Chapter 8

advertisement

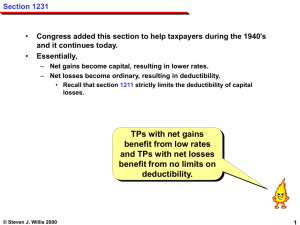

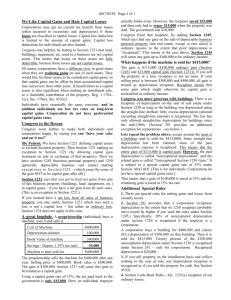

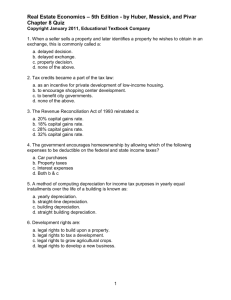

Chapter 8 Property Dispositions Realized Gain or Loss Amount realized on disposition MINUS adjusted basis of property (e.g. cost accumulated tax depreciation = “NBV”) = Realized gain or loss. GENERALLY, realized (economic) gains and losses on disposition are recognized (result in taxable income or deductions) unless there is a specific exception. See Chapter 8. Unrealized (mere appreciation or decline in value) gains and losses are neither realized nor recognized. Amount Realized Cash received FMV of any property received, including buyer’s note Relief of debt. AP3. Reduce the amount realized by selling costs such as sales commissions, broker fees. No adjustment for “inflationary gains.” Installment Sale Method Permits deferral of gain recognition until cash is received on the sale. Gain recognized this year = (cash this year) x (total gain / total sales price). Not allowed for sales of publicly traded stock or for inventory, or to delay recognition of depreciation recapture. Financial accounting uses accrual accounting, so installment sales method for tax creates a temporary book-tax difference. Related Party Losses Relative: family = spouse, sibling, ancestors, lineal descendants Q10 50% controlled corporations Losses realized on sale of property between related parties are NONdeductible. Future gain (but NOT loss) by relative can be offset by disallowed loss. Character of Gain or Loss - Overview Tax or deduct at ordinary rates Ordinary Section1231 net gain Capital Net capital gains and losses: Individual may deduct $3000 net loss. Net LT gain taxed at lower rates. Capital Asset (negatively) Defined Capital assets (under Section1221) are everything EXCEPT: 1) inventory 2) accounts receivable 3) supplies 4) real or depreciable property used in a trade or business (this is the same as Section 1231 property) Capital Asset (negatively) Defined 5) copyright, compositions, artistic efforts created by taxpayer. (exception - patents by inventors are capital assets). 6) certain U.S. government publications 7) Commodities derivative financial instruments held by a dealer 8) Hedging transaction properties. Capital Losses Only deduct capital losses UP TO capital gains. Excess of capital loss over capital gains Individual taxpayers: can deduct $3000 of net losses per year against ordinary income carryforward excess indefinitely against capital gains Corporation NO deduction for net loss in current year carry back 3 years and forward 5 years against capital gains Capital Gains Individuals obtain preferential taxation on long-term (> 1 year) capital gains - generally 20% tax rate (15% as result of 2003 Tax Act). See Chapter 16. Corporations pay tax at regular tax rates. Section 1231 Assets Real or depreciable property used in a trade or business. Q1 GENERAL rule. Net Section 1231 gains and losses IF NET GAIN => add to capital gains and losses. Result is possible lower tax rate on 1231 net gains. IF NET LOSS => add to ordinary gains and losses. Can also offset salary, interest, dividends, etc. Result is ordinary rate benefit of 1231 net losses. Depreciation Recapture Gain on each separate asset may be subject to depreciation recapture. Depreciation recapture does NOT apply if the asset is sold at a loss, nor can it increase the amount of the gain. For sales of depreciable personalty and amortizable intangibles, the gain is characterized as ordinary up to the amount of accumulated depreciation. Why? because depreciation has resulted in prior deductions at ordinary rates. Depreciation Recapture REALTY: Special rules apply to pre-1986 depreciation on accelerated methods: most of this property is fully depreciated, so rules seldom apply. Corporations must recapture 20% of amount that would have been ordinary had it been personalty (lesser of gain or depreciation).. Individuals treat lesser of gain or depreciation as a capital gain subject to a special 25% tax rate - see chapter 16. Section 1231 Netting After all depreciation recapture, NET the remaining Section1231 gains with Section 1231 losses. If a net loss, treat as an ordinary loss and combine with other ordinary income and losses. If a net gain, then the net gain is treated as a capital gain UNLESS: Section 1231 Look Back Rule The net 1231 gain is treated as ordinary income recapture to the extent of unrecaptured Section 1231 losses during the prior five years. EXAMPLE: Start business in 1990. Section 1231 gains and losses. 1998 net gain $10 treated as capital. 1999 net loss ($15) treated as ordinary. 2000 net gain $23 treated as $15 ordinary (recapture 1991) and $8 capital. 2001 net loss ($40) treated as ordinary. 2002 net gain $6 treated as ordinary. Still have $34 unrecaptured loss from 1993. 2003 net gain $50 treated as $34 ordinary, $16 capital.