Document

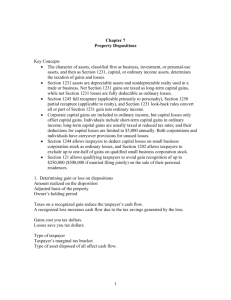

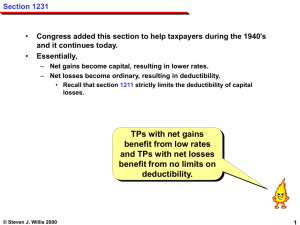

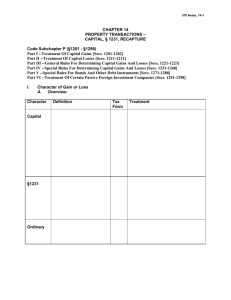

advertisement

Module 20 Capital Assets Menu 1. Capital assets 2. Capital gains and losses 3. §1231 4. Depreciation recapture Capital Assets Key Learning Objectives In general Definition of a capital asset Special issues All Assets Are Capital Assets Except Inventory Accounts/notes receivable from sale of goods or services Depreciable or real property used in a trade or business (§1231 property) Copyrights and creative works Certain U.S. government publications Special Issues Additional clarifications provided by Congress include: Sales or exchanges by dealers in securities Sales of subdivided real estate Nonbusiness bad debts Capital Gains and Losses Key Learning Objectives Sale or exchange Holding period Corporate taxpayers Individual taxpayers Sale or Exchange The recognition of a capital gain or loss Usually requires the sale or exchange Code doesn't define the terms "sale" and "exchange." The Supreme Court, however, says that the terms are to be given their ordinary meaning Holding Period Holding period runs from Day after acquisition date to trade date Long vs. short controlled by code in effect on date of sale Code states more than for holding period Two Holding Periods for Capital Gains Short term < 12 months Long term > 12 months Four Tax Rates for Capital Gains for Individuals Net short term gains taxed as ordinary income Net long term gains taxed at 20%/10% taxed at 28% if “collectable” Some gain from real property taxed at 25% am’t related to unrecaptured depreciation deductions 25% Rate on Gains From Real Property Applies to noncorporate taxpayers "unrecaptured Sec. 1250 gain,” Building original cost = $100,000 Depreciation taken $30,000 (straight line) Selling price $110,000 Gain = $40,000 ($110,000 - $70,000) $30,000 limited to 25% preference rate $10,000 could be taxed at 20%/10% rates In Class Exercise: Preference Rate on Capital Gains Single taxpayer’s taxable income for 2000 is $102,000 If this is all ordinary income, what is her regular tax liability? Note: use excerpt from 2000 tax rate schedules on next slide Solution = $26,301 Note same answer if income included short term capital gains Excerpt from 2000 Tax Table If taxable income is At least 63,550 90,800 But less The Tax is Filing than Status 132,600 14,381.5 Single 147,050 20,854.5 Head of House + 31% of excess of taxable income over column 1 In Class Exercise: Preference Rate on Capital Gains Single taxpayer’s taxable income for 2000 is $102,000 If $20,000 of this is a net long term gain, what is her regular tax liability? Note: use excerpt from 2000 tax rate schedules on previous slide Solution = $24,101 [102,000-20,000-63,550]*.31 20,000 *.20 + 14,381.5 + In Class Exercise: Preference Rate on Capital Gains Single taxpayer’s T. I. for 2000 is $102,000 If $20,000 is from the sale of a collectible held more than 12 months, what is her regular tax liability? Note: use excerpt from 2000 tax rate schedules on earlier slide Solution = $25,701 [102,000-20,000-63,550]*.31 20,000 *.28 + 14,381.5 + Preference Rate for Filers in 15% Tax Bracket Prior to 1997, filers had to have MTR> 28% before net capital gains had preference treatment Long term capital gains now give all filers preferential rates If filer is in 15% MTR, these gains are taxed at 10% In Class Exercise: Preference Rate on Capital Gains Single taxpayer’s TI for 2000 is $22,000 If ordinary income, what is regular tax liability? In 2000 all ordinary income under $26,250 is taxed at 15% for single filers Solution = $3,300 $22,000 * .15 The same answer applies if income includes short term capital gains or long-term gains from collectibles In Class Exercise: Preference Rate on Capital Gains Single taxpayer’s taxable income for 2000 is $22,000 If $10,000 of this is a net long term gain, what is his regular tax liability? In 2000 all ordinary income under $26,250 is taxed at 15% for single filers Solution = $2,800 [22,000-10,000]*.15 + 10,000 *.10 Netting Process Net by holding period first Net across holding periods if they carry opposite signs Negative and positive In Class Exercise 1: Netting Capital Gains and Losses J&J have $100,000 of taxable income before capital gains transactions 5,000 ST Capital gain 30,000 LT Capital