The “ability to ___ principle” is an accepted principle of tax fariness.

advertisement

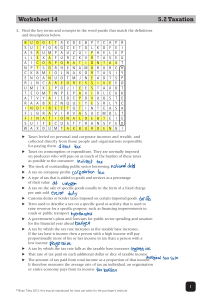

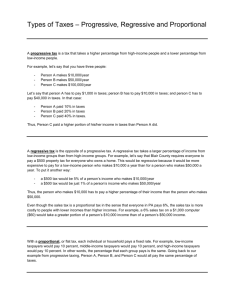

The “ability to ___ principle” is an accepted principle of tax fairness. Pay _____ collected are used to provide education and public services. Taxes You must use Form ____ if your taxable income exceeds $100,000. 1040A In a graduated tax system, tax rates ______ as income increases. Increase A person who lives with you and receives support from you is called a/an _________. Dependent You must ____ a tax return to receive a refund of taxes withheld unnecessarily. File To itemize deductions, you must use the Long Form ______. 1040 (Schedule A) Each ________ claimed by a taxpayer reduces total tax liability. Exemption Taxpayers should not itemize unless their deductions exceed the ______ deduction. Standard Taxes based on the ability to pay is called __________. Progressive ______ taxes are based on a flat rate that does not change according to income level. Proportional You can not itemize deductions on Form _____. 1040 EZ Use of a tax ______ does not absolve one from an error on your tax return. Preparer The sole function of the _____ is to collect income taxes and to enforce tax laws. Internal Revenue Service (IRS) The power to levy taxes rests with ______. Congress Worker’s compensation and unemployment compensation are _______. Taxable Which of the following is not a taxable income: Wages, Tips, Salaries, Alimony, Child Support Child Support By designating $3 to the Presidential Election Campaign Fund, you do not increase your ______. Liability In the U.S., responsibility for paying income taxes rests with the ________. Individual Tax ____ is a serious crime punishable by a fine or imprisonment or both. Evasion If you have many deductions, it’s a good idea to ______ instead of taking the standard deduction. Itemize The largest source of government income in the U.S. is _______ Income Taxes Which of the following people must sign a tax return? The Tax Payer The Tax Payer’s Spouse The Person Who Prepared the Return All of them The income tax is an example of which type of tax: Progressive Proportional Regressive Excise Progressive Sales tax is an example of which type of tax? Progressive Proportional Regressive Excise Regressive Property tax is an example of which type of tax? Progressive Proportional Regressive Excise Proportional As taxable income increase, income tax rates _____. Decrease The first income tax became necessary during what war? War of 1812 You must file your income tax returns no later than _____. April 15 An examination of tax returns by the IRS is called an ______. Audit Definitions: A person who can be claimed as an exemption by a tax payer. Dependent A type of income that must be claimed on a Form 1040. Alimony Taxes that increase in proportion to income Progressive A type of income received that is not taxable. Child Support Taxes for which the rate remains constant, regardless of the amount of income Proportional Money collected by the government through taxes. Revenue The type of tax that requires those who can least afford it to pay the most in proportion to their income. Regressive Willful failure to file and pay taxes. Tax Evasion An amount you may subtract from your income for each person who depends on your income to live. Exemption A person who can be claimed as an exemption by a taxpayer Dependent Income ranges where the more you make the higher the tax rate you pay Tax Brackets To list allowable expenses on your tax returns. Itemize Good Luck on Your Test!