Chapter 13

advertisement

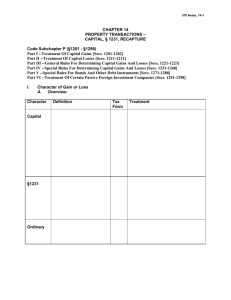

Income Tax Chapter 13 Section 1231 and Recapture Provisions I) Introduction to Section 1231 Assets A) Recall from chapter 5 that depreciable property or real property used in a trade or business are not capital assets. 1. These assets are generally considered to be '1231 property. B) Historical Justification C) Qualifying assets do not become '1231 assets until held for required holding period for LTCG treatment. 1. Until this time they are "ordinary" income property D) Text discusses recapture rules after '1231 rules but '1231 gains are those that survive recapture provision hurdles. E) Treatment of net '1231 gain and <loss> 1. If netting results in loss -- ordinary loss 2. If netting results in gain -- generally will receive LTCG treatment a. Gain subject to special treatment if prior '1231 net losses exist. b. Unrecaptured '1250 Gain (which essentially is unrecaptured on the sale of '1250 property) is subject to a special 25% tax rate. II) Netting process of '1231 gains and <losses> A) Remember these are gains after all recapture hurdles. B) Steps in netting process 1. Net the gains and <losses> from casualties and thefts (not condemnations) of '1231 assets and non-personal use assets held for long-term holding period. If gains > losses -- include excess in '1231 netting (see # 2 below) If losses > gains -- do not include in '1231 pot (business casualty losses deduct for AGI) (other deduct from AGI subject to 2% limit) 2. Net out all '1231 gains and losses (including gain from above) Also all condemnation gains and losses of '1231 assets and nonpersonal use assets held more than one year are included. If loss > gain -- ordinary If gain > loss -- LTCG subject to recapture as ordinary income to extent of net '1231 losses for the 5 preceding years (Alookback@ rules) III) Depreciation recapture provisions A) Enacted to prevent ordinary deducts during life (depreciation) and LTCG when sold. B) Affects nature of gain. Converts potential '1231 gains into ordinary income. 1. Total recapture can never exceed gain recognized on the property. C) '1245 Recapture 1. Generally applies to depreciable personal property (i.e. machinery and equipment) and amortizable intangible assets 2. Rules also apply to ACRS nonresidential real property acquired between 1981 and 1986 inclusive if accelerated percentages are used. 3. '1245 will only apply if property sold at a gain. 4. Recapture (ordinary income) potential includes a. Depreciation allowed or allowable since 1962 b. Any '179 deduction c. Basis reduction for 2 of I.T.C. 5. Quick application of '1245 Recapture a. If selling price original cost => all gain is '1245 gain b. If selling price > original cost => selling price - original cost ='1231 gain and original cost - adjusted basis = '1245 gain D) '1250 Recapture 1. Generally applies to depreciable real property a. Note exception above in III C) 2. 2. Amount of recapture potential depends upon a. Type of property -- residential rental vs. nonresidential real property b. When placed in service 3. Recapture potential only exists if "EXCESS" depreciation is taken (additional depreciation) a. Depreciation actually taken (or allowable, given depreciation method used) vs what straight line depreciation would have been. b. So MACRS prop not subject to '1250 recapture since straight line depreciation is required. 4. Determining recapture potential a. Commercial (nonresidential) real property I) If pre-ACRS (Before 1981) a) Post 1969 excess depreciation is subject to recapture. ii) If ACRS (Between 1981 and before 1987) a) Subject to '1245 rules if accelerated rates are used. (i.e. not elect straight line) b. Residential rental property 1. Post 1975 excess depreciation will be 100% recaptured. E) Special recapture considerations 1. Remember the total gain taxed (recap and recognized gain on the transaction!! '1231) can never exceed 2. With installment sales -- all gain which is recapture must be reported in year of sale regardless of how much cash is received. 3. Recapture potential carries over to donee. 4. Recapture potential carries over to new property received in like-kind exchange 5. Recapture potential terminates at death F) '1239 Transactions 1. Sales of depreciable property between related parties (for instance a corporation or partnership in which an individual owns more than 50%) a. Depreciable in hands of transferee 2. All gain is ordinary income IV) Unrecaptured '1250 gains subject to 25% tax rate. A) Maximum amount subject to 25% rate is the depreciation taken on the real property sold. 1. Amount will never exceed recognized gains. 2. Any '1250 recapture also reduces the 25% gain amount. 3. If the property is treated as '1245 property (nonresidential real estate acquired in 1981-1986 on which accelerated depreciation was taken), no 25% gain can exist.