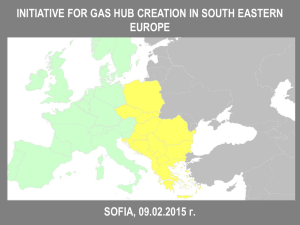

South Stream

advertisement

Challenges in Gas Transmission: The V4+ Perspective Andreas Rau Member of the Board of Directors European Economic Congress, Katowice, 17 May 2011 Facts and Figures 2010 Holding Trade & Sales Employees Turnover Transmission 100% 893 > € 800 million Transmission volume 71 bcm Key Business Data Distribution 100% transmission contracts for 90bcm/a 2,270 km of pipelines Storage E&P 56% Storage 35% four compressor stations (aggregated power >1,000 MW; Veľké Kapušany biggest compressor station in the EU) 2 Market Position About 75% of today’s gas flow from Russia to Western Europe is passing through Slovakia St. Petersburg Existing Eustream 90 bcm/a EuRoPol Gaz 33 bcm/a Moscow Minsk Berlin Warsaw Prague Vienna Kiev New Nord Stream 2 x 27.5 bcm/a South Stream 30-60 bcm/a Nabucco 31 bcm/a Bratislava Budapest New projects can easily double existing pipeline capacities! New challenges due to increasing pipe-to-pipe competition! 3 Development of Transmission Capacities in Slovakia Capacity 2009=100% expected impact of Nord Stream contracted capacities max. technical capacities (acc. to decommissioning plan) How reasonable are new routes if they lead to stranded investment elsewhere? 4 Our Vision: A Central European “Gas Turntable” Poland interconnection PL/SK? access to LNG (Świnoujście)? Ukraine gas storages and E&P? technical cooperation SK/UA? reverse flow at SK/UA border (capacity cca. 85 mcm/d) Czech Republic reverse flow (capacity of 25 mcm/d via Lanzhot) Austria development of Baumgarten Hub reverse flow (capacity of cca. 40 mcm/d via BOG) Hungary SK/HU Interconnector (“bridgehead” for Nabucco) access to LNG (Krk)? 5 Short-term / Short-haul Gas Transmission 4 20 annual capacity [bcm] 18 16 no. of contracts 3 14 12 2 10 8 6 4 1 2 0 0 2006 2007 2008 2009 2010 • increasing no. of hub related transactions in SK (e.g. arbitrage NCG/CEGH) • sufficient transmission capacities available in Slovakia in the long run (no investment need) • new products (e.g. title transfer, VTP prepared) • positive impact expected from SK/HU interconnector 6 TSO Cooperation : GATRAC Cross border VP2VP products – Overview VP Direct connection between respective VPs Bundled products with one single contract (similar “train tickets”) Bookable with each participating TSO on FCFS-principle First product: Firm daily capacity Bookable one to more days ahead* No renomination * More days ahead will be used to allow bookings over the weekend and holidays and to align capacity booking periods with trading times on the EEX Gas Spot Market 7 7 The North-South Gas Corridor • discussion triggered i.a. by 2009 gas crisis • strong political support by V4+ initiative (six countries directly involved) • 2,300 km of pipelines (+upgrade of existing lines) • 900,000 t of steel • investment approx 3,800 MEUR • financing under EU programmes: 220 MEUR • access to two LNG terminals (Świnoujście, Krk) Realistic concept for enhancing market liquidity and security of supplies or wishful thinking? 8 The Hugarian/Slovak Interconnector I SK/HU • 115 km of pipeline length • 5 bcm/a of (design) capacity • bidirectional flow • investment app. 120 MEUR • financing under EERP (30 MEUR) • start of operations initially planned for 2013 9 The Hungarian/Slovak Interconnector III 6/2009 MoU signed by FGSZ and Eustream 7/2009 EEPR application Requested capacity in direction SK-HU Daily flow rate [mil. Nm3] 15 12/2009 end of non-binding open season 13 Total requested capacity 11 Technical capacity 9 7 5 3 1 2020 8 7 6 2021 2022 2023 Total requested capacity 5 4 3 2 31 20 27 29 20 25 20 20 21 19 17 23 20 20 20 20 20 13 20 FGSZ withdraws from project, OVIT new partner on Hungarian side 2018 2019 Duration of the booking period Requested capacity in direction SK-HU 14,000 Daily flow rate [mil. Nm3] 4/2011 2016 2017 1 0 10/2010 EEPR grant decision by EC 12/2010 end of binding open season II (start of operations postponed to 2014) Requested capacity in direction SK-HU 2014 2015 10 9 15 6/2010 end of binding open season I Daily flow rate [mil. Nm3] -1 2013 12,000 10,000 Total requested capacity 8,000 Technical capacity 6,000 4,000 2,000 0,000 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Duration of the booking period 10 Conclusions • further diversification of transmission routes and supply sources (e.g. Nord Stream, Nabucco, South Stream ) – mainly enhancing east-west capacities • huge efforts of TSOs to increase transmission capacities and implement new interconnections (forward and reverse flow) • special focus on establishing a north-south corridor in Central Europe • significant financial support of EU and political support by V4+ • TSOs introducing new products (e.g. GATRAC) • some uncertainties as to development of commodity markets • some routes already having spare capacities today Start with realistic projects (e.g. HU/SK) and then follow a step-by-step approach (always verifying market demand, needs in terms of security of supply and cost/benefit ratio) 11 For further information: www.eustream.sk 12 Strategic Challenges EU gas demand stagnating? stricter environmental regulations pipe-to-pipe competition consolidation among European TSOs? new unbundling requirements short-term bookings and increased speed of shipper transactions 13 Back-up: Main Gas Corridors in Central Europe 8 9 7 11 6 1 2 3 5 4 1 2 3 4 5 6 7 8 9 10 11 12 13 - CZ/SK reverse flow Lanžhot AT/SK reverse flow WAG AT/SK reverse flow TAG SK/HU interconnector Internal reverse flow SK Gazelle EuRoPol Gaz / Jamal Nord Stream LNG PL LNG CRO OPAL HU/CRO interconnector Nabucco / South Stream 13 12 10 14