Gain What is J&Js net capital gain/loss position? Solution: In Class Exercise 1: Netting Capital Gains and Losses LT ST NET Gain 30,000 5,000 Loss -0-0Net 30,000 5,000 N/A* *Don’t net if both have same sign Only the 30,000 is a net capital gain entitled to maximum 20% tax rate In Class Exercise 2: Netting Capital Gains and Losses Crumb had the following transactions for the year 2000 $25,000 long-term capital gain $12,000 long-term capital loss $8,000 short-term capital gain $15,000 short-term capital loss What is Crumb’s net capital gain/loss position? Solution--In Class Exercise 2: Netting Capital Gains and Losses LT ST NET Gain 25,000 8,000 Loss 12,000 15,000 Net 13,000 - 7,000 6,000* * Net again if long and short term have different signs Only 6,000 is a net capital gain entitled to maximum 20% (10%) tax rate In Class Exercise 3: Netting Capital Gains and Losses Crumb had the following transactions for the year 2000 $5,000 long-term capital gain $12,000 long-term capital loss $8,000 short-term capital gain $5,000 short-term capital loss What is Crumb’s net capital gain/loss position? Solution--In Class Exercise 3: Netting Capital Gains and Losses Gain Loss Net LT ST NET 5,000 8,000 12,000 5,000 -7,000 3,000 -4,000 LTCL Corporate Taxpayer Net capital loss not deducted Applies to net aggregate loss, not individual transactions Excess losses carry back (3 years) then forward (five years) No preference rate on net LTCG In Class Exercise: Net Capital Loss Assume Crumb is a corporation Crumb's taxable income is $50,000 before the $4,000 net capital loss What is Crumb’s taxable income after the net capital loss is considered? Solution: In Class Exercise: Net Capital Loss Crumb’s taxable income is still $50,000 after the net capital loss is considered Corporations may not deduct any net capital losses However, the loss can be carried back and used against capital gains of earlier years Individual Taxpayer Capital losses allowed to extent of capital gains + $3,000. Capital loss carry forward only No time limit to c/o Short/long term character retained Short-term losses are deducted first In Class Exercise: Net Capital Loss Assume Crumb is an individual taxpayer Crumb's taxable income is $50,000 before the $4,000 net capital loss What is Crumb’s taxable income after the net capital loss is considered? Solution: In Class Exercise: Net Capital Loss Crumb’s taxable income is $47,000 after the net capital loss is considered Individuals can deduct up to $3,000 of net capital losses each year The excess $1,000 loss CANNOT be carried back to earlier years $1,000 capital loss is carried forward as a long-term capital loss to be used in future §1231 Key Learning Objectives (1) In general §1231 property §1231 loss §1231 gain §1231 Property Depreciable or real property Used in a trade or business AND Held for more than one year Other industry-specific property also qualifies as §1231 property Ordinary gain/loss treatment for assets held one year or less §1231 Netting §1231 gain per transaction is amount left after depreciation recapture Net all §1231 gains/losses for year Net §1231 loss treated as ordinary loss §1231 Property if Net §1231 Gain Lookback to determine if must recapture Prior years' §1231 ordinary losses Look back period is last 5 tax years Net §1231 gain is recharacterized as ordinary income to extent of net §1231 losses in look back period not already recaptured Remainder is LTCG §1231 Key Learning Objectives (2) Gains in excess of losses Recapture net §1231 losses Gains and losses from casualty or theft §1231 netting procedure summary In Class Exercise: Recapture Net §1231 Losses Jan has $22,650 in net §1231 gains for 2000 Apply the lookback rule to determine how much of this is Ordinary income? LTCG? See next slide for Jan’s net §1231 gains and losses for the five-year look back period In Class Exercise: Recapture Net §1231 Losses Jan's history of § 231 net gains (losses) prior to 2000 (none before 1995) 1999 9,000 1998 (15,000) 1997 20,000 1996 (17,000) 1995 5,000 Solution--In Class Exercise: Recapture Net §1231 Losses Start with 1995 to calculate un-recaptured net §1231 losses outstanding at 1-1-00 1995 $5,000 $5,000 net §1231 gain treated as LTCG 1996 ($17,000) No un-recaptured §1231 losses at 1-1-96 $17,000 net §1231 loss treated as ordinary Solution--In Class Exercise: Recapture