Parity conditions in International Finance

advertisement

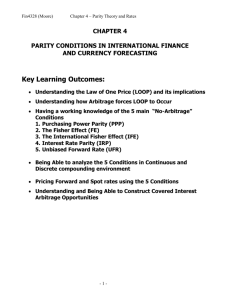

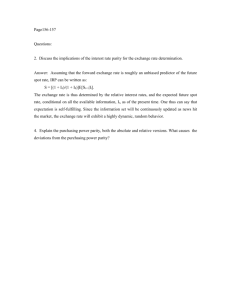

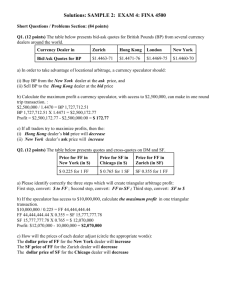

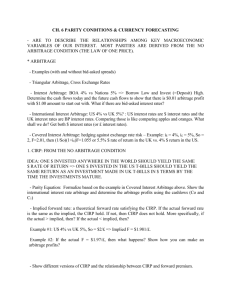

Parity conditions in International Finance A summary Predicting Exchange Rates International Parity Approach: use arbitrage arguments. Fundamental Approach: use macro models Technical Approach: use time series Objective Learn how to predict foreign exchange rates using arbitrage arguments Outline • On arbitrage and speculation • Purchasing Power Parity (PPP) • The International Fisher Effect (IFE) • Interest Rate Parity (IRP) Arbitrage ENCYCLOPÆDIA BRITANNICA Business operation involving the purchase of foreign exchange, gold, financial securities, or commodities in one market and their almost simultaneous sale in another market, in order to profit from price differentials existing between the markets. Arbitrage generally tends to eliminate price differentials between markets. Mind the distinction Arbitrage: attempt at exploiting short-term market inconsistencies in order to extract risk-free profits Speculation: betting that the market will go up or down in the short-term. Speculators take on tremendous risks. Whenever there is high risk involved, arbitrage becomes speculation Arbitrage in the foreign exchange market Uncovered (Speculation) Covered (True arbitrage) Example of uncovered arbitrage i(us) = 5% i(uk) = 8% s = $1.5 • • • • Borrow in $ at 5% Buy pounds and lend at 8% At maturity exchange back pounds for $ Hope that you’ll have enough to repay the loan and make an arbitrage profit Example of covered arbitrage i(us) = 5% i(uk) = 8% s = $1.5 f = $1.48 • • • Borrow in $ at 5% Buy pounds and lend at 8% At maturity exchange back pounds for $ • Repay the loan and make an arbitrage profit Purchasing Power Parity Absolute PPP Goods and services should cost the same regardless of the country Relative PPP The exchange rate is expected to adjust in order to reflect expected relative differences in purchasing power. PPP: Background The basis for PPP is the "law of one price". Competitive markets will equalize the price of an identical good in two countries (expressed in the same currency). Exemplification A particular DVD player sells for: C$ 700 in Sherbrooke US$ 500 in Burlington Exchange rate: US$ 1.50/C$. Consequences Consumers in Burlington would prefer buying it in Sherbrooke. Result: The DVD player price in Sherbrooke should increase to C$750 Caveats (1) Transportation costs, barriers to trade, and other can make a difference. (2) There must be competitive markets for the goods and services in question in both countries. (3) The law of one price only applies to tradable goods. PPP: Implications When a country's domestic price level is increasing (inflation), the exchange rate must depreciated in order to return to PPP. Relative PPP: Calculation E(st)/s0 = (1+inflationh)t/(1+inflationf)t when t=1 E(s1)/s0 = (1+inflationh)/(1+inflationf) The Big Mac Index Food for thought Jan 7th 1999 From The Economist print edition For more than a decade, The Economist’s Big Mac index has offered a light-hearted guide to whether currencies are at their “correct” level. It is based on the theory of purchasing-power parity (PPP)—the notion that a basket of goods and services should cost the same in all countries. Thus if the price of a Big Mac is lower in one country than in America, this suggests that its currency is undervalued relative to the dollar and vice versa. The price of a Big Mac varies in the euro area, from euro3.36 in Finland to a bargain euro2.19 in Portugal. The weighted average price in the 11 countries is euro2.53, or $2.98 at current exchange rates. In America a Big Mac costs only $2.63 (taking the average of three cities). So the Euro is 13% overvalued against the dollar. Big MacCurrencies Apr 27th 2000 From The Economist print edition Some people read tea leaves to predict the future. We prefer hamburgers Some readers beef that our Big Mac index does not cut the mustard. They are right that hamburgers are a flawed measure of PPP, because local prices may be distorted by trade barriers on beef, sales taxes or big differences in the cost of nontraded inputs such as rents. Thus, whereas Big Mac PPPs can be a handy guide to the cost of living in countries, they may not be a reliable guide to future exchangerate movements. Yet, curiously, several academic studies have concluded that the Big Mac index is surprisingly accurate in tracking exchange rates over the longer term. Indeed, the Big Mac has had several forecasting successes. When the euro was launched at the start of 1999, most forecasters predicted that it would rise. But the euro has instead tumbled—exactly as the Big Mac index had signaled. At the start of 1999, euro burgers were much dearer than American ones. Burgernomics is far from perfect, but our mouths are where our money is. The Fisher Effect The Simple Fisher Effect The International Fisher Effect The Fisher Effect Simple Fisher Effect: Nominal interest rates equal real interest rates plus inflation premium: (1+ni) = (1+ ri)(1+inflation) ni = ri + inflation + (ri)(inflation), When (ri)(inflation) is a very small number: ni = ri + inflation International Fisher Effect (IFE) The exchange is expected to change in order to reflect expected relative differences in nominal interest rates. IFE assumes differences in nominal interest rates are driven by expected relative differences in inflation. E(st)/s0 = (1+nih)t/(1+nif)t E(s1)/s0 = (1+nih)/(1+nif), when t=1 Interest Rate Parity (IRP) The forward exchange rate reflects expected relative differences in nominal interest rates. IRP also assumes differences in nominal interest rates are driven by expected relative differences in inflation. ft/s0 = (1+nih)t/(1+nif)t f1/s0 = (1+nih)/(1+nif), when t=1 What is the relationship between forward and future expected exchange rates? Some believe f = E(s) Some believe f = E(s) + risk premium Summary The Law of One Price - the arbitrage argument - says that goods and services should be worth the same when compared across borders An increase in inflation and the resulting increase in the nominal interest rate should cause the domestic currency to depreciate. And vice-versa.