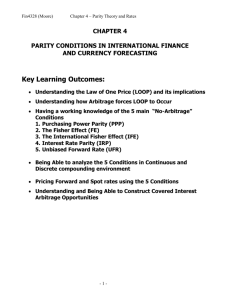

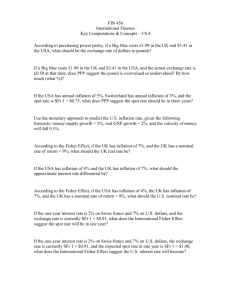

Foreign Exchange Theories: PPP, Fisher Effect, Interest Rate Parity

advertisement

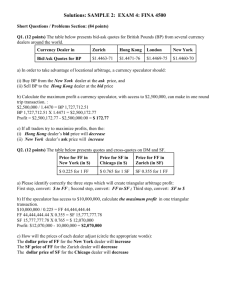

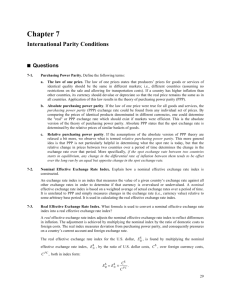

THEORIES OF FOREIGN EXCHANGE International Parity Conditions Exchange Rate Determination What determines equilibrium relationships among exchange rates? International arbitrageur and the "Law of One-price" insure that risk adjusted expected rates of returns are approximately equal across countries. There are five key relationships between: Spot rate Forward rate Inflation rate Interest rate Exchange rate Purchasing Power Parity A unit of domestic currency should purchase the same amount of goods in the home country as it would of identical goods in a foreign country. Absolute form of PPP: “law of one price”: price of similar products to two countries should be equal when measured in a common currency. PPP Example A bottle of wine costs €8 in Paris and $10 in New York. The exchange rate must reflect this price relationship: e0 = Pd/Pf = $10/€8 = $1.25 per € (e0 = $ per FC; direct or American quote) Equivalent to €0.80 per $ in indirect quote, European terms. The strictest version of PPP is not supported empirically, but changes in relative inflation rates are related to changes in exchange rates. Relative form of PPP Acknowledges market imperfections such as: transport costs tariffs and quotas. Rate of change in the prices of products should be similar when measured in a common currency. Relative PPP - Example Example: Suppose the price of wine in Paris increases to € 9 in one year implying an inflation of 12.5%, while in the U.S. the price of wine increases to $10.50 indicating an inflation rate of 5%. The new exchange rate: e1 = Pd,1/Pf,1 = $10.5/€9 = $1.1667 per € or €0.8571 per $ What is the depreciation in the value of €? 1.1667/1.2500 -1 = -6.67% PPP Relative PPP: e1 = OR OR Pd ,1 P f ,1 = Pd ,0 x P f ,0 (1+ d ) (1+ f ) (1+ d ) e1 = e0 x (1+ f ) e1 (1+ d ) = e0 (1+ f ) Approximately: %Δe0 = πd - πf PPP Implication According to PPP, the currency of countries with high inflation rates should devalue relative to countries with low inflations rates. Rationale: if πd > πf, then: domestic imports increase; domestic exports decrease foreign imports decrease; foreign exports increase demand for FC increases; supply decreases demand for LC decreases; supply increases FC appreciates; LC depreciates Relative PPP Example Suppose the U.S. inflation rate is expected to be 3 percent for the coming year, while the Britain's expected rate of inflation is 5 percent. The current exchange rate is $1.50 per £. What should be the £ spot rate in one year? 1.50 × 1.03/1.05 = $1.47 per £ II: Fisher Effect Recall the relationship between nominal and real rates of interest, as expressed in the Fisher theorem: 1 + i = (1 + r*) (1 + π) Or (1+ i) 1+ r* = (1+ ) Approximately: i = r* + π and r* = i - π Generalized Fisher Effect Real rates of interest are equalized across countries through arbitrage. Otherwise funds would flows from countries with low expected real rates of interest to countries with high expected real rates of interests (in the absence of segmented markets) Therefore: r*f = r*d OR if - πf = id - πd Generalized Fisher Effect More precisely: (1+ i d ) (1+ i f ) = (1+ d ) (1+ f ) OR Approximately: (1+ i d ) (1+ d ) = (1+ i f ) (1+ f ) id i f d f III. International Fisher Effect Combines the generalized Fisher effect to show the relationship between nominal interest rates and currency exchange rates. From PPP: e1 (1+ d ) = e0 (1+ f ) From GFE: (1+ i d ) (1+ d ) = (1+ i f ) (1+ f ) Therefore: e1 (1+ i d ) = e0 (1+ i f ) IFE Implications Currencies with low interest rates would appreciate with respect to currencies with high interest rates. A long-run tendency for interest rates differentials to offset exchange rate changes has been demonstrated empirically. Example: Interest rate in U.S. is 4%, while interest rate in Switzerland is 10%. If the current SF spot rate is $0.80, what should be the SF spot rate one year from now? $0.80 × 1.04/1.10 = $0.7564 per SF Or SF depreciates about 5.5% IV. Forward Rates and Expected Future Spot Rates Early studies indicated forward exchange rates to be unbiased predictor of future spot exchange rates. f1 = E[e1] Then the forward rate premium or discount unbiasedly reflects potential gains to be realized from the purchase or sale of forward currencies. This equality captures the relationship between forward and spot rates. Recent work has demonstrated the existence of a slight risk premium. The premium, however, changes signs. Therefore, it is fair to assume that the future spot rates would equal forwards rates. V. Interest Rate Parity Substituting f1 = E[e1] in the IFE equation: e1 (1+ i d ) = e0 (1+ i f ) f1 (1+ id ) = e0 (1+ i f ) Covered interest arbitrage Suppose the interest rates are 4% in the U.S. and 10% in Switzerland. The Swiss Franc spot rate is $0.8000 and 180-day forward rate is $0.7800. Is covered arbitrage possible? Forward discount on SF = (.78 -.80)/0.80 = -2.5% for 180 days or -5% per year. Id = 4% while If + discount = 10% - 5% = 5% Therefore, arbitrage is possible. Covered Arbitrage 1. Borrow $1,000,000 in US @ 4% per year or 2% for half year. Loan plus Interest to be paid in 180 days = $1,020,000 2. Convert $ to SF at the spot rate: $1,000,000/0.80 = SF 1,250,000 3. Invest SF 1,250,000 @ 10% for 180 days: Will receive SF 1,250,000 × (1+10%/2) = SF 1,312,500 in 180 days 4. Sell SF 1,312,500 in forward market @180 forward rate $0.78/SF Will receive 1,312,500 × $0.78/SF = $1,023,750 in 180 days 5. After 180 days receive $1,023,750 from forward contract, and pay-off loan Net profit form arbitrage: $1,023,750 -1,020,000 = $3,750 Prices, Interest Rates and Exchange Rates in Equilibrium Forward rate as an unbiased predictor (E) Forward premium on foreign currency +4% Forecast change in spot exchange rate +4% (yen strengthens) International Fisher Effect (C) (yen strengthens) Interest rate parity (D) Purchasing power parity (A) Forecast difference in rates of inflation -4% (less in Japan) Difference in nominal interest rates -4% (less in Japan) Fisher effect (B)