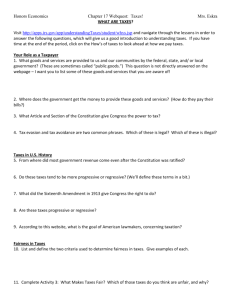

Income tax

advertisement

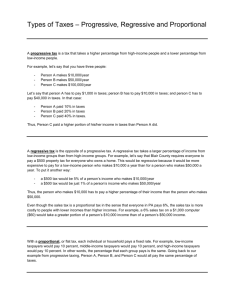

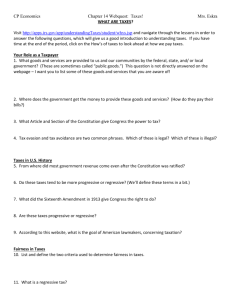

CHAPTER 9, 10, 14 OK! This is my “lecture” on the vocabulary: 1-5 Chapters 9,10, & 14. ABILITY TO PAY PRINCIPLE OF TAXATION #1 Keep in mind that this is a “theory” of taxation or a model; make note of that…it is NOT a tax in itself Ok, the idea is “the more you make the more they take.” “They” being the government. Part 1 of the definition: A person pays tax based upon the amount of money earned. Part 2 of the definitions: …regardless of benefits received. This sounds good but think about the ramifications. Tom and Jackson Tom has a 6 figure income a large house on a good chunk of property a three-car garage with a large boat parked near it a double-wide circular drive way (always wanted one) and NO children Jackson Jackson has a wife and…4 kids a three-bedroom apartment a job earning minimum wage a rather large headache… Who pays?? Let’s think about school taxes… Children receive the benefit of a free public school education through “school” taxes which are based upon property value Tom Pays through the nose…in other words…he pays a lot in school taxes because he owns property…he has no children…he does not reap the reward or “benefit” of his school taxes, directly… Jackson Jackson pays no school/property taxes because he rents; he owns no property. (His landlord may increase the rent for all tenants in order to pay his bill but no tenant receives a bill from the tax office. ) And yet, Jackson has 4 children in school, reaping the benefit of those tax dollars. How does Tom feel? Well, he could feel really, really ticked off. He could feel good that he is helping out his fellow man, a universal good! He might realize that his grandparents paid taxes when they no longer had anyone in school…what goes around comes around. What is this called again? It is called the “ability-to-pay principle of taxation.” You can afford to pay more…so, you do! Benefit principle of taxation (translation of definition) Those who receive the benefits should pay for them, the more you receive the more you should pay Now that makes perfect sense does it not? OK! Let’s think about that in terms of Tom & Jackson. has no children and therefore pays no school taxes. Jackson has children. If he had one child; he pays for that one child. If he had two children; he pays for the two children. has 4 children. Therefore…….. Problem? Jackson cannot afford to pay the school tax for 4 children and they most certainly cannot pay it themselves. Are we getting this? If you receive the benefit; you pay for it. The more you receive; the more you pay. Other benefits are things such as Welfare, Social Security and Unemployment. How can you expect to pay for those services? If you could, you probably wouldn’t need them! Taxes There are three types of taxes collected that are based on your earnings; your income. So, we have now moved away from theories. Proportional taxes You have defined this one…let’s see if it makes sense. Let us say Person A earns $10,000. Person B earns $1,000 dollars. Person C earns $100,000. According to this tax; all would pay the same percent or proportion of their income in taxes. Let’s make it 2%; regardless of income. Each would pay $2 for every 100 dollars earned. No example available. We don’t use this one. Some refer to it as a “flat tax.” 30% NO example Progressive tax This one is based on ATP. (Ability-to-pay) I make more than anyone in this room. Therefore, I pay more in taxes than anyone here. Tax liability increases as income goes up Tax liability decreases as income goes down (Tax liability means what you pay in taxes) How it works Let’s make up an example: If you earn $61, 000 to $90,000 annually you pay 10% of your income If you earn $31, 000 to $60,000 annually you pay 7% of your income If you earn $11, 000 to $30,000 annually you pay 5% of your income $61, 000 - $90,000 = 10% $31, 000 - $60,000 = 7% $11, 000 - $30,000 = 5% INCOME CHANGES; PERCENT CHANGES Example: Income tax Regressive tax Regressive, in this case is backwards Let’s make up an example: If you earn $61, 000 to $90,000; pay 5% of your income If you earn $31, 000 to $60,000; pay 7% of your income If you earn $11, 000 to $30,000; pay 10% of your income $61, 000 - $90,000 = 5% $31, 000 - $60,000 = 7% $11, 000 - $30,000 = 10% INCOME CHANGES; PERCENT CHANGES…but in a backward sort