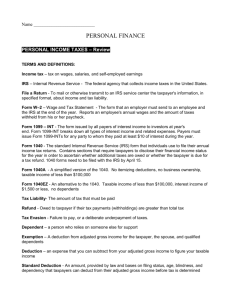

Income and Taxes

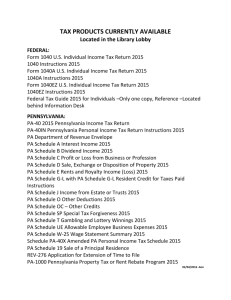

advertisement

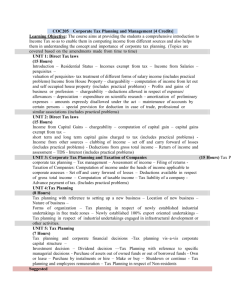

Filing the Income Tax Taxman by The Beatles Album: Revolver Released: 1966 This is a bitter song about how much money The Beatles were paying in taxes. For every $20 earned, $19 went to the government and Capitol Records. People with high earnings pay exorbitant taxes in England, and as a result, The Beatles - as well as The Who and The Rolling Stones spent a lot of time in America and other parts of Europe as "tax exiles." George Harrison is quoted as saying, "Taxman was when I first realized that even though we had started earning money, we were actually giving most of it away in taxes." TAXMAN BY THE BEATLES - Lyrics Let me tell you how it will be There's one for you, nineteen for me 'Cause I'm the taxman, yeah, I'm the taxman Should five per cent appear too small Be thankful I don't take it all 'Cause I'm the taxman, yeah I'm the taxman If you drive a car, I'll tax the street If you try to sit, I'll tax your seat If you get too cold I'll tax the heat If you take a walk, I'll tax your feet Taxman! 'Cause I'm the taxman, yeah I'm the taxman Don't ask me what I want it for (Ah, Mr. Wilson) If you don't want to pay some more (Ah, Mr. Heath) 'Cause I'm the taxman, yeah, I'm the taxman Now my advice for those who die Declare the pennies on your eyes 'Cause I'm the taxman, yeah, I'm the taxman And you're working for no one but me Taxman! Review: Why do we pay taxes? Purposes of Taxation TAX: a required payment to a local, state, or national government. 1. 2. 3. 4. Fund public goods and services. Influence behavior. (cigarette. alcohol) Stabilize the economy. Redistribute income. Taxes in US History Review: What are some examples of taxes? Kinds of Taxes Income tax: income that you earn is subject to tax. Social Security tax: nation’s retirement program; approximately 6% of gross income. Medicare tax: nation’s health care program for elderly and disabled; 1.45% of gross income. Kinds of Taxes Sales tax: tax paid on the value of goods and services. (revenue for state govt.) Excise taxes: included in the price paid by consumers. Fuel = Environmental Alcohol & Cigarettes = Health/Safety Who Collects Federal Taxes? Internal Revenue Service (IRS) – Collects federal taxes, issues regulations, and enforces tax laws written by the United States Congress How does the IRS collect most of your income taxes? Income Taxes Your employer will withhold, or take out, income tax from every paycheck and send the money to the government. How Much is Withheld? Depends on: How much you earn Information you provide on Form W-4 determines how much is withhold Personal Information Exempt status Allowances: factors that affect the amount of income tax withholding. Do I have to file a return? You are required to file a federal income tax return if: Your income is above a certain amount. You are a citizen or a resident of the United States. You are a U.S. citizen who resides in Puerto Rico. The amount of your income tax return is based on your filing status and other factors, such as your age. Confusing forms! Tax Time is Here! Must be filed by April 15th What Do I Need? (Collecting Forms…) Form W-2: Employer will send Form 1099-INT: Bank will send Personal records W-2 shows your total earnings for the year and the total amount of taxes withheld. Make sure all your information is correct when you get this. 1099-INT: shows the earned interest on savings during the year. Other 1099 forms are used for reporting earnings on investments. What will I be asked? 1. Status: Single Married Allowances… 2. Income Includes interest earned How can I reduce my taxes to be paid? What things can you “write off of” you taxes? Deductions: subtracted from income Charitable Contributions Education Casualty, Disaster, and Theft Losses Business use of home Business use of car Employee business expenses Standard vs. Itemized Tax credits Subtracted directly from the amount of tax owed. Ex: Energy Star Appliances, Insulation, Roof, Water Heater Taxable income is different from your gross income because it is the amount after certain deductions. Final calculations: if you have overpaid in taxes for the year, you’ll get a refund, if you’ve underpaid ,you must send the remaining tax to the IRS with your return. Options for Filing Income TAX Turbo Tax Tax Prep Service H&R Block Liberty Tax Service Accountant Paper Forms: 1040EZ 1040 1040 A (LONG) Do you have a simple tax return? You do if you: Have a filing status of Single or Married Filing Jointly Have no dependents/children Claim the standard deduction Have no mortgage payment Have taxable income of less than $100,000 You can use the 1040 EZ! Final result Either you, or your tax preparer, will determine whether you overpaid or underpaid your federal (and state) income taxes. What is the result if you overpaid? What about if you underpaid? How again could you overpay or underpay? Preparing an Income Tax Return Choosing the Tax Form The IRS offers about 400 tax forms and schedules. However, you have a choice of three basic forms: Form 1040EZ Form 1040A Form 1040 Form 1040 is an expanded version of Form 1040A. Personal Finance Unit 4 Chapter 12 © Preparing an Income Tax Return Form 1040EZ Form 1040EZ is the simplest tax form to complete. You may use this form if: Your taxable income is less than $100,000. You are under age 65. You claim no dependents. Your income consisted of only wages, salaries, and tips, and no more than $1,500 of taxable interest. You will not itemize deductions, claim any adjustments to income, or claim any tax credits. Personal Finance Unit 4 Chapter 12 © Preparing an Income Tax Return Form 1040A You may use this form if: Your taxable income is less than $100,000. Capital Gains distributions, but no Capital gains/losses (from sale of investments) You will not itemize deductions Claim tax credits for child/dependent care, education, earned income, retirement savings contributions. Deductions for student loan interest, educator expenses, higher education tuition and fees Personal Finance Unit 4 Chapter 12 © Preparing an Income Tax Return Form 1040 You may use this form if you are not able to use the other two forms: Your taxable income is greater than $100,000. Income from interest and dividends over set limits Income from the sale of property You will itemize deductions (schedule A) Home mortgage interest Medical/dental expenses Personal Finance Real estate property tax Unit 4 Chapter 12 ©