Chapter Two

advertisement

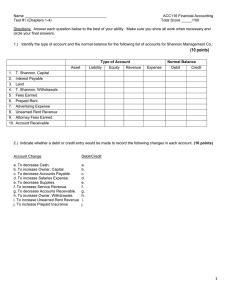

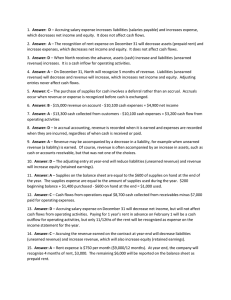

Accounting Information Systems Accrual Basis ◦ When it happens ◦ Cash Basis ◦ When paid ◦ Mostly Service type business Dentist, Doctor, Lawyers 1/10 Places an order Record in purchase order file to track what has been requested and what has been ordered ( managerial) but not in financial accounting records. 2/15 Receives desk and bill Record the exchange of assets --you now have the desk and the cost of the desk, exact amount of the bill. 3/1 Pays the bill Writes a check and sends it to the vendor. COST ◦Original Cost- “Historical” Classification: Assets= Liabilities+Stk Equity+Revenue-Expense Accounts: Cash, A/R, Supplies, Inventory A/P, Mortgage Payable, X Payable,Unearned X Common Stock, Dividends, Retained Earnings Sales, Services Performed Rent X, Wages X, Chart or List of the Accounts Chart of Accounts- ◦ Lists accounts that can be used in recording a business transaction. CFO approval to open an account. Revenue – Expenses = Net Income Who gets the net income? Stockholder Net Income goes to Retained Earnings Dividends reduces Retained Earnings and goes to Stockholders A. A/P B.Supplies C. Dividend D. Fees EarnedE. Supplies X F. A/R G. Unearned RevenueH. Equipment - Double - TWO (2) ◦ Every entry must have at least two entries or accounts ____Debit_______________Credit_______ | | | Washington D.C. AC/DC All transactions must have 1 Debit 1 Credit A=L+SE+R-E Dr Cr Cr Cr Dr A+E+Div Dr Normal Normal Balance = L+SE+R Cr Balance CLASS Cash Wages Expense A/R Common Stock Service Revenue Prepaid Rent A/P Investments NORM BAL CLASS Bonds Payable Income Taxes Exp Land Supplies Exp Prepaid Insurance Utilities Exp Fees Earned Dividends Wages Payable NORM BAL CLASS Unearned Revenue Office Equipment Rent Payable Notes Receivable Interest Expense Notes Payable Supplies Interest Receivable Rent Expense NORM BAL What did you buy or receive How did you or your customer pay for it. What accounts do you use What is it’s classification What its normal balance. Did you increase it - same as normal balance Did you decrease it-opposite of normal balance 4 steps: General Journal Post to General Ledger or T-accounts From GL do a Trial Balance From Trial Balance do Financial Statements May 2 5 7 19 22 25 31 Cash Common Stock Office Equipment Cash Supplies Accounts Payable Cash Program Service Rev (Earned Cash Unearned Program Service Rev Rent Expense Cash Accounts Receivable Program Service Revenue Cash Equipment 2000 | 300 300 | 3000 | 700 1000 5000 A/P 150 | 700| Unearned Rev | 1000 A/R 800 | Supplies Office 150| Common Stock Prog Svc Rev Rent Expense | 2000 |3000 | 800 3800 Report :Does the equation balance-- trial Normal Balance must be maintained Accounting equation vertically A Dr L Cr SE Cr R Cr E Dr XX XX Comaque Shoe Repair Service, Inc. Trial Balance June 30, 20XX Cash $4,210 Repair Supplies 500 Repair Equipment 1,900 A/P $ 300 Common Stock 5,900 Dividends 600 Repair Fees Earned 1,860 Salaries Expense 450 Rent Expense 400 _____ $8,060 $8,060 Transposition 950 to 590 Slides 1000 to 100 All divisable by 9 or numbers add to 9 E2-10 pg 93 E2-13 pg 94 HOMEWORK P2A, P3A, P5A, P7A, P9A