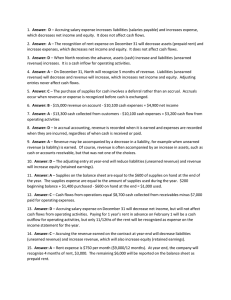

Adjusting Entry Practice Problems

advertisement

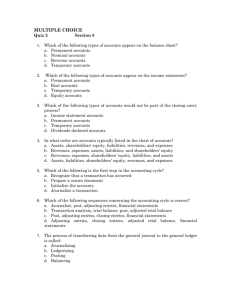

Adjusting entry practice 1). Dobbin Corporation borrowed $1,500,000 on a one-year, 6% note payable on August 1, 2012. All principal and interest will be paid at the maturity date, August 1, 2013. What adjusting entry must Dobbin make related to the note on December 31, 2012? A. Interest receivable + $90,000 Interest revenue + 90,000 B. Interest expense + $37,500 Interest payable + $37,500 C. Interest expense + $52,500 Interest payable + 52,500 D. Interest expense + $90,000 Interest payable + $90,000 2). On May 1, 2012, the premium on a one-year insurance policy on a building was paid amounting to $6,000. At the end of 2012 (end of the accounting period), the financial statements would report A. B. C. D. Insurance expense, $6,000; Prepaid insurance $0. Insurance expense, $0; Prepaid insurance $6,000. Insurance expense, $2,000; Prepaid insurance $4,000. Insurance expense, $4,000; Prepaid insurance $2,000. 3). A company receives rent from a tenant on March 31st. The tenant paid in advance for an entire year, starting April 1st. Rent is at a rate of $750 a month. On December 31st, what will be the necessary adjusting entry? a. A debit to unearned rent revenue and a credit to rent revenue, $6,750 b. A debit to cash and a credit to unearned rent revenue, $9,000 c. A debit to unearned rent revenue and a credit to rent revenue, $2,250 d. A debit to cash and a credit to rent revenue, $6,750 4). Forgetting to recognize the expense of using up a months worth of rent would cause: a. Assets and liabilities to be understated b. Revenues to be overstated and expenses to be understated c. Liabilities to be understated and stockholders’ equity to be overstated d. Assets and stockholders’ equity to be overstated 5). a. b. c. d. 6). Which two financial statements do adjusting entries always affect? Balance sheet and income statement Statement of cash flows and the balance sheet Income statement and statement of retained earnings Statement of retained earnings and the balance sheet On October 1, 2005, you borrow $200,000 at 6% interest and record the promissory note. In April and again in October of the following year, you are required to pay half the annual interest to your creditors. On December 31, 2005, your journal entry for the quarter should: A. Increase Interest Expense for $3,000 and increase Interest Payable for $3,000. B. Increase Cash for $3,000 and increase Accrued Interest for $3,000. C. Increase Interest Expense for $6,000 and decrease Cash for $6,000. D. Increase Interest Expense for $6,000 and increase Notes Payable for $6,000.