Group Work Solutions

advertisement

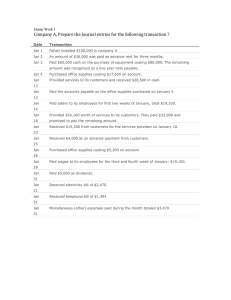

Chapter 3 Group Work For the following identified Accounts: 1) determine the Account Type [A, L, OE, R, or E] ; and 2) determine the Normal Balance – DR or CR [Which side of an entry INCREASES the balance of the account?] Account Type Normal Balance + Cash ______A______ _______DR______ Accounts Payable ______L______ _______CR______ Inventory ______A______ _______DR______ Retained Earnings ______OE_____ _______CR______ Rent Expense ______E______ _______DR______ Accounts Receivable ______A______ _______DR______ Capital Stock [also called Contributed Capital] ______OE_____ _______CR______ Notes Payable ______L______ _______CR______ Sales Revenue ______R______ _______CR______ Utilities Expense ______E______ _______DR______ Problem 3-3 On a separate sheet of paper, prepare a journal entry in a General Journal to record effects of each of the following transactions. March 2: Received contributions of $20,000 from each of the two principal owners of the new business in exchange for shares of stock. March 7: Signed a two-year promissory note at the bank and received cash of $15,000. Interest, along with the $15,000, will be repaid at the end of the two years. March 12: supplies. Purchased $700 in miscellaneous supplies on account. The company has 30 days to pay for the [Turn this sheet over and complete transactions for March 19-31] March 19: Billed a client $4,000 for services rendered by Expert in helping to install a new computer system. The client is to pay 25% of the bill upon its receipt and the remaining balance within 30 days. March 20: Paid $1,300 bill from the local newspaper for advertising for the month of March. March 22: Received 25% of the amount billed the client on March 19. March 26: computer. Received cash of $2,800 for services provided in assisting a client in selecting software for its March 29: Purchased a computer system for $8,000 in cash. March 30: Paid $3,300 of salaries and wages for March. March 31: Received and paid $1,400 in gas, electric, and water bills. Solution Solution to Problem 3-3 Date March 2 March 7 March 12 March 19 March 20 March 22 Description Dr Cash (A) Contributed Capital (OE) 20,000 Cash (A) Note Payable (L) 15,000 Supplies (A) Accounts Payable (L) Cr 20,000 15,000 700 700 Accounts Receivable (A) Sales Revenue (Rev) 4,000 Advertising Expense (E) Cash (A) 1,300 Cash (A) Accounts Receivable (A) 1,000 4,000 1,300 1,000 March 26 March 29 March 30 March 31 Cash (A) Sales Revenue (Rev) 2,800 Computer System (A) Cash (A) 8,000 Wages Expense (E) Cash (A) 3,300 Utilities Expense (E) Cash (A) 1,400 2,800 8,000 3,300 1,400