File - BAF3M Fundamentals of Accounting

advertisement

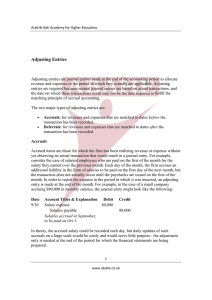

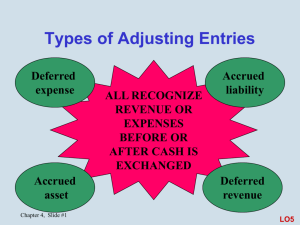

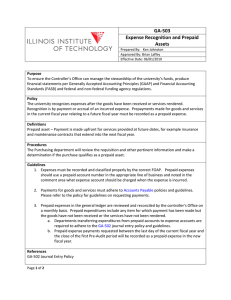

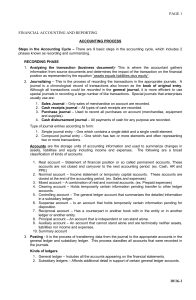

Completing the accounting cycle • Financial statements are the main product of an accounting system. • We move from our: – – – – opening balance sheet through transactions (in our general journal) posting their amounts to our ledger and using those amounts to prepare a trial balance, income statement, and final balance sheet. The Adjustment Process • It is important for financial statements to be up to date, so they can be comparable from year to year. • Bringing accounts up to date is also called ‘making the adjustments.’ Adjusting Entries • The journal entries needed to bring accounts up to date are called ‘Adjusting Entries.’ • It is necessary to make these adjustments so the correct net income or loss can be determined. Adjusting for Supplies • The ‘Supplies’ account is allowed to become inaccurate from day to day (as supplies are used up). • When supplies are purchased, their cost is debited directly to the Supplies account. Supplies Cash 200 200 Journal Entry • The journal entry would have been: Supplies 200 Bank 200 Purchased supplies for cash • As supplies are used (usually daily) no accounting entry is made. • Thus, when we get to the end of our fiscal period, we must make an ‘adjustment’ to the supplies account. • How do we figure out how much we’ve used? – We do a physical count: Let’s say there’s $125 worth of supplies left. (so we must have used $75) We make the adjustment by…. • deducting the amount from the supplies account (CR) and turning it into an expense (DR) Supplies Expense 75 Supplies Adjusting entry for supplies 75 Adjustment 2: Prepaid Expenses • Let’s say, on July 1, we paid an entire year’s worth of rent. ($12,000) We would not want to make an expense of the whole thing, because we technically haven’t used it yet. (But we need to keep track of the $12,000) ‘Prepaid Rent’ Prepaid Rent Bank $12,000 $12,000 Adjusting entry… • At the end of each month we would make an adjusting entry: Rent Expense Prepaid Rent $1000 $1000 reduces this account • This way, we would be expensing our rent each month, and decreasing the amount in the ‘prepaid rent’ account! Prepaid expenses • Prepaid expenses might also be in the form of insurance: • Let’s say we bought an insurance policy for $600 on August 1, 2012. • If we only made an adjustment at yearend, what would the journal entries be on August 1 and Dec 31? Aug 1 Prepaid Insurance Bank $600 Dec 31 Insurance Expense $250 Prepaid Insurance Why? $600 / 12 months = $50 / month (August – Dec = 5 months) $600 $250 Homework • Page 308 – Exercise 1 (Do the adjusting entries for each on a separate piece of journal paper.) – Exercise 3 – Exercise 5