Solutions

advertisement

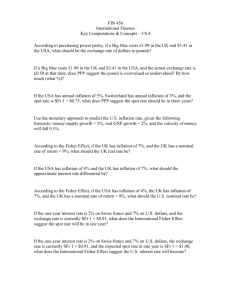

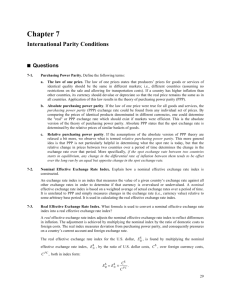

Solutions: SAMPLE 2: EXAM 4: FINA 4500 Short Questions / Problems Section: (84 points) Q1. (12 points) The table below presents bid-ask quotes for British Pounds (BP) from several currency dealers around the world. Currency Dealer in Zurich Hong Kong London New York Bid/Ask Quotes for BP $1.4463-71 $1.4471-76 $1.4469-75 $1.4460-70 a) In order to take advantage of locational arbitrage, a currency speculator should: (i) Buy BP from the New York dealer at the ask price, and (ii) Sell BP to the Hong Kong dealer at the bid price b) Calculate the maximum profit a currency speculator, with access to $2,500,000, can make in one round trip transaction. : $2,500,000 / 1.4470 = BP 1,727,712.51 BP 1,727,712.51 X 1.4471 = $2,500,172.77 Profit = $2,500,172.77 - $2,500,000.00 = $ 172.77 c) If all traders try to maximize profits, then the: (i) Hong Kong dealer’s bid price will decrease (ii) New York dealer’s ask price will increase Q2. (12 points) The table below presents quotes and cross-quotes on DM and SF. Price for FF in New York (in $) Price for SF in Chicago (in $) Price for FF in Zurich (in SF) $ 0.225 for 1 FF $ 0.765 for 1 SF SF 0.355 for 1 FF a) Please identify correctly the three steps which will create triangular arbitrage profit: First step, convert: $ to FF ; Second step, convert: FF to SF ; Third step, convert: SF to $ b) If the speculator has access to $10,000,000, calculate the maximum profit in one triangular transaction. $10,000,000 / 0.225 = FF 44,444,444.44 FF 44,444,444.44 X 0.355 = SF 15,777,777.78 SF 15,777,777.78 X 0.765 = $ 12,070,000 Profit: $12,070,000 - 10,000,000 = $2,070,000 c) How will the prices of each dealer adjust (circle the appropriate words): The dollar price of FF for the New York dealer will increase The SF price of FF for the Zurich dealer will decrease The dollar price of SF for the Chicago dealer will decrease Q3. (20 points) Please use the exact, not the approximate formula to answer all questions in this section. Suppose you have a credit line of $10,000,000 in the US and CD 12,500,000 in Canada, and that you can borrow and lend at the prevailing rates of interest in these two countries. Current spot rate of CD = $0.800; Expected spot rate for CD, one year from now = $0.830; Interest rate in the U.S. = 7.0% ; Interest rate in the Canada = 5.00% a) Calculate the covered rate of return, if the 1-year current forward rate for CD is $0.820 FP = 0.025; Rc = (1.025)*(1.05) - 1 = 7.625% b) If the current 1-year forward rate for CD is $0.820 and you wanted to set up a covered interest rate arbitrage, you would: borrow in: US ; invest in: Canada c) Based on the previous question, calculate your covered interest arbitrage profit (after paying off the loan) in dollars. (0.07625 - 0.07) * 10,000,000 = $62,500 d) Based on the previous question, which of the following forces should result from covered interest arbitrage? Downward pressure on the CD’s forward rate. Upward pressure on the U.S. interest rate. Downward pressure on the Canadian interest rate. e) Calculate the covered rate of return, if the 1-year current forward rate for CD is $0.812 FP = 0.015 ; Rc = (1.015) * (1.05) - 1 = 6.575% f) If the current 1-year forward rate for CD is $0.812 and you wanted to set up a covered interest rate arbitrage, you would: borrow in: Canada ; invest in: US g) Based on the previous question, which of the following forces should result from covered interest arbitrage? Downward pressure on the CD’s spot rate. Downward pressure on the U.S. interest rate. Upward pressure on the Canadian interest rate. h) What should be the current forward premium for CD according to Interest Rate Parity? (1.07 / 1.05) - 1 = 1.904% Q4. (16 points) Please use the exact, not the approximate formula to answer all questions in this section. Suppose the annual inflation rate in the US is expected to be 3.5 %, while it is expected to be 8.00 % in Australia. The current spot rate (on 11/20/02) for the Australian Dollar (AD) is $0.7552 a) According to Purchasing Power Parity, estimate the expected percentage change in the value of the AD during a one-year period: (1.035 / 1.08) - 1 = -4.167% b) According to Purchasing Power Parity, estimate expected value of the AD on 11/20/03. 