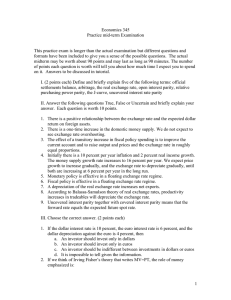

Exam 2

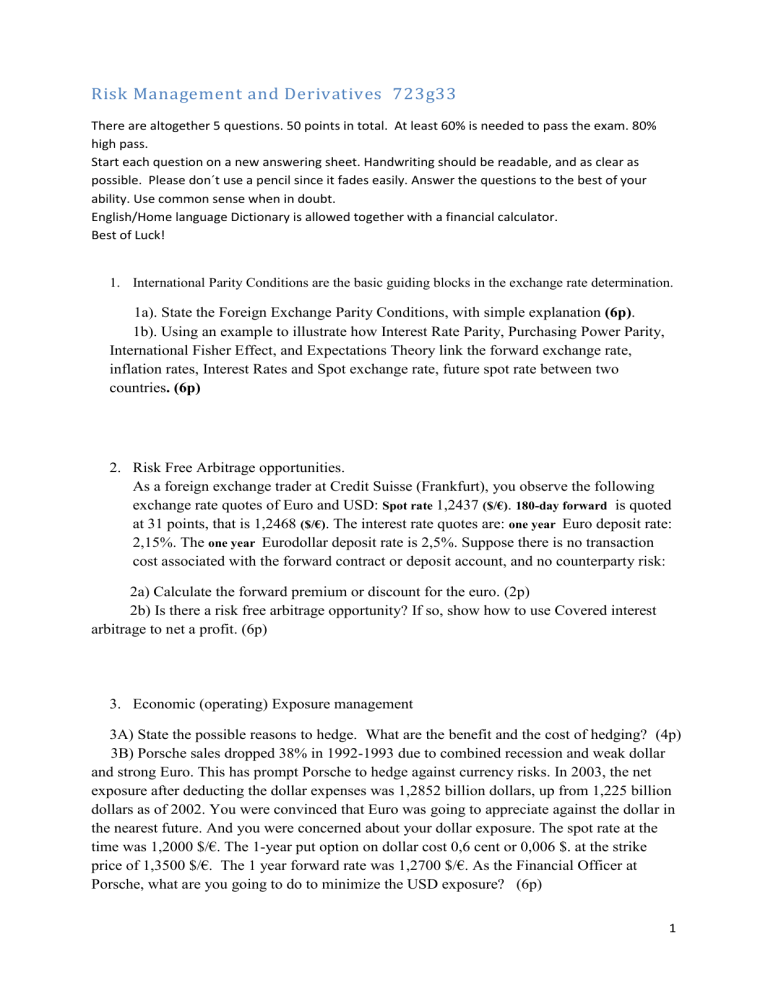

Risk Management and Derivatives 723g33

There are altogether 5 questions. 50 points in total. At least 60% is needed to pass the exam. 80% high pass.

Start each question on a new answering sheet. Handwriting should be readable, and as clear as possible. Please don´t use a pencil since it fades easily. Answer the questions to the best of your ability. Use common sense when in doubt.

English/Home language Dictionary is allowed together with a financial calculator.

Best of Luck!

1.

International Parity Conditions are the basic guiding blocks in the exchange rate determination.

1a). State the Foreign Exchange Parity Conditions, with simple explanation (6p) .

1b). Using an example to illustrate how Interest Rate Parity, Purchasing Power Parity,

International Fisher Effect, and Expectations Theory link the forward exchange rate, inflation rates, Interest Rates and Spot exchange rate, future spot rate between two countries . (6p)

2.

Risk Free Arbitrage opportunities.

As a foreign exchange trader at Credit Suisse (Frankfurt), you observe the following exchange rate quotes of Euro and USD: Spot rate 1,2437 ($/€) . 180-day forward is quoted at 31 points, that is 1,2468 ($/€) . The interest rate quotes are: one year Euro deposit rate:

2,15%. The one year Eurodollar deposit rate is 2,5%. Suppose there is no transaction cost associated with the forward contract or deposit account, and no counterparty risk:

2a) Calculate the forward premium or discount for the euro. (2p)

2b) Is there a risk free arbitrage opportunity? If so, show how to use Covered interest arbitrage to net a profit. (6p)

3.

Economic (operating) Exposure management

3A) State the possible reasons to hedge. What are the benefit and the cost of hedging? (4p)

3B) Porsche sales dropped 38% in 1992-1993 due to combined recession and weak dollar and strong Euro. This has prompt Porsche to hedge against currency risks. In 2003, the net exposure after deducting the dollar expenses was 1,2852 billion dollars, up from 1,225 billion dollars as of 2002. You were convinced that Euro was going to appreciate against the dollar in the nearest future. And you were concerned about your dollar exposure. The spot rate at the time was 1,2000 $/€. The 1-year put option on dollar cost 0,6 cent or 0,006 $. at the strike price of 1,3500 $/€. The 1 year forward rate was 1,2700 $/€. As the Financial Officer at

Porsche, what are you going to do to minimize the USD exposure? (6p)

1

4.

The cost of capital is of importance for international corporations.

4,1) How to calculate the Weighted Average Cost of Capital? (2p)

4,2) Given risk-free rate r f

=4%, market risk return r m

=10 %, β=1,2, calculate the required rate of return on equity, r e.

(2p)

4,3) MNEs enjoy lower cost of capital comparing to local firms due to their unique relationship to international investors and their ability to avoid segmented capital market. State some of the other advantages that MNEs enjoy over the local firms (6p)

5.

Write a short essay (1-2 pages) on the solutions of the Euro-crisis. (10p)

It is official that the Euro-area is having a second dip, that is, recession is unavoidable.

Euro itself might breakup due to the unsustainable debt burden, since there is no plan to have a fiscal union. As it was designed, the ECB cannot fund the budget deficit of the member country. However, the ECB injected 3 trillion € at 1% interest rate to the banking system (Long Term Financing Operations) with 3 years maturity, which has eased the last round crisis but the problem is still here, nothing has changed fundamentally except perhaps avoided a potential bank run. There is a consensus that there will be high inflation and unemployment for years to come after the breakup of the euro. What is your opinion on this issue and what is your strategic solution to the crisis?

2