Update of Sino-Russian Gas Cooperation

advertisement

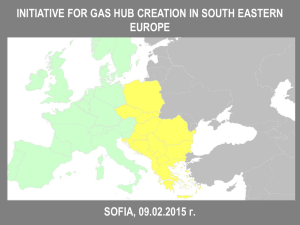

Sino-Russian Gas Cooperation: The Reality and its Global Implications Prepared for London School of Economics (LSE) Seminar May 7, 2013 By Dr. Keun-Wook Paik Senior Research Fellow 1 Sino-Russian Gas Cooperation • In Feb 1997, Gazprom CEO, Rem Vyakhirev’s Asian Policy announced. • In Aug 1998, The Bolshekhetskaya Cavity region of West Siberia, with 3 tcm of natural gas reserves. • In June 2003 Gazprom CEO Alexei Miller’s key note speech at the 22nd World Gas Conference gave a strong hint gas production from East Siberia and Sakhalin Islands would be 26 bcm in 2010, and the figure could reach to 110 bcm in 2020. Miller’s speech also indicated two LNG plants at Vladivostok and Vanino, in addition to Korsakov in Sakhalin Islands. It was the core of Eastern UGSS. • In Autumn 2004, the so-called ‘Discussion Package for the Interagency Working Group to develop a Programme for creating a Unified Gas Production, Transportation and Supply System in Eastern Siberia and the Far East with potential exports to markets in China and other countries in Asia and the Pacific’ was revealed. 2 • In Oct 2004, Gazprom and CNPC have agreed to sign a strategic partnership agreement in Beijing. • In March 2006 a memorandum between Gazprom and CNPC on natural gas supplies and construction of two gas pipelines (with a capacity of 60-80 bcm/y) was signed. • In Sep 2007, Energy Minister Khristenko, signed the approval order (no. 340) creating the Eastern Gas Programme (EGP). • In July 2009 Gazprom commenced the exploration drilling in Kirinskoye field, and Khabarovsk hosted the celebrations dedicated to welding the first joint of the Sakhalin–Khabarovsk–Vladivostok (SKV) gas transmission system. The 1st stage of SKV project was completed in Sep 2011. • Since the Beijing announcement in March 2006, no progress on the gas price negotiation was made, except the general price formula agreement. Consequently the overly advertised St. Petersburg’s price deal in June 2011 produced no result due to the huge price gap between 3 the two sides. Source : Gazprom 4 China’s Gas Expansion and Its Supply alternatives China’s gas industry witnessed a massive expansion during the last ten years. During 2000-2009, China’s gas consumption increased from 24.5 bcm to 88.7 bcm, with annual growth rate of 15.4%. According to NEA, China’s gas demand in 2010 was 110 bcm, of which 94.5 bcm covered by domestic production. The figure in 2011 was projected to be 130 bcm and 110 bcm respectively. In 2010, NEA projected that the demand in 2015 will reach to 260 bcm, or 8.3% of China’s primary energy mix. Right after the 12th FYP (2011-2015) announcement, ERI suggested China’s natural gas supply by 2015 will be 230-240 bcm/y, of which 150 bcm/y by domestic production, 30 bcm/y by LNG and 50 bcm/y by pipeline gas. Wood MacKenzie projected that China’s gas demand will reach to 444 bcm in 2030, with an annual growth rate of 7.5%, with strongest growth pre 2020. 5 China’s Energy Industry Bureaucracy : gas sector • The most important ministry for China’s Oil and Gas Industry under the Chinese Cabinet : National Development and Reform Commission (NDRC). • China’s Gas Price Reform is up to the Price Department of NDRC. • As far as China’s Trans-national Pipeline Development is concerned, CNPC has the exclusive mandate for negotiation and implementation From NDRC. • There were five entities – PetroChina, SINOPEC, CNOOC, China Gas and ENN - that had been authorised by NDRC for the long term LNG supply contract. In Feb 2012, however, reportedly NDRC had lifted restrictions on the construction of LNG terminals, permitting "any company" to build such projects as long as they have signed a longterm contract to import more than 1 mt/y of LNG. • The Ministry of Land and Resources is very aggressively pursuing the shale gas revolution in China but without active role of Chinese NOCs, the result will not be impressive. 