Public Finance

advertisement

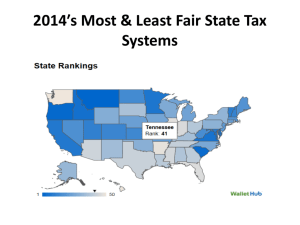

Public Finance HKSAR CE Public Finance 1 Public Finance What is public finance? Public finance means how the government raises funds and spends the money on various kinds of services for the economy. CE Public Finance 2 So public finance is concerned with The revenue and expenditure of the government CE Public Finance 3 The government is referred to as the public sector CE Public Finance 4 The size of the public sector is measured by the amount of public expenditure ( 100% ) GDP CE Public Finance 5 Public expenditure as % of GDP of the HKSAR 1997-98 1998-99 1999-2000 2000-01 2001-02 17.7% 21.2% 22.0% 21.6% CE Public Finance 21.1% 6 Sources of government revenue • tax • non-tax CE Public Finance 7 Classification of taxes CE Public Finance 8 Classification of taxes According to the party who bears the tax burden, taxes can be classified into: ________ direct taxes and ________ indirect taxes According to how the tax payment changes with income, taxes can be classified into: __________, proportional and progressive ____________ regressive taxes __________ CE Public Finance 9 Tax revenue ( 1 ) • Direct tax • Indirect tax CE Public Finance 10 Direct tax • is a tax on income or wealth. • the tax incidence or burden CANNOT be shifted. • the tax rate is either progressive or proportional • Examples in Hong Kong • salaries tax • profit tax • property tax • estate duty • interest tax ? • dividend tax? CE Public Finance 11 Indirect tax • is a tax on goods and services • the tax incidence or burden CAN be shifted ( usually to the consumers, depending on the elasticity of demand and supply ) • the tax rate is regressive • Examples in H.K. • cigarettes tax; stamp duty; general rates; vehicle import tax; airport departure tax; tax on alcoholic liquor; hotel accommodation tax; entertainment tax; betting tax and etc. CE Public Finance 12 Quiz 1 Types Profits tax Estate duty Direct tax Stamp duties Betting duties Property tax Salaries tax Indirect tax Classify the above Hong Kong taxes into direct and indirect taxes. CE Public Finance 13 Tax Revenue ( 2 ) • Progressive tax; • Proportional tax; and • Regressive tax CE Public Finance 14 Progressive, proportional and regressive taxes rogressive tax: Tax payment takes ____________________ an increasing percentage of taxable income as income increases. roportional tax: Tax payment takes ____________________ the same percentage of taxable income as income increases. egressive tax: Tax payment takes ____________________ a decreasing percentage of taxable income as income increases. CE Public Finance 15 Progressive, proportional and regressive taxes A, B and C are three types of tax: Taxable income Tax payment A Average tax rate Tax payment B Average tax rate Tax payment C Average tax rate $150,000 $200,000 $15,000 $15,000 10% 7.5% $10,000 $15,000 6.7% 7.5% $12,000 $16,000 8% 8% Fill in the blanks of average tax rate ! CE Public Finance 16 Progressive, proportional and regressive taxes A, B and C are three types of tax: Taxable income Tax payment A $15,000 $15,000 10% 7.5% $10,000 $15,000 6.7% 7.5% $12,000 $16,000 8% 8% Average tax rate Tax payment C $200,000 Average tax rate Tax payment B $150,000 Average tax rate Which type of tax is a progressive tax? CE Public Finance 17 Progressive, proportional and regressive taxes A, B and C are three types of tax: Taxable income Tax payment A $15,000 $15,000 10% 7.5% $10,000 $15,000 6.7% 7.5% $12,000 $16,000 8% 8% Average tax rate Tax payment C $200,000 Average tax rate Tax payment B $150,000 Average tax rate Which type of tax is a regressive tax? CE Public Finance 18 Progressive, proportional and regressive taxes A, B and C are three types of tax: Taxable income Tax payment A $15,000 $15,000 10% 7.5% $10,000 $15,000 6.7% 7.5% $12,000 $16,000 8% 8% Average tax rate Tax payment C $200,000 Average tax rate Tax payment B $150,000 Average tax rate Which type of tax is a proportional tax? CE Public Finance 19 Quiz 2 Suppose the government levies a tax of $10 on all passengers who depart HK by sea. What type of tax ( progressive / proportional / regressive ) is it? regressive tax. Since all It is a _________ passengers pay the same amount of tax, tax payment takes a smaller proportion of income _______ for the higher income group. CE Public Finance 20 Quiz 3 When the tax payment increases as the income increases, is it a progressive tax ? No ____. A tax is progressive if the tax payments takes an increasing percentage of taxable income as income increases. CE Public Finance 21 Quiz 3 When the tax payment increases as the income increases, is it a progressive tax ? e.g. Taxable income 100,000 150,000 Tax payment 10,000 12,000 Average tax rate 10% 8% Fill in the average tax rates ! CE Public Finance 22 Quiz 3 When the tax payment increases as the income increases, is it a progressive tax ? e.g. Taxable income 100,000 150,000 Tax payment 10,000 12,000 Average tax rate 10% 8% The tax payment increases as the income increases, but it is a regressive _________ tax. CE Public Finance 23 Non-tax revenue • Examples: sale of land; fines and penalty; government fees and etc. CE Public Finance 24