Course Outline - UMT Admin Panel

advertisement

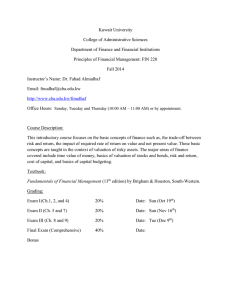

University of Management and Technology Course Outline Course code: FN-550 / FN-545 Course title: MANAGERIAL FINANCE/FM Program MBA Credit Hours 3 Duration 30 sessions (1H 15M each) Prerequisites All accounting courses Resource Person Counseling Timing (Room# ) Contact Chairman/Director Program signature…………………………………. Date…………………………………………. Course Outline Page 1 Learning Objective: By the end of this course you should be able to realize: That a working knowledge of finance is important even if you are not planning a career in finance. Besides wanting to pass this course, why do you need to understand finance. How should a business organization manage its everyday financial activities? Understand the difference between accounting profits and cash flows. The value of money versus time (the concept of time value of money). The role of interest rate on the economy. The role of interest on Value (example: your savings and loans). An overview of the Capital Budgeting process and techniques. Apply and evaluate financial information in a simulated case setting. Increase your confidence to participate in financial decision making. Learning Methodology: The resource person shall explain and discuss a topic in accordance with course outline & students shall be asked to solve & discuss various exercises, problems & cases based on those discussions. Guidance in this respect will be provided by the instructor in and outside the class during counseling hours. Grade Evaluation Criteria Following is the criteria for the distribution of marks to evaluate final grade in a semester. Quizzes / Assignments 20% Group Project/Case Study 20% Mid-Term 25% Final exam 35% Total Course Outline 100% Page 2 Recommended Text Books: Course pack Reference Books: 1. Fundamentals of Financial Management, Brigham & Houston (Concise 4e) 2. Fundamentals of Corporate Finance by Brealey, Myers, Marcus (5e) 3. Corporate Finance by Ross, Westerfield, and Jordan (8e) Calendar of Course contents to be covered during semester Course code FN-550 / FN-545 Session Course title: MANAGERIAL FINANCE TOPIC Discussion Topics AN OVERVIEW OF FINANCIAL MANAGEMENT An introduction to Financial Management Major areas and functions in Financial Management Important Financial Decisions Overview of analysis of Financial Statement and cash flows. 1 TIME VALUE OF MONEY 2,3 BONDS AND THEIR VALUATION 4,5 RISK AND RATES OF RETURN Course Outline Time lines, Future Value, Present Value. Present Value and Future Value of Ordinary Annuities. Perpetuities Uneven cash flow streams, different compounding periods, Fractional time periods, Effective interest. Loan Amortization. Characteristics of Bonds with call provisions and sinking funds and other features. Bond valuation & bond markets. Bond Yields: yields to maturity, yield to call current yield, capital gains yield. Investment returns, expected rate of return Stand alone risk: standard deviation & CV Risk aversion and required returns Page 3 6,7 8 MID TERM STOCKS AND THEIR VALUATION 9,10 11,12 Portfolio risk: Diversifiable vs Market. Security Market Line and CAPM. WEIGHTED AVERAGE COST OF CAPITAL (WACC) THE BASICS OF CAPITAL BUDGETING Type of common Stock, common stock markets and transaction. Stock Valuation Models: constant growth Gordon model, supernormal growth stock valuation, corporate value model. Stock market equilibrium. Efficient market hypothesis. Cost of Debt. Retained Earning: CAPM approach, discounted approach. Cost of New Common Stock. Adjusting WACC for risk. Optimal Capital structure and Marginal Cost Importance of Capital budgeting. Capital budgeting decision rules. Payable period, NPV, IRR, MIRR,NPV vs IRR 13,14,15 Course Outline Page 4