6 China Gas Production In July 2009, Jia Chengzao, chairman of the Chinese Petroleum Society strongly Indicated China’s gas production capacity will reach to 250 bcm/y by 2030, and Consequently China has to import 150 bcm/y of gas to cover the 400 bcm/y gas demand by 2030. In May 2010, Jie Mingxun, president of CBM Company under PetroChina made a projection that by 2020 China’s gas production will reach to 202 bcm, of which 62 bcm – tight gas 30 bcm, CBM 20 bcm, and shale gas 12 bcm – will be covered by unconventional gas production. In other words, conventional gas production will be 140 bcm by 2020. (Dec 2010, CNPC revised this figure to 210 bcm by 2020) In March 2011, right after the 12th FYP (2011-2015) announcement, Energy Research Institute (ERI) under NDRC suggested China’s natural gas supply by 2015 would be 230-240 bcm/y, of which 150 bcm/y by domestic production, 30 bcm/y by LNG and 50 bcm/y by pipeline gas. In late Feb 2012, Xu Yongfa, president of CNPC Economics & Technology Research Institute said China will increase natural gas output to 200 bcm/y by 2020, adding that the role of gas in the national energy mix is projected to reach 8 percent by 2015, 10 percent by 2020 and 12 percent by 2030. 7 As of 2010, there were three major gas production bases under CNPC. The first is Changqing field, Ordos basin, with 21 bcm/y ; the second is Tarim field, Tarim basin, with 18 bcm/y ; the third is Sichuan field, Sichuan Basin, with 15 bcm/y. Three main Basins : • Tarim basin : Kela 2 (284 bcm), Dina 2 (175 bcm) and Dabei 3 (130 bcm) are the flagship fields. • Ordos basin : Sulige 6, projected production of 35 bcm/y by 2015. • Sichuan basin : Longgang (700-750 bcm), and Puguang (405 bcm) are the flagship fields. Recent discovery of Yuanba field will add 6 bcm/y by 2015. According to NEA’s CBM industry’s development plan for 2011-2015 period, China’s CBM is projected to reach 20-24 bcm by the end of 2015, of which 10-11 bcm from surface well and 11-13 bcm from underground sources. This target figure was reconfirmed by NDRC’s 12th FYP plans. The draft plans envisages 21.5-23.5 bcm/y production by 2015. (Dec 2011) China’s 12th FYP (2011-2015) for shale gas development plan, China aims at boosting its annual shale gas production to 6.5 bcm/y by 2015 and 80 bcm/y by 2020. (Dec 2011) the figure became 60-100 bcm by 2020. (March 2012) 8 Table 6. China’s Gas Demand Projection 2005 2010 unit : bcm/y 2015 2020 63.7 106.8 153.4 CNPC 2002 CNPC 2006 CNPC 2009/10 300.0 CNPC 2011 350.0 120.0 Sinopec 2006 ERI 2002 ERI 200.0 140.0 64.5 120.0 210.7 240.0 160.0 200.0 2010 200.0 300.0 ERI 2011 230-40 NEA 2010 260 Xinhua 2010 Cnooc 2002 270-300 61.0 100.0 150.0 200.0 Source : K-W Paik, Sino-Russian Oil and Gas Cooperation 9 Table 7. CNPC’s Gas Demand Projection : 2010 vs 2011 unit : bcm RS 2010 2015 2020 2025 2030 2010 119.9 231.1 297.3 350.7 392.4 2011 129.0 350.0 500.0 2012 550.0 HGS 2010 126.0 242.4 317.5 384.2 438.0 LGS 2010 114.6 218.7 279.2 315.6 341.1 Note : RS means Reference Scenario ; HGS means High Growth Scenario ; LGS means Low Growth Scenario Source : CNPC 10 China’s WEP Corridor Development The driving force of China’s natural gas expansion is WEP corridor Development. CNPC started the planning and study of WEP 1 project in 1996, and two years later the preliminary FS was submitted. The overall plan of WEP 1 was completed by 2000. The State Council requested SDPC (now NDRC) to set up a working group before the end of March 2000. A conference titled “West Gas Transport East” was organised by SDPC during March 24-26, 2000. Gov’t bodies like SDPC, SETC, MOF, MLNR, SAPC, SPC, CNPC, SINOPEC, CNOOC, and CIECC + Xinjiang, Gansu, Ningxia, Shaanxi, Shanxi, Anhui, Jiangsu, Henan provinces, Shanghai Municipality + State financial institutions like PBOC, BOC, SDB, ICBC and CBC attended the conference. WEP 1 project was state level commitment to accelerate the economic development of remote western part of China to reduce the wealth gap between the prospering coastal provinces and the interior areas. CNPC 11 was mandated to implement the development. Driven by urgent necessity of WEP 1 expansion (from 12/y to 17 bcm/y), WEP II proposal was officially presented in the draft of Guidelines for 11th FYP (2006-2011). In Dec 2009, Central Asia-China Gas pipeline and the western segment of WEP II were put into operation, and in June 2011 the construction of the infrastructure for the major line of WEP II with a total distance of 8,653 km and a total budget of 142.2 bn yuan (US$ 