Financial Accounting Examination

advertisement

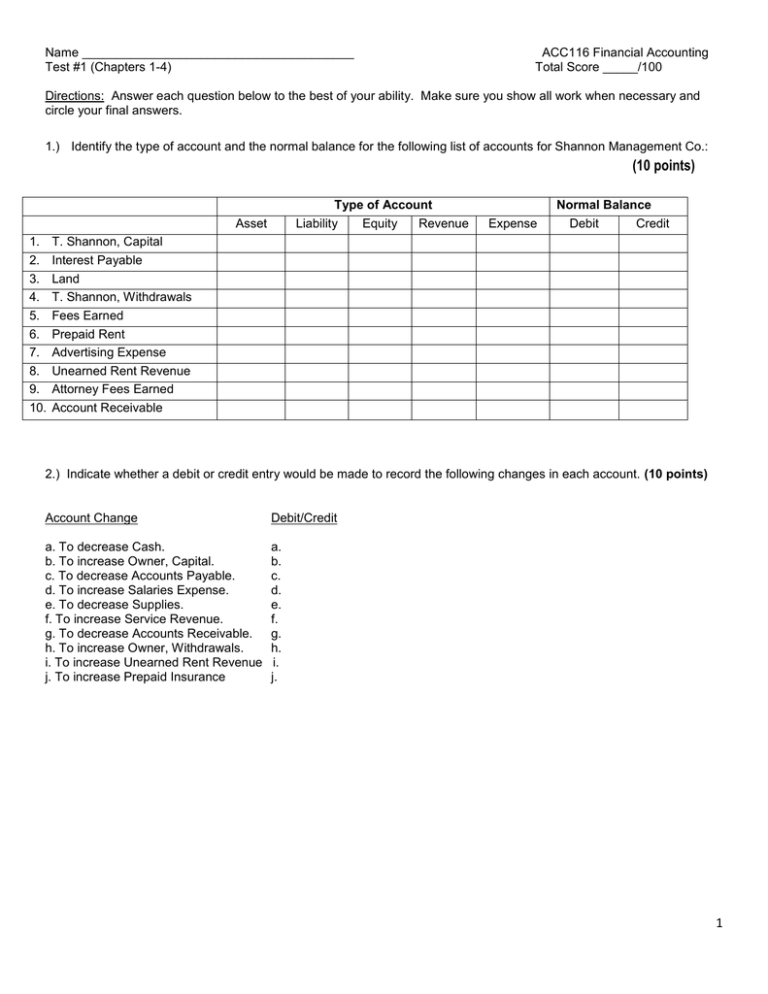

Name _______________________________________ Test #1 (Chapters 1-4) ACC116 Financial Accounting Total Score _____/100 Directions: Answer each question below to the best of your ability. Make sure you show all work when necessary and circle your final answers. 1.) Identify the type of account and the normal balance for the following list of accounts for Shannon Management Co.: (10 points) Type of Account Liability Equity Revenue Asset 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Expense Normal Balance Debit Credit T. Shannon, Capital Interest Payable Land T. Shannon, Withdrawals Fees Earned Prepaid Rent Advertising Expense Unearned Rent Revenue Attorney Fees Earned Account Receivable 2.) Indicate whether a debit or credit entry would be made to record the following changes in each account. (10 points) Account Change Debit/Credit a. To decrease Cash. b. To increase Owner, Capital. c. To decrease Accounts Payable. d. To increase Salaries Expense. e. To decrease Supplies. f. To increase Service Revenue. g. To decrease Accounts Receivable. h. To increase Owner, Withdrawals. i. To increase Unearned Rent Revenue j. To increase Prepaid Insurance a. b. c. d. e. f. g. h. i. j. 1 3) Atlas, Inc. has the following assets, liabilities, revenues and expenses for the current year. The accounts are listed below in alphabetical order. The company has a December 31, 2013 year end. (30 points) Accounts receivable Accounts payable Building Cash Commission expense Common stock Interest payable Land $28,000 37,000 45,000 80,000 20,500 22,000 1,500 40,000 Office equipment Office supplies Service revenue Supplies expense Utilities expense Wage expense $59,500 5,000 130,000 8,000 8,500 11,500 Beginning balance of retained earnings was $120,000 and dividends were $5,000 for the year. Required: Prepare the income statement, statement of retained earnings, and balance sheet for Atlas, Inc. for the current year. 2 4) Missy's Exotic Vacations, Inc., had the following transactions during its first month of operations: (30 points) June 1 The company received cash of $35,000 and a building valued at $60,000. The corporation issued common stock to the shareholders. 2 Borrowed $20,000 from the bank and signed a note payable. 8 Purchased equipment on account for $6,000. 9 Received cash of $2,000 for services. 10 Performed services for a client on account, $8,500. 12 Paid office salaries of $2,000. 15 Paid for the equipment purchased June 8 on account. 22 Purchased office supplies and paid cash of $700. 30 Paid auto expense of $400. 30 Paid the monthly rent of $2,200. REQUIRED: 1. Journalize the entries showing date, debit, credit, and amount using the required general journal entry format. You do not have to include the explanations 2. Post the entries to their t-accounts. Use the following accounts: Cash (101), Accounts Receivable (110), Supplies (120), Building (161), Equipment (162), Accounts Payable (201), Note Payable (202), Common Stock (300), Service Revenue (401), Salaries Expense (501), Auto Expense (502), Rent Expense (503). 3. Prepare an unadjusted trial balance for the month of June showing debit/credit balance, account, account number, and trial balance totals. 3 5) Frost Company faced the following situations. Journalize the adjusting entry needed at December 31, 2013 for each independent situation. Include date, debit, credit, amount, and explanation. (20 points) a. The business has interest expense of $7,000 that it must pay early in January 2013. b. Interest revenue of $3,000 has been earned buy not yet received. c. On July 1, when the business collected $19,300 rent in advance, it debited Cash and credited Unearned Rent Revenue. The tenant was paying for two years rent. d. Salary expense is $1,000 per day (Monday through Friday) and the business pays its employees every Friday. This year, December 31st falls on a Wednesday. e. The unadjusted balance in the Supplies account is $2,900. The total cost of the supplies on hand is $1,400. f. Equipment was purchased at the beginning of this year at a cost of $140,000. The equipment’s useful life is ten years with a residual value of $10,000. Record depreciation for this year. Extra Credit: (10 points) Directions: Journalize the adjusting entries needed on December 31, the end of the current accounting period for Petra Industries using the following data. Include debit, credit, amount, and explanation. A. The balance in Office Supplies before adjustment is $4,200. A physical count reveals $2,750 of supplies on hand at December 31. B. A computer was purchased on January 1 for $12,000. The computer has a useful life of 3 years and is depreciated using the straight-line method. C. A one-year insurance policy costing $5,400 was purchased on November 1. D. Employee salaries are owed for 4 days of a regular 5 day work week. Weekly payroll is $13,600. E. Unearned Maintenance Revenue has a balance of $21,000 before adjustment. Records show that $14,050 of that amount has been earned by December 31. 4