Net §1231 Losses 1997 $20,000 $17,000 un-recaptured §1231 losses at 1-1-97 $17,000 of 20,000 treated as ordinary $3,000 treated as LTCG 1998 ($15,000) No un-recaptured §1231 losses at 1-1-98 $15,000 net §1231 loss treated as ordinary Solution--In Class Exercise: Recapture Net §1231 Losses 1999 $9,000 $15,000 un-recaptured §1231 losses at 1-1-99 $ 9,000 is treated as ordinary income 2000 $22,650 $6,000 un-recaptured §1231 losses at 1-1-00 $ 6,000 of $22,650 treated as ordinary $16,650 treated as LTCG §1231 Property Net §1231 gain or loss determination involves a complex 3-step netting process discussed in the text §1231 Netting Process Step 1 Net current year casualty gains and losses Net loss is ordinary loss Net gain is §1231 gain and goes to Step 2 §1231 Netting Process Step 2 Net current year §1231 gains and losses Net loss is ordinary loss Net gain goes to Step 3 §1231 Netting Process Step 3 Apply 5-year lookback Recharacterize gain as ordinary to extent of un-recaptured §1231 losses in look back period Remainder of gain is long-term capital gain and goes to capital gain and loss netting pool Depreciation Recapture Key Learning Objectives (1) In general Recovery property Application to losses §1245 Recapture §1245 Depreciation Recapture Applies to gains only, not losses Applies generally to non-real estate i.e. 3,5,7 year MACRS property §1245 recapture potential = total depreciation taken Ordinary gain is recognized to the lesser of §1245 recapture potential or realized gain Gain not subject to recapture is §1231 gain In Class Exercise: §1245 Recapture T bought a machine in 1998 for $120,000 T sold the machine in 2000 for $140,000 Total MACRS depreciation taken as of the date of the sale was $75,000 How much should T report As ordinary income under §1245? As §1231 gain? Solution: In Class Exercise: §1245 Recapture T should report $75,000 of ordinary income under §1245 $20,000 §1231 gain Amount realized Cost 120,000 Depreciation 75,000 Basis Gain §1245 recapture 140,000 45,000 95,000 75,000 Depreciation Recapture Key Learning Objectives (2) §1250 Property Additional issues §1245 and §1250 Differences between §1245 and §1250 §291--Additional recapture for corporations §1250 Recapture Applies to gains only, not losses Applies to real estate Never applies if straight-line method used Thus, no recapture for MACRS Post-1986 realty Residential Realty §1250 Recapture Potential §1250 recapture potential Excess of accelerated depreciation over straight-line MACRS--S/L only so no recapture In Class Exercise: §1250 Recapture--Residential T purchased residential property for $300,000 in 1982 T sold the property in 2000 for $260,000 Total ACRS depreciation was $175,000 Straight-line depreciation would be $155,000 How much should T report As ordinary income under §1250? As §1231 gain? Solution: In Class Exercise: §1250 Recapture Residential T should report $20,000 of ordinary income under §1250 $115,000 of §1231 gain. Amount realized Cost Depreciation Basis Gain 260,000 300,000 175,000 125,000 135,000 Solution: In Class Exercise: §1250 Recapture Residential Accelerated depreciation Straight-line depreciation §1250 recapture §1231 gain Total gain 175,000 155,000 20,000 115,000 135,000 Nonresidential Realty §1250 Recapture Potential Pre-1981 Excess of accelerated depreciation over straight-line subject to recapture Same rule as residential realty ACRS (1981-1986) All depreciation subject to recapture MACRS--S/L only so no recapture In Class Exercise: §1250 Recapture Non-Residential T purchased nonresidential real property for $600,000 in 1986 T sold the property in 2000 for $460,000 Total ACRS depreciation was $345,000 Straight-line depreciation would be $315,000. How much should T report As ordinary income under §1250? As §1231 gain? Solution: In Class Exercise: §1250 Recapture Non-Residential T should treat this as §1245 property AND Recognize the entire $205,000 gain as ordinary Amount Realized 460,000 Cost 600,000 Depreciation 345,000 Basis 255,000 Gain 205,000 §291--Additional Recapture for Corporations Applies to §1250 property Additional recapture is based on §1245 rules §291--Additional Recapture for Corporations The additional recapture amount is 20 % of the amount by which §1245 recapture amount exceeds §1250 recapture amount Total recapture is sum of §1250 recapture AND §291 amount