21.9 bn) was completed. WEP III plan was mentioned during 2007- 08 period, and WEP IV was mentioned for the first time in 2009. In April 2010, Chinese government announced that the western section of WEP III is scheduled to start operation in 2012 and the eastern section from 2014. In April 2011, NEA said construction of WEP III, IV and V will start during 12th FYP (2011 – 2016). However, the announcement of increase of gas import for Turkmenistan from 30 bcm/y to 65 bcm/y indicates that the chance for Altai gas via WEP III is virtually nil. 12 13 CNPC’s preference of Central Asian Gas Supply The critical difference between Russia and Central Asian Republics with regard to gas supply to China is whether the value chain business is allowed or not. For example, Turkmenistan allowed CNPC to explore and develop its gas fields, while Russia completely ruled it out. The availability of “Equity Gas” option gave CNPC enough of a cushion to balance the burden from the high border export price. This is the reason why CNPC has secured as much as 100 bcm/y of gas supply from Turkmenistan, Uzbekistan, and Kazakhstan. In fact, importing relatively a small scale pipeline gas from Turkmenistan incurred CNPC around US$ 0.8 bn loss in 2010. CNPC has to find a way subsidize these loss from the pipeline gas import, and this is the reason why NDRC’s Pricing Department did not give a green light on CNPC’s price negotiations with Gazprom. If China’s domestic gas price reform can be implemented, CNPC would not need to drag its feet for the tedious gas price negotiation with Gazprom. The chance is not so high as 14 the price reform will go through the step by step approach. Figure Map 1.17 - THE EAST ASIAN "GRAND DESIGN" BASINS D Irkutsk E Sakha (Yakutsk) F Krasnoyarsk G Sakhalin H West Siberian Fields PIPELINES 1 West/East Pipeline 2 Irkutsk-Beijing 3 Long Term Russian Plan 4 Sakhalin/Japan 5 Japanese Trunk Line 6 Turkmenistan/China 7 Kazakhstan/Bhina H 3 3 F 3 J E D 2 7 G 3 4 3 I 6 5 1 C B A BASINS I Dauletabad (Turkmenistan) J Karachaganak (Kazakhstan) Distance From New York to San Francisco For Reference BASINS A Szechuan B Ordos C Tarim 15 China’s LNG Expansion As of 2011, China has five LNG receiving terminals with the capacity of 17 mt/y at Guangdong, Fujian, Shanghai, Liaoning, and Jiangsu provinces. By 2015 China is set to have 10 LNG import terminals in operation with 30-35 mt/y import volume. Many of the 60 or so LNG carriers that will be required by 2020 to meet China’s LNG needs will be built in China’s domestic shipyards. In early March 2012 CNOOC’s proposed Tianjin floating storage and regasification unit (FSRU), China’s first offshore LNG terminal was preliminarily approved by NEA. This is a very significant initiative by CNOOC as the Tianjin FSRU became the first terminal above Shanghia by CNOOC. It was the territory dominated by CNPC and SINOPEC. If the second stage LNG terminal development is made during 2016-2020, China’s coastal provinces will have at least 60 mt/y of LNG import capacity by 2020. However, the decision on the expansion will be heavily affected by the result of shale gas development in China during the 2016-2020 and the projected LNG import price. 16 Table 10. China’s LNG Import Projects 1st / 2nd mpta Operat Company / Status ion time Guangdong Dapeng 3.7 / 3.3 2006 CNOOC / Operation Fujian Futian 2.6 / 3.4 2009 CNOOC / Operation Shanghai Yangshan 3.0 / 3.0 2009 CNOOC / Operation Liaoning Dalian 3.0 / 3.0 2011 CNPC / Operation Jiangsu Rudong 3.5 / 3.0 2011 CNPC / Operation Zhejiang Ningbo 3.0 / 6.0 2012 CNOOC / Under Const Hebei Tangshan 3.5 / 3.0 2013 CNPC / Under Const Guangdong Zhuhai 3.5 / 3.5 2013 CNOOC / Under Const Shandong Qingdao 3.0 / 3.0 2013 SINOPEC / Under Const Sub-Total 28.8/60.0 Hainan Yangpu 3.0 / 3.0 2014 CNOOC / Proposed Guangxi Tieshan 3.0 / 3.0 2015 SINOPEC / planned Total 34.8/66.0 Source : K-W Paik, Sino-Russian Oil and Gas Cooperation 17 Summary I Sino-Russian gas cooperation in the first half decade of the century was so limited because Russia tried to replicate its experience with oil exports, but found China unwilling to agree. This unwillingness was due to four main factors : i)Russia refused to allow equity in fields or pipeline projects, and therefore refused China any control in the value chain, which is what the Chinese wanted; ii) Russia demanded unattractively high prices ; iii) China had alternative import options (the Central Asian Republics, Myanmar, and LNG imports) as well as the potential to expand domestic production ; iv) There was a lack of trust on both sides. Russia wanted to avoid depending completely on China as a market, and China wanted to avoid over-dependence on Russia as a source of supply. This failure of the price negotiations is a reflection of all of these problems. 