of way…. Example: Sales tax Questions? Comments? Hostile disagreements? Let’s see! Number from 1 – 7 in your notebook and let’s have some practice. The choices of answers are proportional, progressive, and regressive. Proportional = the same for everyone; 1 % regardless Progressive= higher income; higher tax bill and vice versa ex: income tax Regressive = backwards, lower income; the higher the tax bill and vice versa ex: sales tax Practice tax quiz use your notes Proportional = the same for everyone; 1 % regardless Progressive= higher income; higher tax bill and vice versa ex: income tax. Regressive = backwards, lower income; the higher the tax bill and vice versa ex: sales tax 1. a tax of $500 on all persons • 1. a tax of $500 on all persons Proportional = the same for everyone; 1 % regardless Progressive= higher income; higher tax bill and vice versa ex: income tax. Regressive = backwards, lower income; the higher the tax bill and vice versa ex: sales tax • 2. a tax of $8 on every $10 earned Proportional = the same for everyone; 1 % regardless Progressive= higher income; higher tax bill and vice versa ex: income tax. Regressive = backwards, lower income; the higher the tax bill and vice versa ex: sales tax 3. sales tax on food Proportional = the same for everyone; 1 % regardless Progressive= higher income; higher tax bill and vice versa ex: income tax. Regressive = backwards, lower income; the higher the tax bill and vice versa ex: sales tax 4. Income tax of 10% on incomes less than $15,000 dollars 20% on income between $15,000 + $30,000 and 30% on incomes over $30,000 Proportional = the same for everyone; 1 % regardless Progressive= higher income; higher tax bill and vice versa ex: income tax. Regressive = backwards, lower income; the higher the tax bill and vice versa ex: sales tax 5. 12% tax on all income Proportional = the same for everyone; 1 % regardless Progressive= higher income; higher tax bill and vice versa ex: income tax. Regressive = backwards, lower income; the higher the tax bill and vice versa ex: sales tax 6. income tax in which higher incomes are taxed at a higher rate than lower incomes Proportional = the same for everyone; 1 % regardless Progressive= higher income; higher tax bill and vice versa ex: income tax. Regressive = backwards, lower income; the higher the tax bill and vice versa ex: sales tax 7. tax in which the same percentage of income is collected from all individuals 1. a tax of $500 on all persons = the percentage would vary depending upon income…it would take a larger percent of a poor’s man’s income; therefore REGRESSIVE check next 2 slides 2. a tax of $8 on every $10 earned = everyone is paying the same percent of income no matter what PROPORTIONAL 3. sales tax on food = all sales tax are…REGRESSIVE. WHAT IS A SALES TAX? A TAX ON PURCHASES 4. Income tax of 10% on incomes less than $15,000 dollars, 20% on income between %15,000 + $30,000; and 30% on incomes over $30,000 = %s vary; ATP; PROGRESSIVE 5. 12% tax on all income = every one pays the same percent of INCOME….PROPORTIONAL 6. income tax in which higher incomes are taxed at a higher rate than lower incomes = % varies according to your income; ATP…PROGRESSIVE 7. tax in which the same percentage of income is collected from all individuals = same % for all; PROPORTIONAL HINTS: All sales tax are regressive. Let’s go back to and for a minute. Let us say that and both bought clothing because they want to work on the car. They both spend the same amount on clothing and the same amount in taxes. Let’s say that ? paid $8 in tax. He had 56 dollars in his pocket. We will pretend the $56 is his income. He just spent 1/7 of his income in taxes. 8/56. Does that make sense? Let’s say that ? paid the same $8 in tax. He had 16 dollars in his pocket. We will pretend the $16 is his income. (8/16) He just spent 1/2 of his income in taxes. And furthermore… If I paid 20 % of my income in taxes; that would be proportional. If I paid $20 in taxes that would be regressive. Think about it: You pay a “poll” tax of 100 dollars. You only make a 100 dollars. You just paid 100 % of your income in taxes. I have to pay the $100 poll tax also. I made $500. I paid only 1/5 or 20% of my income in taxes… The percent is not the same. So, it is NOT proportional. And, “it takes a larger percent/proportion of a poor man’s income.” So, regressive it is!!! DONE! Time for the real, graded quiz. Need ½ sheet with heading, number from 1-5.