Chapter 7

Capital Gains and

Other Sales of

Property

“If a client asks in any but an extreme

case whether, in your opinion, his sale

will result in capital gain, your answer

should probably be, ‘I don’t know, and

no one else in town can tell you.’”

-- James L. Wood

Copyright © 2014 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

McGraw-Hill/Irwin

©The McGraw-Hill Companies, Inc. 2008

LO #1 Terms & Tax Forms

• Basis of property purchased is the cost

of the asset including cash, debt

obligations, and other property or

services included in acquiring the asset.

• Basis of assets transferred by

inheritance are valued at the FMV of the

property at the date of death or FMV on

the alternate valuation date if an estate

return is being filed and the estate

income is reduced by the valuation.

7-2

LO #1 Terms & Tax Forms

• Basis of property transferred to a

taxpayer from a spouse or former

spouse incident to a divorce

settlement, is the same as the

spouse’s or former spouse’s adjusted

basis before the transfer.

• Assets transferred by gift can be

valued at FMV or basis of the donor

depending if the FMV is < or = >

basis.

7-3

LO #1 Terms & Tax Forms

• Adjusted basis is the cost of the asset

less any accumulated depreciation.

• The difference between the amount

realized from the sale and the adjusted

basis of the asset;

– Amount realized > adjusted basis = gain

– Amount realized < adjusted basis=(loss)

7-4

LO #1 Terms & Tax Forms

• The nature of tax reporting for gains and

losses on the sale of property depends

primarily on the “use” of the asset rather

than on the asset “form.”

7-5

LO #1 Terms & Tax Forms

• Form 4797 – Sales of Business Property

– Use to report any and all gains or losses

from sale or liquidation of business

property.

– The form has four parts to it and is very

detailed to include all possible situations

involving property used in a business

• Schedule D – Capital Gains and Losses

– Use to report any and all gains or losses

from sale of property held for investment.

• Form 8949 – Record transactions

7-6

LO # 2 Classifying Assets

• Ordinary Asset

– Ordinary income property is any

asset that is “not” a capital asset.

• Capital Asset (§1221)

– Any asset used for personal

purposes or investment.

• Eight exceptions to this definition

7-7

LO # 2 Classifying Assets

• § 1231 Business Asset

– Depreciable or nondepreciable property

used in a trade or business

– Held for more than one year

• Any business asset disposed of within

one year of acquisition is an ordinary

income asset and is taxed to the

taxpayer at ordinary tax rates.

7-8

LO # 3 Ordinary Assets

• Inventory and accounts receivable are

not ordinary income assets unless they

are sold outside the normal course of

business.

• Sale of business property held less than

one year.

• Gains are taxed at the taxpayer’s regular

rate

– There is no preferential tax treatment

• Losses are fully deductible

7-9

LO #4 Capital Assets

• Tax treatment depends on holding

period of the asset. Assets must be

held for more than one year for

preferential tax treatment.

– Exceptions:

• Property received through a gift or

nontaxable exchange generally has same

holding period as the transferor.

• Property acquired through inheritance is

always considered long-term property.

7-10

LO #4 Capital Assets

• Long term capital gain rates:

– 0%,15%, or 20% for most capital assets

– 25% rate for depreciable real property

used in a trade or business (§ 1250)

– 28% rate for “collectibles” and gains on

§1202 (Qualified Small Business Stock)

property.

7-11

LO #4 Capital Assets

• All short-term gains and losses are

netted.

• All long-term gains and losses are

netted.

• The resultant gain or loss determines

the deductibility of a loss and the tax

rate used for gain.

7-12

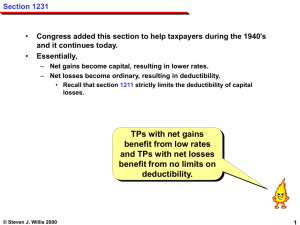

LO #5 §1231 Business Assets

• Recall that §1231 assets are those

used in a trade or business that are

held for > 1 year.

• Gains and losses from the sale of

§1231 assets are netted before tax

rates are applied.

• A net §1231 gain is taxed as a longterm capital gain subject to recapture

provisions

7-13

LO #5 §1231 Business Assets

• Recapture provisions apply to

depreciation taken as a deduction in

prior years.

• Depreciation recapture rules are

designed to “transform” some or all of

the §1231 gain into an ordinary gain.

7-14

LO #5 §1231 Business Assets

• Net §1231 gains receive preferential

tax rate treatment

• Net §1231 losses are treated as

ordinary losses not subject to

deductibility limit provisions of $3,000

per year.

7-15

LO #5 §1231 Business Assets

• §1245 applies to personal trade or

business property and is a subset of

§1231 property

– Tax rate to “recapture” the depreciation

portion of a gain is taxed at ordinary rates

– Remaining gain, if any, is taxed at

preferential rates.

7-16

LO #5 §1231 Business Assets

• § 1250 applies to buildings –

residential or nonresidential

(commercial) and is a subset of §1231

property

– The amount of capital gain

attributable to depreciation

previously taken is taxed at the 25%

rate up to the depreciation amount

considered “unrecaptured”.

– Remaining gain, if any, is taxed at

preferential rates

7-17

LO # 6 Special Types of Sales

• Sales of stock purchased as blocks

of stock at different prices and/or

dates are valued either using

specific identification or the first-in,

first-out method for determining

basis.

7-18

LO # 6 Special Types of Sales

• A mutual fund pools resources from various

investors and purchases shares of stock in a

portfolio

• Form 1099-DIV is the form sent annually to

individual investors in the mutual fund to

record dividends, capital gains, and

distributions from the fund for the year.

• Capital gains distributions from mutual funds

are reported on Schedule D (or directly on

Form 1040 if Schedule D is not required to be

filed).

7-19

LO # 6 Special Types of Sales

• Three methods to calculate the “basis” of

shares in a mutual fund purchased

throughout a period

– First-In, First-Out – assumes first shares

purchased are the first shares sold.

– Specific Identification – assumes that the shares

sold can be identified with a specific purchase.

– Average Basis – Calculate the average of shares

purchased for a period and use an average to

determine the cost basis of shares sold.

7-20

LO # 6 Special Types of Sales

• Worthless securities are treated as

losses from a sale or exchange of a

capital asset on the last day of the

taxable year.

– Declaration of bankruptcy is not

sufficient to indicate worthlessness.

– Often difficult to pinpoint exactly when a

security becomes worthless to determine

a “sale date” for long-term versus shortterm treatment.

7-21

LO # 6 Special Types of Sales

• Sales of assets given as gifts:

– FMV<donor’s adjusted basis at time of

gift

• Use donor’s adjusted basis for a gain

• Use FMV for a loss

• Special provision, if the sell price is between

the adjusted basis and the FMV, there is no

gain or loss on the sale.

– FMV=>donor’s adjusted basis at time of

gift

• Use donor’s adjusted basis for a gain or

loss

7-22

LO # 6 Special Types of Sales

• Basis to beneficiaries is the FMV at the date

of death or alternate valuation date (AVD

applies only if valuing the asset reduces the

overall estate amount).

• The holding period is always considered

long-term

– Example: Property inherited with a basis

of $3,000 is sold six months later for

$4,000. The $1,000 gain is considered

long-term and qualifies for preferential tax

treatment.

7-23