18 Table 11. The Characteristics of China’s Central Asian Model and Russian Model. Central Asian Model Russian Model Oil Sector • Oil asset buyout or oil company buyout in Kazakhstan • “Loan for oil” : 2005 & 2009. • Oil company buyout (2006, Udmurtneft) • Upstream JV (Vostok Energy) allowed. Natural Gas Sector • “Equity Gas” in Turkmenistan and Uzbekistan • Pipeline Construction • Value Chain business No Equity Gas in upstream and mid-stream allowed. But “Loan for Gas” option between Gazprom and CNPC was explored in 2011. Source : K-W Paik, Sino-Russian Oil and Gas Cooperation. 19 Table 12. Sino-Russian Oil and Gas Trading Projection unit : mt/y & bcm/y 2020 2030 Oil Gas Oil Gas Business as usual scenario 25-30 30 25-30 40 Optimistic scenario 30-35 68 40-45 68 15 0 15 20 Pessimistic scenario Source : K-W Paik, Sino-Russian Oil and Gas Cooperation. 20 Update of Sino-Russian Gas Cooperation : Since St. Petersburg summit meeting in June 2011, Beijing authority has made some efforts not to lose the momentum of Sino-Russian gas cooperation. During the visit to Moscow in late April 2012, then deputy premier Li Kechang’s delegation made very clear that China is interested in taking upstream equity stake in East Siberia’s gas development. In early June 2012, during World Gas Congress in Malaysia, Gazprom Export CEO Alexander Medvedev has spoken of a mysterious “asset swap” that could finally break the deadlock over the company's proposed 68 bcm/y gas-supply deal with China. In return for a highly desired upstream role for CNPC in Russia, Gazprom could win access to the massive Chinese gas distribution market. In early Dec 2012, Russia’s deputy premier Arkady Dvorkovich confirmed that Russia was reviewing the Chinese proposals on advance payments under contracts. In March 2013, Moscow summit between President Xi Jinping and President Putin announced that the priority will be given to the Eastern Route with 38 21 bcm/y supply capacity. Source : CNPC (2012) 22 23 Source : Gazprom Background Explanation : A string of reports that Gazprom’s monopoly position of gas export was fundamentally challenged by both Novatek’s Yamal LNG project and Rosneft’s Arctic LNG export scheme. After Igor Sechin’s visit to Beijing in Feb 2013, Gazprom CEO Alexei Miller visited Beijing on March 13, 2013 and announced that special focus was laid on key commercial and technical parameters of pipeline gas supplies to China, particularly, from the Power of Siberia gas pipeline. It added that joint efforts had been ramped up to sign a contract for Russian gas supply to China in 2013. However, one day later (March 14) CNPC announced that it took 20% of equity of ENI’s Mozambique offshore project with 75 tcf proven gas reserves, with the payment of US$ 4.2 bn. This was an indirect confirmation by CNPC that until the final breakthrough is made, CNPC will open all options open as the financial burden of the large scale LNG imports in the coming years will be too big, without the sizable upstream equity buy-out. It is a very clear message to Gazprom. 24 Useful Reference : Keun-Wook Paik, Sino-Russian Oil and Gas Cooperation : The Reality and Implications (Oxford : Oxford University Press, 2012). http://www.naturalgaseurope.com/sino-russian-energy-cooperationkeun-wookpaik?utm_source=Natural+Gas+Europe+Newsletter&utm_campaign=409 7141029-RSS_EMAIL_CAMPAIGN&utm_medium=email http://www.eastasiaforum.org/2013/01/19/sino-russian-gas-cooperationthe-reality-and-implications/ http://www.chathamhouse.org/sites/default/files/public/Research/Energy, %20Environment%20and%20Development/1212bp_paik.pdf http://interfaxenergy.com/natural-gas-news-analysis/asia-pacific/russiachina-pipeline-success-hinges-on-japan/ 25