Chapter 4

advertisement

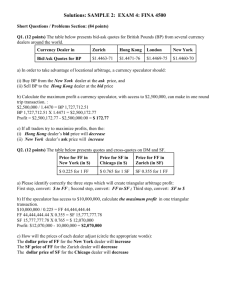

Fin4328 (Moore) Chapter 4 – Parity Theory and Rates CHAPTER 4 PARITY CONDITIONS IN INTERNATIONAL FINANCE AND CURRENCY FORECASTING Key Learning Outcomes: Understanding the Law of One Price (LOOP) and its implications Understanding how Arbitrage forces LOOP to Occur Having a working knowledge of the 5 main “No-Arbitrage” Conditions 1. Purchasing Power Parity (PPP) 2. The Fisher Effect (FE) 3. The International Fisher Effect (IFE) 4. Interest Rate Parity (IRP) 5. Unbiased Forward Rate (UFR) Being Able to analyze the 5 Conditions in Continuous and Discrete compounding environment Pricing Forward and Spot rates using the 5 Conditions Understanding and Being Able to Construct Covered Interest Arbitrage Opportunities -1- Fin4328 (Moore) Chapter 4 – Parity Theory and Rates ARBITRAGE AND THE LAW OF ONE PRICE I. THE LAW OF ONE PRICE A. Law states: Identical goods sell for the same price worldwide. B. Theoretical basis: If the price after exchange-rate adjustment were not equal, arbitrage in the goods worldwide ensures eventually it will. II. Five Parity Conditions Result From Arbitrage Activities (if LOOP) 1. 2. 3. 4. 5. 6. 7. Purchasing Power Parity (PPP) The Fisher Effect (FE) The International Fisher Effect (IFE) Interest Rate Parity (IRP) Unbiased Forward Rate (UFR) Present and Future Value Relations Can State in Discrete or Continuous Compounding A. THE THEORY OF PURCHASING POWER PARITY (PPP) Spot exchange rates between currencies will change to the differential in inflation rates between countries. (Logic) Relative PPP: exchange rate of one currency against another will adjust to reflect changes in the price levels of the two countries Current Spot Rate and Inflation Rates will give best prediction of Future price. -2- Fin4328 (Moore) Chapter 4 – Parity Theory and Rates 1. Discrete time Math Consequences: (formula) F0,t S0 t 1 id 1 i t f a. Note, both Forward and Spot are Direct Quotes PPP Example (discrete time) Projected inflation rates for the United States and Germany for the next five years. U.S. inflation is expected to be 10 percent per year, and German inflation is expected to be 4 percent per year. a. If the current exchange rate is $0.95/€, what should the exchange rates for the next five years be? METHOD According to PPP, the exchange rate for the euro at the end of year t should equal 0.95(1.10/1.04)t. Hence, projected exchange rates for the next 5 years are 1. $1.0048 2. $1.0628 3. $1.1241 4. $1.1889 5. $1.2575. b. Suppose the annual average U.S. inflation over the next five years is 3.2% and Germany averages 1.5%, and the exchange rate in five years is $0.99/€. What has happened to the real value of the euro over this five-year period? (Future to Spot) ANSWER. The real value of the euro at the end of five years is S=F (1 + i f )t t = 0.99 x ( 1.015 5 ) = 0.9111 1.032 (1 + i h ) Hence, even though the euro has appreciated in nominal terms over this five-year period, it has fallen in real terms by 4.09% [(0.9111 - 0.95)/0.95]. -3- Fin4328 (Moore) Chapter 4 – Parity Theory and Rates 2. Continuous time Math Consequences: (formula) F0,t S0 t 1 id 1 i t Discrete f F0,t S0 e d i i f t Continuous Case B. THE FISHER EFFECT (FE and IFE) nominal interest rates (NR) are a function of the real interest rate (RR) and a premium (IR) for inflation expectations. NR = RR + IR IFE: Real Rates of Interest 1. Should tend toward equality everywhere through arbitrage. 2. With no government interference nominal rates vary by Inflation differential or NRD - NRF = IRD - IRF 3. According to the IFE, countries with higher inflation rates have higher interest rates. 4. Due to capital market integration globally, interest rate differentials are eroding. -4- Fin4328 (Moore) Chapter 4 – Parity Theory and Rates 5. Mathematical Consequences of IFE a. Discrete time Case F0,t S0 t 1 NRd 1 NR f t a. Continuous time Case NR NR t F0,t S0 e d f Example (IFE) Three-year deposit rates on Eurodollars and Eurofrancs (Swiss) are 12% and 7%, respectively. If the current spot rate for the Swiss franc is $0.3985, what is the spot rate implied by these interest rates for the franc three years from now (i.e. the 3-year futures)? ANSWER. If rus and rsw are the associated Eurodollar and Eurofranc nominal interest rates, then the international Fisher effect says that 3 1.12 F0,t $0.3895 $0.4570 3 1.07 F0,t $0.3895 e.12 .07 3 $0.4525 C. Parity Conditions Linked by The adjustment of rates and prices to inflation D. Inflation & home currency depreciation are jointly determined by: 1. Jointly determined by the growth of domestic money supply 2. Relative to the growth of domestic money demand. -5-