • Organization • Organization • How long has it existed? • Team or star • Employee turnover….not just managers • ADV • Edge • Process information • Quantitative managers • Private equity www.boysarnold.com 12 Tested. Trusted. Manager Selection • Transparency • Easy - Vendors, documents, etc. • Harder - Investment thoughts and rationale • Capacity • Are they closed • Can they give personal attention • Performance • On the second page for a reason • Fees • Transparent • Aligned www.boysarnold.com 13 Tested. Trusted. Who do I ask? • Analyze current donors and giving habits to create strategies • Board members • The Passionate • Annual Donors • Planned Gift Donors • Major Gift Donors www.boysarnold.com 14 Tested. Trusted. Part 2 :: Benefits of charitable contributions • Am I Robbing Peter to Pay Paul? • Selling your organization • Marketing www.boysarnold.com 15 Tested. Trusted. Are Other Fundraising Efforts Jeopardized? • It is critically important to integrate the endowment program into all of the organization's fundraising programs and activities and ensure that organizational resources are devoted to promoting and supporting it. • It is a myth that raising endowment funds will diminish funds for other fundraising efforts such as the annual campaign or special events. • Annual gifts usually come from current income and are dedicated to the operating support of the organization. Most endowments are built through planned giving. • Endowment building might be part of a capital campaign that involves bricks-and-mortar projects - to provide financial stability for the long-term maintenance and upkeep of new facilities. www.boysarnold.com 16 Tested. Trusted. Build It • • • • • build familiarity with the organization encourage donors to "think big" push annual giving to new levels build volunteer leadership increase the organization's visibility among stakeholders and the community • enables donors to pledge over several years, which allows them to consider giving larger amounts of money www.boysarnold.com 17 Tested. Trusted. Marketing the Endowment Program The purpose of endowment marketing is to give prospective donors reasons to contribute - either through outright or planned gifts. Important elements of a successful marketing strategy are consistent promotion, personal contact, and positioning the organization's mission. Some goals might include: • • • • Creating visibility for the organization and the people it serves Increasing awareness of the endowment and its purposes Identifying potential endowment donors Educating prospective donors about the various ways to make endowment gifts • Generating donor inquiries about endowment and planned giving information and services • Recognizing endowment donors www.boysarnold.com 18 Tested. Trusted. Marketing the Endowment Program Key concepts to emphasize: • • • • • • Naming opportunities Fulfillment of mission Permanence (long-term support of the organization) Memorial (contributing to a fund to honor an individual) Specific purpose (e.g., scholarship, program support) Funding flexibility (endowment can be funded by various combinations of outright gifts and planned gifts) • Developing and implementing the endowment marketing plan should involve staff, board members, and volunteers, and it should be an integral part of the organization's strategic plan. All appropriate departments should incorporate endowment marketing into their work plans. www.boysarnold.com 19 Tested. Trusted. Part 3 :: We Have an Endowment Already! • When it stalls • Maximizing your success • Risk Management www.boysarnold.com 20 Tested. Trusted. Why it goes wrong • Lack of diversification • Lack of liquidity in stressed times • Lack of inflation protection • Events change more quickly than governance www.boysarnold.com 21 Tested. Trusted. Ideas for success • Culture • Governance • Time horizon www.boysarnold.com 22 Tested. Trusted. Ideas for success - Culture • You solve problems • The organization • The income beneficiaries • The donors • Think strategically • Goal of the endowment currently and how it may change • How do investment decisions effect the income beneficiaries? • What are the donors trying to accomplish? • Helping the organization • Taxes and income • Which type of asset makes the most sense to use • How to balanced needs/wishes of the three entities? www.boysarnold.com 23 Tested. Trusted. Ideas for success - Culture Fiduciary thinking • What’s best for the organization • Reputation • Funding: Both short-term and long-term • Align with strong partners • Board & Fundraiser • Professionals • Attorney • CPA • Investment Manager • Vendors Single Team • Tolerate short-term volatility • Don’t manage by CNBC or Bloomberg or Salespeople www.boysarnold.com 24 Tested. Trusted. Ideas for success - Governance • Real time and dynamic • Open mind • Goals that are flexible, but with direction • Who is on your investment committee • Transparency and accountability • Investment committee • Manager/consultant • Focus on net returns and alignment www.boysarnold.com 25 Tested. Trusted. Ideas for success – Time Horizon • Indefinite? • Long-term investing requires careful risk management • Short-term decisions are amplified over 20 or 30 years • Manage cash flows years in advance • Know the future cash flows and match the portfolio to meet them www.boysarnold.com 26 Tested. Trusted. The world has changed • Twenty years of cheap credit and leverage is over • Tail winds of declining bond yields are gone and so is absolute yield • Events change more quickly than governance • Price of investor capital has gone up www.boysarnold.com 27 Tested. Trusted. Endowment – Risk Management • Define a diversified portfolio • Asset classes • Long/Short strategy • Long only • Too much diversification • Fixed vs. variable obligations • Drawdown and how it effects the end beneficiary • Liquidity • Income Investments • Efficient Frontier • Don’t get caught up in day to day market moves • Can’t build an all weather portfolio • Must use judgment (Quantitative vs. Qualitative) • Long-Term Capital www.boysarnold.com 28 Tested. Trusted. Investment Policy Statement • Goals and Objectives • Return & Risk • Required return to meet goals • Risk • From a portfolio focus • From an organization focus They must agree in the end • Constraints • Time • Taxes • Liquidity/Income • Regulatory • Unique www.boysarnold.com 29 Tested. Trusted. Practical Application • ABC Endowment • • • • • Endowment size Institution’s inflation Current Spending Rule Distribution as % of budget Management Fee $50,000,000 3.25% 4.00% of previous year’s ending market value 5.00% 1.00% Year Ending 31 Market Value of December Endwoment 2007 2008 2009 2010 2011 4% Spending Allowance for the Following Year $49,000,000 $53,000,000 $49,500,000 $55,000,000 $50,000,000 www.boysarnold.com $1,960,000 $2,120,000 $1,980,000 $2,200,000 $2,000,000 30 Tested. Trusted Debbie Patrick joined Boys Arnold & Company as the Director of Business Development in April 2012. Debbie is a native of Dallas, TX and graduated from the University of Texas at Austin with Bachelor of Science degree in Communications. She has enjoyed careers in real estate, information technology, sales and fundraising development. Debbie lives in Hendersonville and has volunteered her time with many non-profit organizations, currently serving on the boards of the WNC Chapter of the Association of Fundraising Professionals, Hendersonville Country Club, Pardee Hospital Foundation, the Asheville-Mountain Area Chapter of the American Red Cross and is a member of Chapter BF of PEO. Garst Reese joined Boys Arnold in August of 2005 and is an investment counselor, serving on the company’s Investment and Financial Planning Committees, and working as a research analyst for the firm. A native of Johnson City, Tennessee, Garst received a BA degree in Business Administration from Lenoir-Rhyne College and worked nine years as a financial consultant in the investment industry before receiving an MBA from the Babcock Graduate School of Management at Wake Forest University. Garst has achieved the designation of Chartered Financial Analyst (CFA) and is a member of the CFA North Carolina Society. Debbie Patrick dpatrick@boysarnold.com Garst Reese greese@boysarnold.com www.boysarnold.com www.boysarnold.com 31