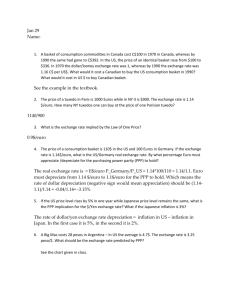

Exchange Rates and Price Levels

advertisement

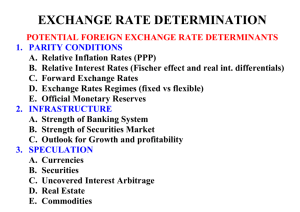

FIN 40500: International Finance Purchasing Power Parity The relationship between exchange rates and prices starts with a very basic idea – ANY PRODUCT SHOULD COST THE SAME EVERYWHERE. Suppose that a BMW sells for $40,000 in the United States and E 30,000 in Germany. The current exchange rate is $1.25 per Euro. 1 Borrow $37,500 and convert it to Euros at $1.25/Euro. 2 Buy a BMW in Germany for E30,000 and ship it back to the US. 3 Sell the car in the US for $40,000 $37,500 = E 30,000 $1.25 P eP* ($40,000 $37,500) $2,500 A 6.7% return The act of arbitrage should eliminate the profit opportunity Suppose that a BMW sells for $40,000 in the United States and E 30,000 in Germany. The current exchange rate is $1.25 per Euro. 1 Increased demand for Euros should increase the price of a Euro. P eP* 3 2 Increased demand for BMWs in Germany should increase the German price . Increased supply in US should drive down US price The Law of One Price (LOOP) states that, given a domestic and foreign price, there is only one arbitrage free exchange rate As in the previous example, if the Euro is undervalued relative to LOOP, buy in Europe and sell in the US P eP* The arbitrage free exchange rate is given by the ratio of prices $40, 000 = $1.33 per Euro E30,000 Domestic Price P e * P if the Euro is overvalued relative to LOOP, buy in US and sell in Europe eP* P Foreign Price Purchasing Power Parity (PPP) refers to the same concept as the Law of One Price, with specific prices replaced by general price indices PPP Exchange Rate e= USA CPI = 199.8 (March 2006) = CPI (USA) CPI (UK) 199.8 195.0 England = $1.025/L CPI = 195.0 (March 2006) Currently, the British Pound is trading at $1.786 $1.786 – $1.025 $1.205 X 100 = 74% Is the British pound really overvalued by 74%? One problem with this method had to do with how the CPI (in both the US and Britain) are calculated: Suppose that we have two goods: BMWs and Computers 2006 1992 PBMW $40,000 PBMW $30,000 PC $3,000 PC $2,250 A price index is defined as a weighted average of individual good’s prices CPI .5PBMW .5PC CPI .5$40,000 .5P$3,000 $21,500 2006 1992 CPI .5$30,000 .5$2,250 $16,125 The prices are then normalized by a ‘base year’ CPI1992 100 $21,500 CPI 2006 100 133.3 $16,125 We can correct for this by looking at PPP in relative terms %e USA Inflation = 3.4% (12 months) * 3.4 2.4 1% The dollar should depreciate by 1% against the pound England Inflation = 2.4% (12 months) 12 months ago, the British pound was trading at $1.904 $1.904 ( 1.01) = $1.923 $1.786 – $1.923 $1.923 X 100 = -7.1% Now, it looks like the British pound is undervalued Its easy to calculate currency values with the PPP method. Just compare inflation differentials with actual currency price changes! What’s a better currency predictor, Coffee or Burgers? The right answer is “neither!” Overall, it turns out that inflation differentials alone provide a relatively poor forecast of the exchange rate Country Exchange Inflation PPP implied Actual Rate Differential exchange rate Exchange (12/2003) (US-Foreign) Rate (12/2004) JPY/USD .00928 3.5% .00960 .00963 EUR/USD 1.23 -.5% 1.224 1.34 GBP/USD 1.75 1.5% 1.776 1.93 CAD/USD .761 -.5% .757 .820 CHF/USD .791 1% .799 .872 AUD/USD .740 .5% .7437 .768 The exception would be countries with notoriously high inflation rates – Zimbabwe has a 585% annual inflation rate (2006). From 1998 to 2006, the Zimbabwe dollar fell from 24 per US dollar to 96,000!!! Alternatively, we could estimate a forecasting equation using inflation differentials %et t Percentage change is exchange rate (dollars per foreign currency) – an increase is a depreciation * t Parameters to be estimated – PPP implies that alpha is zero and beta is one Typically, estimated values for beta are close to zero and statistically insignificant The real exchange rate is the price level adjusted exchange rate. Its meant to capture the relative value of goods and services across countries P* RER e P Foreign CPI Nominal Exchange Rate Domestic CPI By definition, the PPP explanation of exchange rates assumes that the real exchange rate is constant (and equal to one) Empirically, real exchange rates are clearly not constant. In fact, the correlation between real and nominal exchange rates is nearly one. This casts some serious doubt on PPP. 300 250 200 150 100 50 Jan-85 Jan-89 Jan-93 Yen/$ Real Jan-97 In reality, there are costs that will inhibit arbitrage of goods between countries. Let’s take another look at our BMW example. P $40,000 P* E 30,000 Let’s assume