0.7552 ( 1 - 0.04167) = $ 0.7237 c) Suppose the value of the AD is $0.7357 on 11/20/03, which country (US or Australia) has experienced gain in real purchasing power? Australia d) Suppose the value of the AD is $0.87 on 11/20/03: The net cash flow of a US exporter to Australia will: increase e) If the real rate of interest is expected to be 2%, use the Fisher model to calculate the nominal rate of interest in Australia based on the country’s inflation rates. (1.02) * (1.08) - 1 = 10.16% Q5. (16 points) Please use the exact, not the approximate formula to answer all questions in this section. Current spot rate of SF = $0.6543; Expected spot rate of SF, one year from now = $0.6925; Current 1-year forward rate for SF = $0.6808; 1-year interest rate in the U.S. = 7.5% ; 1-year interest rate in the Switzerland = 3.5% a) Calculate the covered rate of return: FP = 0.045; Rc = (1.045)*(1.035) - 1 = 7.692% b) Calculate the uncovered rate of return from the US point of view: % change in SR = 5.838% Ru = (1.05838)*(1.035) - 1 = 9.543% c) If you could borrow and invest at the prevailing rates of interest in both countries, then you should: Borrow in US dollars and invest in SF d) Based on the prevailing rates of interest and FX market prices in both countries, the IFE suggests that there will be an i. upward pressure on the current spot rate for SF ii. downward pressure on the spot rate for SF, one year latter e) Based on IFE, calculate the expected spot price of SF one year from now. (1.075 / 1.035) - 1 = 3.865% SR1 = 0.6543 (1.03865) = $ 0.6796 Q6. (8 Points) Please fill in the blanks with letter (a, b, c, etc.,) associated with the most appropriate phrases from the phrases listed below: 1. According to the International Fisher Effect, the difference between the domestic and foreign interest rates has an effect on the percentage difference between the current spot exchange rate and future spot exchange rate 2. According to the Purchasing Power Parity Theory, the difference between the domestic and foreign inflation rates has an effect on the percentage difference between the current spot exchange rate and future spot exchange rate 3. According to the Fisher Effect, the sum of the real rate and inflation premium has an effect on the nominal rate of interest 4. According to the Interest Rate Parity Theory, the difference between the domestic and foreign interest rates has an effect on the forward premium or discount Multiple Choice Section: (8 X 2 = 16 points): 1. According to the IFE, if British interest rates exceed U.S. interest rates: the British pound will depreciate against the dollar 2. Assume the nominal US interest rate is 3% and the nominal Swiss rate is 6%. The real rate of interest in both country is 2%. According to the International Fisher Effect, the swiss franc will depreciate by about 3% 3. According to the International Fisher Effect, if Country X has a much lower nominal rate than other countries, its inflation rate will likely be lower than other countries, and it currency will strengthen. 4. Given a home country and foreign country, Purchasing Power Parity (PPP) suggests that: home currency will depreciate if the current home inflation rate exceeds the current foreign inflation rate. 5. In which case will locational arbitrage most likely be feasible? One bank’s bid price for a currency is greater than another bank’s ask price for the currency. 6. Given a home country and a foreign country, purchasing power parity suggests that: a. the inflation rates of both countries will be the same b. the nominal interest rates of both countries will be the same c. both a and b d. none of the above 7. According to the International Fisher Effect, if investors in all countries require the same real rate of return, the differential in nominal interest rate among any two countries: is due to their inflation differential 8. If interest rate parity exists, then, covered interest arbitrage is not feasible.