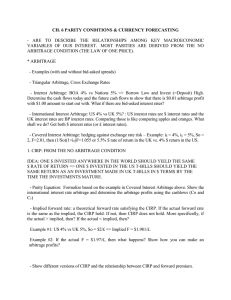

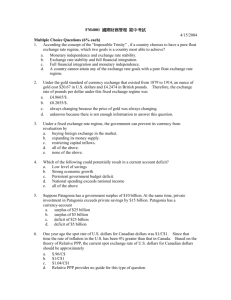

CH. 6 PARITY CONDITIONS & CURRENCY FORECASTING

advertisement

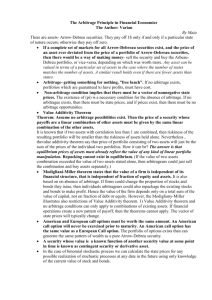

CH. 6 PARITY CONDITIONS & CURRENCY FORECASTING - ARE TO DESCRIBE THE RELATIONSHIPS AMONG KEY MACROECONOMIC VARIABLES OF OUR INTEREST. MOST PARITIES ARE DERIVED FROM THE NO ARBITRAGE CONDITION (THE LAW OF ONE PRICE). * ARBITRAGE - Examples (with and without bid-asked spreads) - Triangular Arbitrage, Cross Exchange Rates - Interest Arbitrage: BOA 4% vs Nations 5% => Borrow Low and Invest (=Deposit) High. Determine the cash flows today and the future cash flows to show that there is $0.01 arbitrage profit with $1.00 amount to start out with. What if there are bid-asked interest rates? - International Interest Arbitrage: US 4% vs UK 5%? : US interest rates are $ interest rates and the UK interest rates are BP interest rates. Comparing those is like comparing apples and oranges. What shall we do? Get both $ interest rates (or £ interest rates). - Covered Interest Arbitrage: hedging against exchange rate risk – Example: i$ = 4%, i£ = 5%, So = 2, F=2.01, then (1/So)(1+i£)F=1.055 or 5.5% $ rate of return in the UK vs. 4% $ return in the US. 1. CIRP: FROM THE NO ARBITRAGE CONDITION IDEA: ONE $ INVESTED ANYWHERE IN THE WORLD SHOULD YIELD THE SAME $ RATE OF RETURN => ONE $ INVESTED IN THE US T-BILLS SHOULD YIELD THE SAME RETURN AS AN INVESTMENT MADE IN UK T-BILLS IN $ TERMS BY THE TIME THE INVESTMENTS MATURE. - Parity Equation: Formalize based on the example in Covered Interest Arbitrage above. Show the international interest rate arbitrage and determine the arbitrage profits using the cashlows (Co and C1) - Implied forward rate: a theoretical forward rate satisfying the CIRP. If the actual forward rate is the same as the implied, the CIRP hold. If not, then CIRP does not hold. More specifically, if the actual > implied, then? If the actual < implied, then? Example #1: US 4% vs UK 5%, So = $2/£ => Implied F = $1.981/£. Example #2: If the actual F = $1.97/£, then what happens? Show how you can make an arbitrage profits? - Show different versions of CIRP and the relationship between CIRP and forward premium. 1+i$ = (1/So)*(1+i£)*F or 1+i$ = (F/So)*(1+i£) or (1+i$)/(1+i£) = (F/So) or subtracting “1” from both sides, (F – So)/So = i$ - i£ Aside) With the implied forward rate, show that we have -1% on both sides. -THREE ASSUMPTIONS: 1) THE SAME RISK 2) NO TRANSACTIONS COSTS 3) NO RESTRICTIONS ON FOREIGN INVESTMENTS INCLUDING NO OR IDENTICAL TAXES - EMPIRICAL EVIDENCE 2. PPP IDEA:ONE $ (BP) SHOULD HAVE THE SAME PURCHASING POWER AROUND THE WORLD. =>PRICES OF CONSUMPTION BASKETS (or THE PRICE LEVELS) BEING THE SAME BETWEEN THE US AND UK WHEN PRICES ARE MEASURED IN A COMMON CURRENCY ($ or BP). - Example: Big Mac Meal: €3 in France vs. $3.90 in Baltimore, inconsistent with this concept? With $/€ = 1.2, the $ price of one Big Mac Meal in France is $3.60. The exchange rate which would satisfy the law of one price should be = 3.9/3=$1.30/€ => Prices of twinkies/bagels/cars/--- in the US and UK should be the same after making an adjustment for the different currency values i.e., exchange rates. Or $ (£) prices should be the same. $CPI's IN TWO COUNTRIES SHOULD BE EQUAL. => $ (£) Living costs are the same! - ABSOLUTE VERSION: P$ = So* P£ or So = P$/P£ - RELATIVE VERSION: e = I$ – I£ - Real exchange rate: q = (1+I$)/[(1+e)*(1+I£)] -THREE ASSUMPTIONS: 1) IDENTICAL CONSUMPTION PATTERNS ACROSS THE BORDER 2) NO TRANSPORTATION COSTS, 3) ALL GOODS ARE TRADABLE - EMPIRICAL EVIDENCE 3. THE FISHER EFFECT 1) THE FISHER EFFECT (CLOSED or DOMESTIC VERSION) THE NOMINAL INTEREST RATE IS EQUAL TO A REAL INTEREST RATE PLUS AN EXPECTED RATE OF INFLATION. i$ = ρ$ + E(I$) (approximation) - Example: If ρ$ = 2% and E(I$) =3.4%, what should be i$ according to the Fisher Effect? 2) THE FISHER OPEN (or THE INTERNATIONAL FISHER EFFECT): ASSUMING THAT THE REAL INTEREST RATES ARE EQUAL ACROSS COUNTRIES, THE NOMINAL INTEREST DIFFERENTIAL SHOULD BE EQUAL TO THE EXPECTED INFLATION DIFFERENTIAL. That is, i$ - i£ = E(I$) - E(I£) Now, combining together with the relative PPP, the change in the exchange rate should be then equal to the interest rate differential. That is, E(e) = i$ – i£ 4. FORWARD PARITY: THE FWD DIFFERENTIAL EQUALS THE EXPECTED CHANGE IN THE EXCH RATE. OR, THE FWD RATE IS AN UNBIASED PREDICTOR OF THE FUTURE SPOT EXCH RATE. F = E(S1) *EMPIRICAL EVIDENCE * Comparison of the (C)IRP, PPP, IFE, and Fwd Parity * FORECASTING EXCHANGE RATES * Why a firm needs to forecast exchange rates? – Exchange rate changes can affect very substantially cashflows (directly like contractual amount or indirectly via changes in firm’s competitive position), discount rates, and eventually the value of the firm. *Forecasting Techniques: 1) Technical Forecasting (“history repeats itself”) –using historical data (e.g., pacific), statistical tools, and charts to extract patterns/trends. - Moving Average? - Limitations 2) Fundamental Forecasting – based on fundamental relationships between economic variables and exchange rates. - Using key economic variables (e.g., yardeni.com) from economic theories, sensitivity analyses, and parity conditions. (traditional flow model, asset market model, and parity conditions) - Limitations 3) Efficient Market-Based Forecasting – Using the current spot rates (Random Walk Hypothesis) or the forward rates. 4) Mixed Forecasting and Exchange Rate Forecasts (e.g., biz.yahoo.com/ifc) * Evaluation of Forecast Performance * Exchange rate forecasting in a fixed-rate system