that it costs $5,000 to ship a BMW from Germany to the US (12.5% of the purchase price) For arbitrage to occur, it must be profitable P eP $5,000 0 * Buy in Germany, Sell in the US Insert the appropriate prices and solve for the exchange rate 40,000 e30,000 $5,000 0 e $1.17 In reality, there are costs that will inhibit arbitrage of goods between countries. Let’s take another look at our BMW example. P $40,000 P* E 30,000 Let’s assume that it costs $5,000 to ship a BMW from Germany to the US (12.5% of the purchase price) We also have to consider the alternative strategy eP P $5,000 0 * Buy US, Sell in Germany Insert the appropriate prices and solve for the exchange rate e30,000 40,000 $5,000 0 e $1.50 In reality, there are costs that will inhibit arbitrage of goods between countries. Let’s take another look at our BMW example. P $40,000 P* E 30,000 Let’s assume that it costs $5,000 to ship a BMW from Germany to the US (12.5% of the purchase price) The shipping cost provides a range within which arbitrage can’t occur e Buy in US, Sell in Germany $1.50 No Arbitrage Possible $1.17 This range represents a 24% change in the value of the dollar !! Buy in Germany, Sell in US Time A 24% band encompasses much of the EUR/USD movement! Suppose that there are two goods in each country; haircuts and beer. Note that haircuts are a nontraded good. Price indices in Europe and the US are defined equally (50% Beer, 50% Haircut) Europe United States PB* E10 P $12 PH* E 20 P $24 P* .5(E10 ) .5(E 20 ) E15 P .5( $12 ) .5( $24 ) $18 At an exchange rate of $1.20 per Euro, LOOP holds for each individual good and PPP holds for the index – the real exchange rate equals 1 PB PH * $1.20 * PB PH eP* 15 RER 1.20 1 P 18 Now, suppose that the price of a haircut rises in Europe to E30 – because a haircut is not traded, there is no need for the exchange rate to adjust Europe United States PB* E10 P $12 PH* E 30 P $24 P * .5(E10 ) .5(E 30 ) E 20 P .5( $12 ) .5( $24 ) $18 The 25% inflation should cause a 25% depreciation of the Euro (i.e. a fall in the EUR/USD to $.90, but this doesn’t happen. eP* 20 RER 1.20 1.33 P 18 Instead, the Euro appreciates in real terms by 33%!! The previous example represented an increase in the relative price of a non-traded good. This causes a real appreciation of a country’s currency US CPI Personal Care 4% Tobacco & Smoking Products 1% Food & Beverage 16% Education & Communication 5% Housing 40% Recreation 6% Medical 6% When you consider that over 50% of the US CPI is non-traded, these relative price changes are important!! Transportation 17% Apparel 5% Now, suppose that the two goods are beer and peanuts – assume that more beer is consumed in Europe than in the US Europe United States PB* E10 P $12 Pp* E 5 P $6 P* .80(E10 ) .20(E 5 ) E 9 P .20( $12 ) .80( $6 ) $7.2 At an exchange rate of $1.20 per Euro, LOOP holds for each individual good, but PPP does not hold! PB Pp * $1.20 * PB Pp eP* 9 RER 1.20 1.50 P 7.20 Now, suppose that the price of beer in increases by 50% worldwide Europe United States PB* E15 P $18 Pp* E 5 P $6 P* .80(E15 ) .20(E 5 ) E13 P .20( $18 ) .80( $6 ) $8.40 Europe experiences a 36% inflation rate while the US experiences a 15% inflation rate. The nominal exchange rate is constant, LOOP still holds for each individual good but the Euro experiences a real appreciation PB Pp * $1.20 * PB Pp eP* 13 RER 1.20 1.85 P 8.40 Given the importance of relative prices (real exchange rate movements), we can use a modified version of PPP. % Change in Nominal Exchange Rate = % Change in Real Exchange Rate Inflation + Differential Relative Price Movements The two major relative price movements are: Relative price of non-traded goods (causes a real currency appreciation) Terms of Trade (relative price of imports) – an increase in the relative price of imports (worsening of the terms of trade) causes a real depreciation The competing alternative explanation deals with differing adjustment speeds across different markets. P* RER e P Exchange rates are determined in asset markets – new information is incorporated rapidly into prices Prices are determined in commodity markets – new information is incorporated slowly into prices. Therefore any nominal movement will be reflected in the real exchange rate until commodity prices can “catch up” How can we tell the difference between “sticky prices” and relative price movements? RER If the “sticky price” story is correct, then the real exchange rate should be mean stationary 1 RER Time 1 Time If the “relative price” story is correct, then the real exchange rate will not be mean stationary – i.e. real exchange rates are unpredictable!